What are the early developments we should always search for to determine a inventory that might multiply in worth over the long run? Usually, we’ll wish to discover a development of rising return on capital employed (ROCE) and alongside that, an increasing base of capital employed. In the end, this demonstrates that it is a enterprise that’s reinvesting income at rising charges of return. And in gentle of that, the developments we’re seeing at Caterpillar’s (NYSE:CAT) look very promising so lets have a look.

We have found 1 warning signal about Caterpillar. View them for free.

Return On Capital Employed (ROCE): What Is It?

Simply to make clear if you happen to’re uncertain, ROCE is a metric for evaluating how a lot pre-tax earnings (in proportion phrases) an organization earns on the capital invested in its enterprise. The system for this calculation on Caterpillar is:

Return on Capital Employed = Earnings Earlier than Curiosity and Tax (EBIT) ÷ (Complete Property – Present Liabilities)

0.24 = US$13b ÷ (US$85b – US$33b) (Primarily based on the trailing twelve months to March 2025).

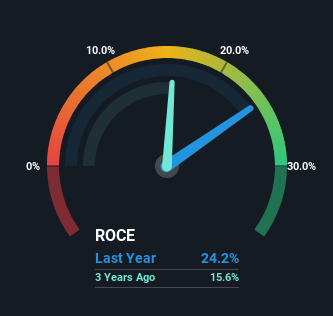

Due to this fact, Caterpillar has an ROCE of 24%. In absolute phrases that is an ideal return and it is even higher than the Equipment business common of 11%.

View our latest analysis for Caterpillar

Above you’ll be able to see how the present ROCE for Caterpillar compares to its prior returns on capital, however there’s solely a lot you’ll be able to inform from the previous. If you would like, you’ll be able to check out the forecasts from the analysts covering Caterpillar for free.

How Are Returns Trending?

Caterpillar is displaying promise provided that its ROCE is trending up and to the best. Extra particularly, whereas the corporate has saved capital employed comparatively flat over the past 5 years, the ROCE has climbed 64% in that very same time. Principally the enterprise is producing larger returns from the identical quantity of capital and that’s proof that there are enhancements within the firm’s efficiencies. The corporate is doing effectively in that sense, and it is price investigating what the administration workforce has deliberate for long run progress prospects.

The Backside Line On Caterpillar’s ROCE

As mentioned above, Caterpillar seems to be getting more adept at producing returns since capital employed has remained flat however earnings (earlier than curiosity and tax) are up. And with the inventory having carried out exceptionally effectively over the past 5 years, these patterns are being accounted for by traders. With that being stated, we nonetheless assume the promising fundamentals imply the corporate deserves some additional due diligence.

On a separate observe, we have discovered 1 warning sign for Caterpillar you may most likely wish to learn about.

Excessive returns are a key ingredient to robust efficiency, so try our free checklist ofstocks earning high returns on equity with solid balance sheets.

New: AI Inventory Screener & Alerts

Our new AI Inventory Screener scans the market every single day to uncover alternatives.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Shopping for

• Excessive progress Tech and AI Corporations

Or construct your personal from over 50 metrics.

Have suggestions on this text? Involved in regards to the content material? Get in touch with us instantly. Alternatively, e mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is basic in nature. We offer commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles should not meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary scenario. We goal to deliver you long-term targeted evaluation pushed by basic knowledge. Word that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.