Skip to content

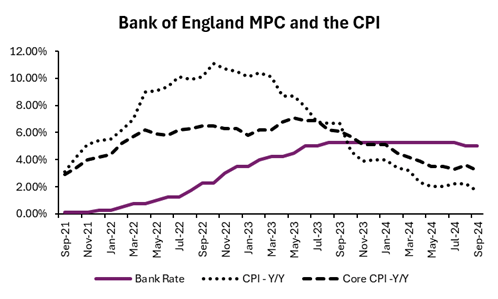

The Financial institution of England’s Financial Coverage Committee (MPC) is anticipated to cut back the Financial institution Price by 25 foundation factors to 4.75 p.c on November 7, 2024, in mild of easing inflationary pressures. Current information reveals UK inflation has dropped from 2.2 p.c in August to 1.7 p.c in September, prompting a shift from a restrictive financial coverage to 1 that helps financial development.

The true economic system is presently dealing with blended indicators. Core inflation fell from 3.6 p.c in August to three.2 p.c in September year-over-year, and from 0.4 p.c to 0.1 p.c month-over-month, indicating a broader moderation in value pressures. Nonetheless, stagnant wage development continues to squeeze family budgets, probably dampening client spending. Whereas unemployment has barely decreased from 4.1 p.c to 4.0 p.c, the tight labour market is displaying indicators of cooling, which might additional justify a charge reduce if it dampens client confidence.

Because the final MPC assembly, the RPI and RPI-P signifies that financial exercise is falling behind market expectations, elevating considerations about development. This context suggests a possible unanimous vote for the 25-basis level reduce, though discussions round a extra aggressive 50 foundation level transfer could come up if stronger motion is deemed vital.

Current fiscal measures within the Price range aimed toward boosting client spending might present further room for the MPC to maneuver with out jeopardizing inflation targets. General, the November seventh assembly is pivotal, because the anticipated charge reduce goals to alleviate excessive borrowing prices, assist client spending, and foster financial development whereas guaranteeing the MPC stays vigilant about inflationary dangers.

Share This Story, Select Your Platform!