If we wish to discover a potential multi-bagger, usually there are underlying developments that may present clues. In an ideal world, we might wish to see an organization investing extra capital into its enterprise and ideally the returns earned from that capital are additionally growing. This reveals us that it is a compounding machine, capable of regularly reinvest its earnings again into the enterprise and generate increased returns. With that in thoughts, the ROCE of IMI (LON:IMI) appears nice, so lets see what the pattern can inform us.

We have found 1 warning signal about IMI. View them for free.

Understanding Return On Capital Employed (ROCE)

Simply to make clear when you’re uncertain, ROCE is a metric for evaluating how a lot pre-tax earnings (in share phrases) an organization earns on the capital invested in its enterprise. Analysts use this formulation to calculate it for IMI:

Return on Capital Employed = Earnings Earlier than Curiosity and Tax (EBIT) ÷ (Complete Property – Present Liabilities)

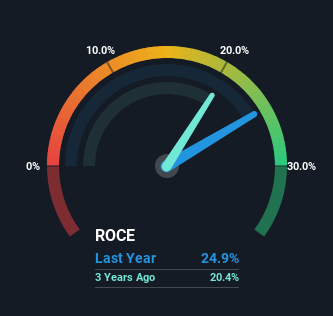

0.25 = UK£410m ÷ (UK£2.5b – UK£844m) (Primarily based on the trailing twelve months to December 2024).

So, IMI has an ROCE of 25%. That is a incredible return and never solely that, it outpaces the typical of 14% earned by corporations in the same business.

View our latest analysis for IMI

Within the above chart we have now measured IMI’s prior ROCE in opposition to its prior efficiency, however the future is arguably extra vital. If you would like to see what analysts are forecasting going ahead, you need to take a look at our free analyst report for IMI .

What Does the ROCE Development For IMI Inform Us?

We just like the developments that we’re seeing from IMI. The numbers present that within the final 5 years, the returns generated on capital employed have grown significantly to 25%. The quantity of capital employed has elevated too, by 31%. The growing returns on a rising quantity of capital is frequent amongst multi-baggers and that is why we’re impressed.

Our Take On IMI’s ROCE

All in all, it is terrific to see that IMI is reaping the rewards from prior investments and is rising its capital base. And with the inventory having carried out exceptionally effectively over the past 5 years, these patterns are being accounted for by buyers. Subsequently, we expect it might be value your time to test if these developments are going to proceed.

On a last word, we have discovered 1 warning sign for IMI that we expect you need to be conscious of.

If you would like to see different corporations incomes excessive returns, take a look at our free list of companies earning high returns with solid balance sheets here.

If you happen to’re seeking to commerce IMI, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With shoppers in over 200 international locations and territories, and entry to 160 markets, IBKR permits you to commerce shares, choices, futures, foreign exchange, bonds and funds from a single built-in account.

Take pleasure in no hidden charges, no account minimums, and FX conversion charges as little as 0.03%, much better than what most brokers provide.

Sponsored Content material

New: AI Inventory Screener & Alerts

Our new AI Inventory Screener scans the market every single day to uncover alternatives.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Shopping for

• Excessive development Tech and AI Firms

Or construct your individual from over 50 metrics.

Have suggestions on this text? Involved concerning the content material? Get in touch with us immediately. Alternatively, e mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is basic in nature. We offer commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles should not meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary scenario. We purpose to deliver you long-term centered evaluation pushed by elementary information. Be aware that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.