When Brian P. Brooks was a monetary regulator in the course of the first Trump administration, he would hear complaints about “debanking” and pressure himself to not roll his eyes.

The expression was being utilized by representatives of some reasonably polarizing companies, similar to non-public prisons and fracking operators, who complained to Mr. Brooks, the acting comptroller of the currency, that their financial institution accounts have been being closed with out warning. His response boiled right down to the free-market equal of robust luck. He didn’t see it as his job to compel banks to do enterprise with anybody particularly.

5 years later, Mr. Brooks, who now runs a brokerage agency and advises cryptocurrency firms, says he’s satisfied there’s a drawback. He’s amongst a rising variety of folks within the finance world who’ve urged Trump administration officers over the previous half-year — in conferences in Washington and on the Mar-a-Lago membership in Florida — to crack down on the observe.

“The electrical firm can’t deny you service as a result of it doesn’t like your appears to be like, and neither can a financial institution,” Mr. Brooks stated in an interview.

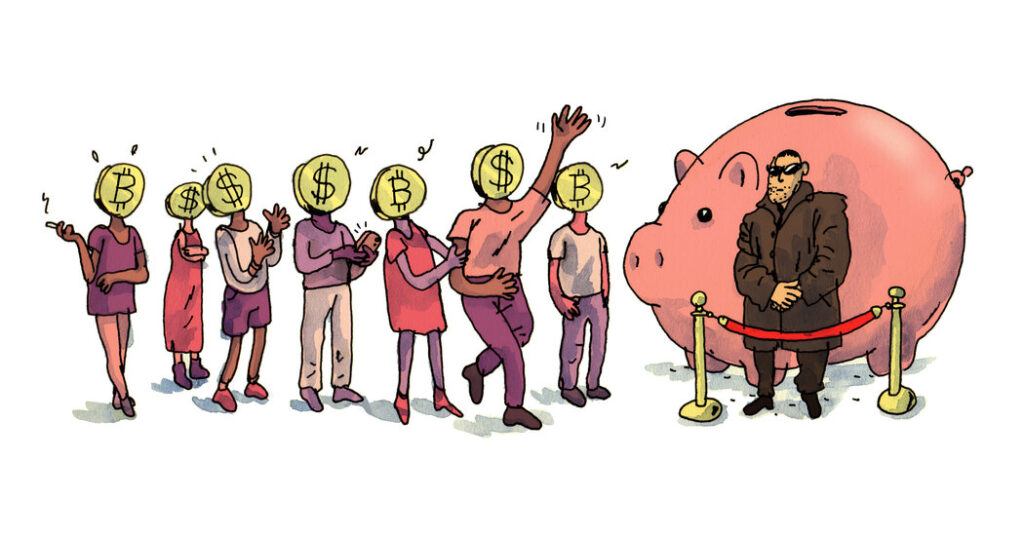

In current months, the cry of “debanking” has rung out from conservative and non secular teams and the Trump Group to accuse lenders of politically motivated discrimination. It’s coming from cryptocurrency companies that say regulations bar them from opening strange financial institution accounts, and from liberal lawmakers talking up for individuals and businesses whose A.T.M. playing cards are shut off with out warning.