Skip to content

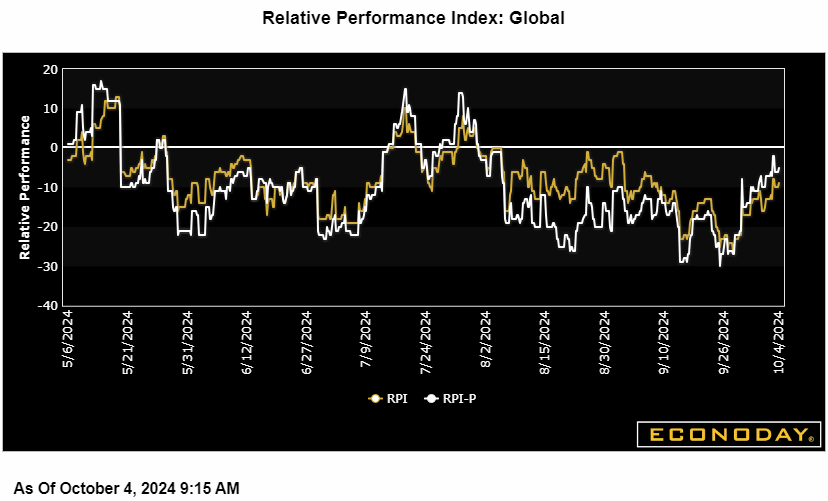

At minus 8, Econoday’s Relative Financial Efficiency Index (RPI) continues to point out latest international financial exercise lagging market expectations, however not by a lot. China specifically stays a major drag, however Eurozone readings have improved and the U.S. continues to outperform.

Within the U.S., a reminder of simply how tight the labour market is saved the RPI and RPI-P (each 19) above zero. General outperformance versus market expectations has been a function of the financial system since early September and should elevate new doubts about how rapidly the Federal Reserve will ease coverage over coming months.

In Canada, an absence of key knowledge final week left the RPI-P at minus 10 and the RPI-P at 3. General financial exercise is broadly matching expectations which implies monetary markets will stay centered on the scale of a possible rate of interest lower by the Financial institution of Canada later this month.

Within the Eurozone, the RPI (2) nearly crept again above zero whereas the RPI-P (14) made somewhat extra progress. Crucially, the hole between the 2 measures primarily displays a surprisingly weak September inflation report and it’s this that has considerably boosted the possibilities of one other lower within the European Central Financial institution’s key rates of interest subsequent week.

Within the UK, financial knowledge usually final week stunned on the upside and had been agency sufficient to elevate the RPI to 17 and the RPI-P to 11. Financial exercise on the whole is now operating forward of expectations however not by a lot and to not the extent that would supply a transparent pointer to how the November MPC will vote.

Very like the Eurozone, constructive readings on the Swiss RPI (4) and RPI-P (21) present financial exercise operating just a little stronger than anticipated. Nevertheless, inflation continues to shock on the draw back and September’s notably weak report has additional boosted hypothesis concerning the Swiss Nationwide Financial institution easing once more in December.

In Japan, a blended bag of knowledge was on steadiness agency sufficient to maintain each the RPI (16) and RPI-P (28) above zero. Even so, the broader image is much less convincing and dovish feedback from new PM Shigeru Ishiba have left buyers all of the extra unsure about when the Financial institution of Japan will tighten once more.

In full distinction to the U.S., the Chinese language RPI and RPI-P each closed out the week at minus 50, extending the unbroken run of sub-zero readings that started again at the beginning of August. Such readings merely reinforce the necessity for the nationwide central financial institution to ship on the bazooka financial stimulus package deal that it introduced late final month.

Econoday’s RPI supplies a useful abstract measure of how an financial system has just lately been evolving relative to market expectations.

A studying above zero signifies that the financial system on the whole has been performing extra strongly than anticipated and vice versa for a studying beneath zero. The nearer is the worth to the utmost (+100) or minimal (-100) ranges, the larger is the diploma to which markets have been under- or over-estimating financial exercise. A zero outturn would suggest that, on common, the market consensus has been right. Word too that the index is sensitized to position further weight upon these indicators that buyers contemplate to be a very powerful.

Share This Story, Select Your Platform!