Please word that we aren’t authorised to offer any funding recommendation. The content material on this web page is for data functions solely.

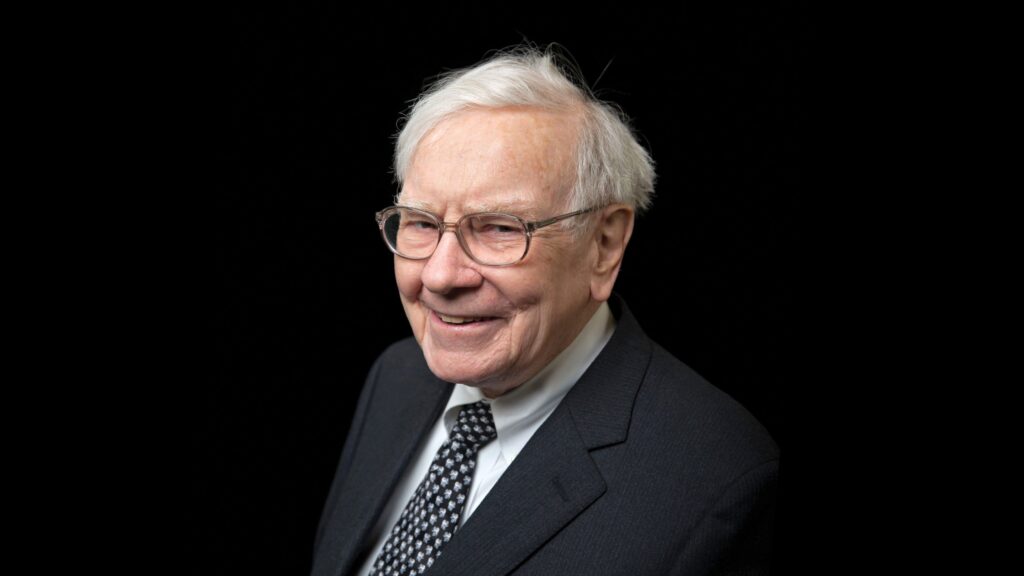

Berkshire Hathaway launched its Q1 13F earlier this week, which confirmed that Warren Buffett continued to promote shares, particularly in banking and monetary firms. Listed below are the important thing takeaways from the conglomerate’s quarterly submitting.

Berkshire didn’t disclose any new holdings within the quarter but revealed a secret place between $1 billion and $2 billion, which is probably going a brand new firm. Aside from that, the conglomerate added to stakes in Pool Company, Occidental Petroleum, Verisign, Constellation Manufacturers, Domino’s Pizza, Sirius XM Holdings, and Heico-A.

Berkshire Hathaway Added Extra Pool Corp. Shares

General, there have been no actual surprises right here, and Berkshire has progressively been including shares of Occidental Petroleum because it has the regulatory approvals to carry its stake to 50%. Additionally, Pool Company, Domino’s Pizza, and Constellation Manufacturers are comparatively new holdings, and sometimes Berkshire provides to stakes in subsequent quarters after the preliminary buy. Amongst these purchases, Berkshire greater than doubled its stake in Pool Company and Constellation Manufacturers throughout Q1.

Berkshire Hathaway Exits Citigroup

Berkshire Hathaway trimmed stakes in Financial institution of America, DaVita Inc., Capital One Monetary Corp, T-Cell, Constitution Communications, and Liberty Media, and fully exited Citigroup and Nu Holding. Citi was a comparatively new place for Berkshire, and Buffett first purchased a stake in Q1 2022 amid the corporate’s turnaround. Nonetheless, the “Oracle of Omaha” bought shares in This autumn and finally exited the title in Q1.

Warren Buffett Has Been Promoting Financials for The Final Many Quarters

Notably, whereas Warren Buffett has traditionally had a aptitude for banking and monetary firms, and the key firm the place he was constructing a stake in 2023 turned out to be Zurich-based insurer Chubb, the Oracle of Omaha has bought stakes in lots of banks during the last couple of years.

These embody Wells Fargo, the place Berkshire as soon as held an almost 10% stake. Buffett additionally exited names like JPMorgan Chase and Goldman Sachs. By the way, whereas Buffett has held fats stakes in main banks, he ensured that Berkshire’s stake remained under 10% to flee regulatory scrutiny.

Nonetheless, he made an exception for Financial institution of America and elevated Berkshire’s stake within the second-largest US financial institution past 10% after getting regulatory approval. Nonetheless, the Oracle of Omaha has been progressively promoting Berkshire’s stake within the financial institution.

Berkshire Has Internet Offered Shares for 10 Consecutive Quarters

Berkshire was a internet vendor of shares in Q1, and the corporate bought shares value $4.7 billion whereas its inventory shopping for totaled solely $3.2 billion. Q1 marked the tenth consecutive quarter when Buffett was a internet vendor of shares and bought extra shares than he purchased.

Berkshire’s money pile has been progressively rising and soared to a brand new document excessive of just about $348 billion on the finish of March. The Warren Buffett-run firm now owns almost 5% of all excellent U.S. Treasury payments because the nonagenarian hasn’t been capable of finding compelling alternatives to speculate that money.

In the course of the annual assembly earlier this month, Buffett stated that Berkshire was near doing a $10 billion deal, however finally held again. Buffett, nonetheless, downplayed the recent market volatility and stated, “What has occurred within the final 30, 45 days … is de facto nothing.”

Buffett stated that during the last six many years, there have been three situations when Berkshire shares misplaced 50% in worth and added, “I don’t get fearful by issues that different individuals … are afraid of in a monetary method.”

He emphasised, “Let’s say Berkshire went down 50% subsequent week, I might regard that as a incredible alternative, and it wouldn’t hassle me within the least.”

Buffett Introduced His Retirement

In the direction of the end of the annual meeting, Buffett disclosed that he would retire as the corporate’s CEO and hand over the baton to Greg Abel.

In the meantime, regardless that Buffett introduced his retirement, he burdened that he didn’t intend to promote his stake within the conglomerate. I’ve no intention, zero, of promoting one share of Berkshire Hathaway. It should get given away progressively,” stated Buffett.

He added, “I might add this: The choice to maintain each share is an financial choice, as a result of I feel the prospects of Berkshire can be higher beneath Greg’s administration than mine.”

“However I’ll are available, and there might come a time once we get an opportunity to speculate some huge cash. When that point comes, I feel it could be useful with the board — the truth that they know I’ve obtained all my cash within the firm, and I feel it’s good, and I’ve seen what Greg has completed,” stated Buffett, reaffirming his religion in Abel’s management.

Abel, on his half, signaled continuity on the conglomerate that owns a number of companies other than stakes in publicly traded firms. “It’s actually the funding philosophy and the way Warren and the group have allotted capital for the previous 60 years,” stated Abel. He added, “Actually, it is not going to change. And it’s the method we’ll take as we go ahead.”

Berkshire Carried out Extremely Properly Below Buffett

Later in an interview, Buffett admitted that his choice was primarily because of the results of ageing. He noticed a decline in his vitality ranges and general effectivity, significantly when in comparison with his successor, Abel. He talked about experiencing “heartbreaking moments” similar to dropping his stability, forgetting names, and struggling to learn newspapers.

In the meantime, Berkshire Hathaway has carried out extremely nicely beneath Buffett and achieved a compounded annual return of 19.9% from 1965 by 2024, which far exceeds the S&P 500 Index’s annual return of 10.4% over the identical interval.