NRIs don’t even profit from indexation, which adjusts the acquisition value for inflation. Patrons should deduct tax on the entire sale worth. Nevertheless, consumers can apply for a decrease TDS certificates to scale back this quantity.

Moreover, NRIs typically face difficulties managing the property remotely. Duties reminiscent of approving repairs, managing upkeep prices, or renewing rental agreements normally require property homeowners to be bodily current. Nevertheless, NRIs do have the choice of appointing an influence of lawyer (PoA).

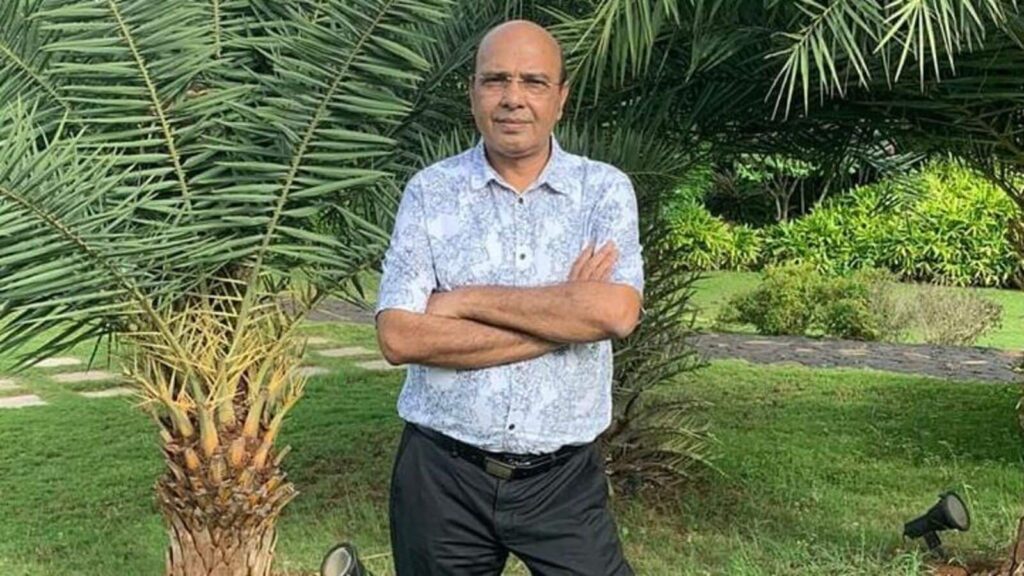

Mahesh Ahuja, a seasoned actual property dealer with years of expertise within the business, shares with Mint his perspective on why residential properties could not at all times be the perfect funding selection for NRIs.

Why did you resolve to remain on hire as a substitute of shopping for a home?

As somebody who labored within the Indian Navy earlier, I skilled the effort of continuously shifting properties as a consequence of transfers. I did not need to undergo that once more, so renting gives me the pliability to maneuver simply.

For most individuals, a home needs to be thought of extra of a consumption merchandise than an funding. The appreciation for residential properties is commonly not as excessive as that of business properties, which I’ve targeted on as a substitute.

My son is an NRI based mostly within the US, and I’ve seen many NRI shoppers battle with sustaining and transferring properties in India, particularly when their youngsters are settled overseas and have little interest in the property. I did not need to create that sort of trouble for my family.

Nevertheless, I’ve discovered that the emotional and sensible advantages of proudly owning a home are sometimes overemphasized, particularly for folks in my stage of life. At this age, I am extra targeted on making certain monetary safety for my household by way of strategic investments reasonably than tying up a considerable amount of capital in a residential property, which could be arduous to liquidate.

How and when did you begin your actual property profession?

I had been with the Navy for about 13 years. I resigned for private causes. Proper earlier than I resigned, I had began on the lookout for a home to purchase. My first go to was to a property, the place I met an actual property agent who was pitching the mission to me.

Despite the fact that the agent was fairly good, I keep in mind pondering that I may do that job higher. I used to be impressed by his gross sales pitch and character, and I felt I had the proper abilities to reach actual property, given my background in public talking and coaching.

So, once I resigned, I made a decision to offer actual property a shot within the early 2000s. Over the following few years, between 2003 and 2006, I ended up flipping round 20-25 properties of my very own, making good cash within the course of.

Why did you dump all of your actual property holdings?

By 2006, I had constructed up an honest actual property portfolio, however I began to have some considerations concerning the market circumstances and the sustainability of the speedy appreciation we had been seeing.

I had some challenges with shoppers when it got here to promoting their properties. I needed to promote my very own property to pay the cash again to traders, as there have been disputes round fee phrases and switch processes. Furthermore, personally, I did not really feel like proudly owning a home, the effort that comes alongside I discussed earlier.

Lastly, in 2006, I made the acutely aware determination to dump all my residential actual property holdings, contemplating the hassles of transferring the property to my son.

What challenges do you see NRI households going through with properties in India?

Making certain the property is well-maintained and brought care of generally is a fixed headache for NRI homeowners, particularly if they aren’t bodily current. Discovering dependable tenants, gathering hire, and coping with any points generally is a logistical nightmare from overseas. When the mother and father go away, the method of transferring the property to the kids could be extraordinarily tedious and complex, particularly if the kids usually are not .

Why could actual property not be funding for NRIs?

As an NRI, any property funding I make in India could be topic to the danger of the Indian rupee depreciating towards the overseas forex I earn. The rupee has depreciated virtually 50% within the final 20 years. This could considerably erode the true returns on the funding. Rental yields on residential properties in India are sometimes fairly low, typically within the vary of 2-3%. This makes it tough to generate significant passive earnings from the funding.

Furthermore, there are vital transaction prices concerned in shopping for and promoting actual property in India, reminiscent of stamp obligation, registration charges, and brokerage, which collectively are roughly about 12% of the property on the time of buy and capital features taxes upon the sale. When it is time to promote the property and repatriate the funds again to my residence nation, there could be complicated tax and regulatory hurdles to navigate. These can eat into the general returns.

The returns typically do not justify the effort and dangers for NRIs. For NRIs, I’ve discovered that the potential upsides of proudly owning actual property in India are sometimes outweighed by the downsides—the forex danger, low yields, excessive transaction prices, and repatriation challenges.

Until an NRI has a really robust emotional or private attachment to a property in India, I consider it is typically not the perfect use of their capital. The cash is commonly higher off invested in additional liquid belongings like fastened deposits, which offer you roughly the identical returns with none trouble.

How can NRIs sort out the challenges round succession and the switch of property?

Given the complexities concerned, it is necessary for NRIs to plan forward and take proactive steps to facilitate a clean switch of property. Listed here are some key issues I’d suggest|:

Drafting a transparent and legally binding will is essential. This ensures the property is transferred as per your needs reasonably than leaving it to likelihood or household disputes.

Appoint an in depth member of the family or pal residing in India as a nominee or energy of lawyer. This individual can deal with the day-to-day administration. Maintain all property-related paperwork, such because the sale deed, up-to-date and simply accessible. This may streamline the switch course of when the time comes.

Gifting the property to your youngsters when you are nonetheless alive could be one other solution to facilitate a smoother transition. I’ve personally determined to not maintain on to any residential property in India. As a substitute, I’ve targeted my investments on extra liquid industrial actual property.

What’s your message to aged mother and father who personal properties with NRI youngsters overseas?

I’ve seen this situation play out very often, and I’ve come to the conclusion that it is typically not advisable for aged mother and father on this scenario to personal property in India. When the kids are settled overseas, they typically have little to little interest in the property again in India. It turns into extra of a burden than an asset for them.

Making certain the property is well-maintained and managed generally is a fixed headache for aged mother and father, particularly if they aren’t bodily current in India.

My suggestion could be to noticeably contemplate promoting the property and investing the proceeds in additional liquid, simply manageable belongings. This could possibly be within the type of FDs, mutual funds, and even gifting the cash to the kids for their very own use.

What’s your suggestion to younger traders in the present day?

Method actual property investments with a really strategic and pragmatic mindset. Listed here are the important thing factors I’d emphasize. If you wish to put money into actual property, deal with industrial properties, particularly well-located retailers, reasonably than residential investments. Industrial properties have a tendency to understand at a a lot larger charge and supply higher rental yields, be very selective concerning the properties you put money into.

Deal with a residential property as a consumption merchandise, not an funding. When shopping for a home to dwell in, assume the value of the property is actually zero. Prioritize your individual consolation and desires over funding returns relating to your major residence. Search for respected actual property advisors who’ve a confirmed monitor document.

Diversify your investments throughout completely different asset lessons. Search skilled recommendation.

Do you continue to actively work as a dealer?

Sure, after 2006, I’ve consciously averted investing in residential actual property for myself. My focus has been on industrial properties, which I consider supply higher returns and fewer complications.

As a dealer, I proceed to be very energetic available in the market. I take part in the true property sector by way of my brokerage enterprise reasonably than immediately proudly owning residential properties.

It is a determination that has served me effectively through the years and aligns with my general funding philosophy.