Skip to content

Though there are many stories on the financial information calendar within the September 23 week, none is prone to be a standout after the FOMC introduced a charge minimize of fifty foundation factors on September 18 to deliver the fed funds goal charge vary all the way down to 4.75 to five.00 %. Information associated to the housing market, client confidence, and manufacturing will all have been compiled earlier than the announcement. The impression of decrease charges will ship a lift to the financial system that received’t be seen within the stories till subsequent month.

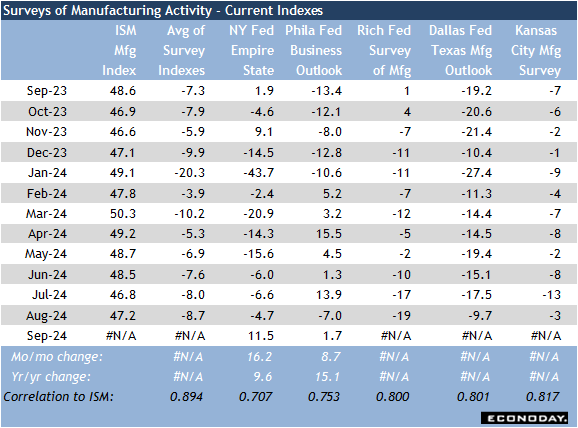

What could show most fascinating within the week – since it can mirror the more moderen state of the financial system – is the following surveys of producing for September. The surveys for September from the New York and Philadelphia Feds each present a turnaround within the normal enterprise situations indexes to constructive territory. The New York index was up 16.2 factors to 11.5 after six straight months of contraction. The Philadelphia index rose 8.7 factors to 1.7, returning the index to enlargement after plunging 20.9 factors to -7.0 in August. Neither normal enterprise situations index has the strongest correlation with the ISM Manufacturing Index (New York 0.707, Philadelphia 0.753), so might not be one of the best trace as to what’s occurring on the nationwide degree for September.

Alternatively, the composite indexes from Richmond and Kansas Metropolis – versus the diffusion indexes from the opposite Fed district financial institution surveys – have strong correlations with the ISM measure at 0.800 and 0.817, respectively. The Richmond manufacturing index is about for launch at 10:00 ET on Tuesday and the Kansas Metropolis manufacturing composite index is at 11:30 ET on Thursday. If the Richmond manufacturing index breaks away from the string of unfavourable readings of November 2023 by way of August 2024, or at the very least improves from the near-term backside of minus 19 in August, it can add to the brighter outlook for the manufacturing facility sector. The Kansas Metropolis index hasn’t seen a constructive studying since September 2022. If it will get a raise from the minus 3 in September, it can additional broaden the outlook for the recession within the manufacturing facility sector nearing an finish.

Share This Story, Select Your Platform!