Latest tax controversies might contain celebrities’ use of private companies to attenuate taxes

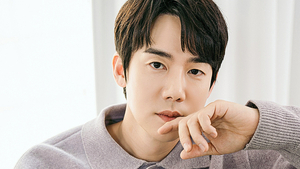

Yoo Yeon-seok, the star of hit Ok-dramas such because the “Hospital Playlist” sequence and “Reply 1994,” has joined a listing of celebrities going through hefty tax payments.

Yoo was just lately slapped with a tax invoice of roughly 7 billion gained ($4.8 million), reportedly the biggest ever imposed on a South Korean movie star.

In response to mounting criticism and allegations of tax evasion, Yoo’s company, KingKong by Starship Leisure, issued a press release on Friday explaining that the tax evaluation outcomes from variations “in the way in which (Yoo’s) tax consultant and the tax authorities have interpreted and utilized tax legislation.”

The company additional famous, “This earnings tax evaluation has not been finalized or formally notified, and we plan to actively make clear the factors of competition relating to the interpretation and software of the legislation by way of correct authorized procedures.”

Yoo will not be alone in going through scrutiny over tax points.

In February, actress Lee Ha-nee, identified for her work in “Knight Flower” and “Excessive Job,” was hit with a 6 billion gained tax evaluation. Final yr, actor Park Hee-soon underwent a tax investigation by the Seoul Regional Tax Workplace, leading to an extra tax invoice of roughly 800 million gained.

The development has drawn scrutiny over celebrities’ use of private companies — typically with themselves as CEOs — to attenuate their tax liabilities.

The three celebrities every function private companies regardless of being affiliated with different businesses — Park Hee-soon, Lee Ha-nee and Yoo Yeon-seok function CEOs of Twopark Playground, Hanee, and Without end Leisure, respectively.

Beneath Korean legislation, companies are usually taxed at decrease charges than people, with larger thresholds for taxable earnings, making company constructions extra advantageous for tax functions. Moreover, bills associated to upkeep, automobile repairs and different enterprise operations could be deducted as enterprise prices, successfully lowering the proprietor’s taxable earnings.

The celebrities contend that the disputes stem from differing interpretations of tax legislation moderately than deliberate tax evasion, with Park Hee-soon denying the allegations in an official assertion, asserting that “This tax evaluation arose in the course of the course of between the tax authorities and my tax consultant and has no direct connection to my authorized obligations as an actor.”

Lee Ha-nee equally defended her place, stating, “The extra tax resulted from a distinction in perspective between the tax authorities and my tax consultant, and I’ve paid the complete quantity.”

Public sentiment, nevertheless, has grown more and more essential as suspicions mount over high-profile figures allegedly avoiding billions in taxes.

Criticism has been mounting over Yoo Yeon-seok’s look in Seoul Broadcasting System’s new sequence “Shinyirang Regulation Workplace” (direct translation), set to premiere this August, the place he performs a lawyer who punishes evil. SBS has but to launch an official assertion relating to Yoo’s involvement within the sequence.

yoonseo.3348@heraldcorp.com