The IRS says it processed 11.7 million tax returns within the first week of the 2025 submitting season. Right here, carts loaded with paperwork are seen at an IRS processing facility in Austin, Texas, final September.

Brandon Bell/Getty Pictures

conceal caption

toggle caption

Brandon Bell/Getty Pictures

The IRS began accepting tax returns on Jan. 27 — and by the April 15 federal deadline, the company expects to obtain greater than 140 million particular person tax returns. Meaning tens of millions of individuals can be asking one query: When will I get my refund cash?

About 28% of the 11.7 million returns processed by the IRS resulted in direct-deposit refunds within the first week of submitting, according to the IRS.

When the present submitting season started, “the IRS was coming in in a robust place. That is good for taxpayers,” Janet Holtzblatt, a senior fellow on the City-Brookings Tax Coverage Heart, tells NPR, citing the company’s latest investments in customer support.

After all, many federal companies are actually roiled by the Trump administration’s controversial goals of shrinking employees dimension and eliminating packages (extra on that beneath).

This is a fast information to navigating the 2025 tax submitting season:

Verify your tax return’s standing

In the event you’re about to file, or have already finished so, you may monitor the progress of your return for tax yr 2024 on-line. The IRS has a devoted Where’s My Refund page that can present the standing of your tax return by round 24 hours after you file electronically.

To check your refund’s status, you may have to know the “precise entire greenback refund quantity proven in your tax return,” the IRS says, so be sure to have that readily available.

The monitoring device helps you comply with your return by way of three important phases: when your return has been acquired (and is being processed); when your refund is accredited (and the anticipated date of its situation); and affirmation that the refund has been despatched.

Your refund ought to come inside three weeks

The IRS says most refunds can be issued inside 21 days of your submitting date. As lately, the IRS recommends submitting electronically and utilizing direct deposit to get refunds extra shortly.

However for those who filed early and are in search of refunds associated to 2 conditions — the Earned Revenue Tax Credit score and the Further Youngster Tax Credit score — you may need to attend a bit longer. That is as a result of the IRS can solely situation these refunds after mid-February, underneath a requirement within the PATH Act of 2015.

The delay “was an effort to forestall, or to restrict, identification fraud,” Holtzblatt tells NPR.

In these instances, she provides, “the refunds wouldn’t start to be paid till after Feb. 15, which interprets into individuals not getting it till early March.”

Hundreds of thousands extra individuals can file without spending a dime on-line

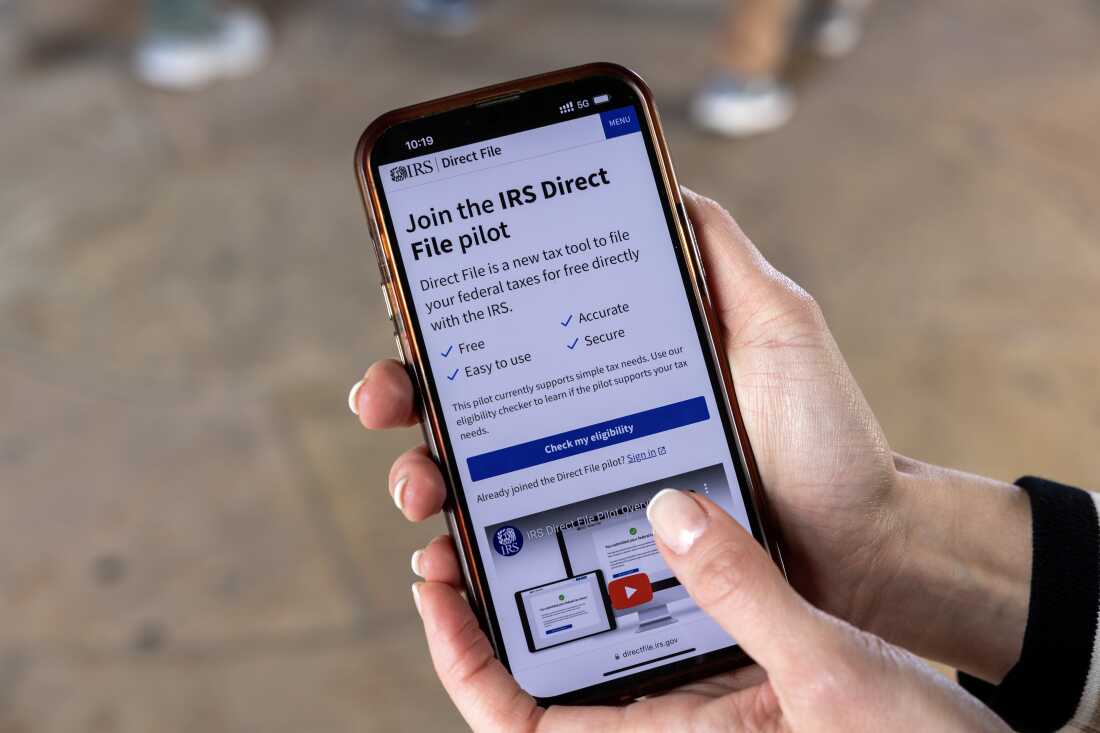

A cellphone consumer seems to be at details about the IRS Direct File program on the IRS constructing in Washington, D.C., final April. The free tax return service has now grown to 25 states.

Tasos Katopodis/Getty Pictures for Financial Safety Venture

conceal caption

toggle caption

Tasos Katopodis/Getty Pictures for Financial Safety Venture

The free Direct File system has expanded since final yr’s 12-state pilot program, rising to 25 participating states this yr. It is geared toward individuals with comparatively simple tax returns.

“After they did the pilot, they discovered that a big proportion of those that used it and completed it had been very happy,” Holtzblatt says of the device on the IRS web site.

The enlargement of this system is “a giant step for the IRS and for taxpayers,” Holtzblatt says, noting that it provides on-line steering to assist individuals file electronically at no cost.

Direct File is obtainable in a number of massive states, equivalent to New York, Texas, Florida and California. However filers in different states and the District of Columbia are out of luck (though all 50 states were invited to participate).

There are additionally limits on the kinds and quantity of earnings you may report. Direct File cannot deal with gig work or rental earnings, as an illustration. And wages for a single filer cannot be greater than $200,000.

You may examine your eligibility here.

The IRS faces adjustments

The IRS received long-awaited reduction in 2022, within the type of $80 billion from the Inflation Discount Act, together with its common appropriations. The cash adopted years of experiences that the company was underfunded and understaffed; amongst different issues, it was meant to assist the company replace its pc methods, increase customer support and enhance tax enforcement.

A 2021 examine discovered the U.S. authorities misses out on round $600 billion in unpaid taxes annually. The IRS had also been reporting lengthy phone wait occasions and a rising backlog of unprocessed returns.

When the IRS received the primary infusion of cash in 2022, “they instantly went out and employed some 5,000 new individuals who may help taxpayers,” Holtzblatt says. “They’re there to make the submitting season extra smoother.”

However Congress has clawed again some $40 billion of IRS funding — first in a finances deal in 2023, and once more in December.

“The shortfalls in IRS appropriations are prone to proceed and perhaps even enhance,” Holtzblatt says, including that hiring freezes would additionally hamper the company.

As for Direct File, the IRS has mentioned this system is everlasting. However its destiny grew to become clouded earlier this month, when Elon Musk, the billionaire head of the brand new Division of Authorities Effectivity (DOGE), tweeted that he “deleted” the agency that labored on the net device.