As the worldwide inhabitants ages at an unprecedented price, a seismic shift is reshaping economies, industries, and funding landscapes. By 2030, one in six folks worldwide will probably be aged 60 or older, and the variety of people over 80 will surpass 426 million by 2050. This demographic transformation will not be merely a social problem—it’s a $70 trillion financial alternative. Traders who align with the longevity-driven megatrend are poised to capitalize on improvements in healthcare, finance, and expertise that cater to getting old demographics.

AI and Healthcare Innovation: Revolutionizing Elder Care

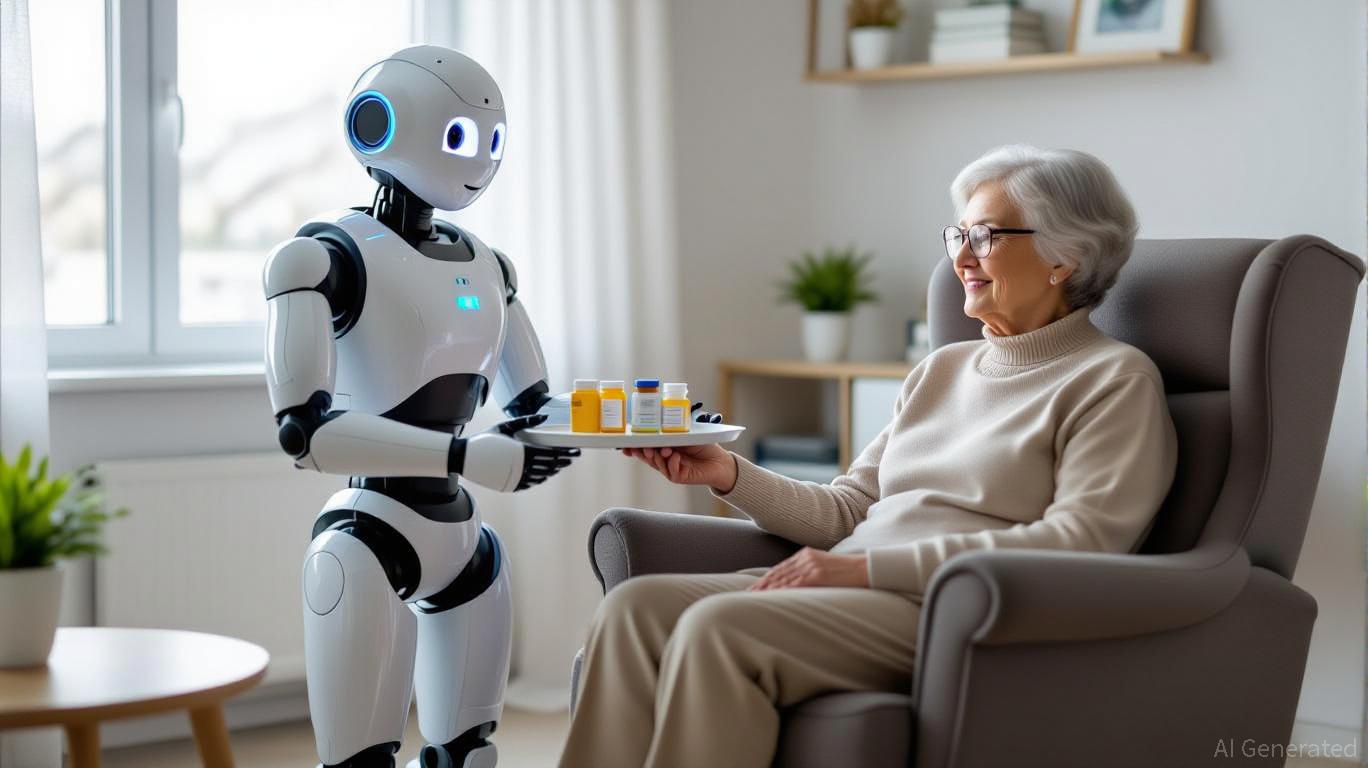

The healthcare sector is on the forefront of the longevity economic system, with synthetic intelligence (AI) and robotics redefining how care is delivered. AI diagnostics, personalised medication, and telemedicine are decreasing prices and bettering outcomes for age-related circumstances like Alzheimer’s and continual illnesses. The worldwide healthcare AI market is projected to succeed in $613.81 billion by 2030, rising at a staggering 21.2% CAGR.

Humanoid robots, akin to Tesla’s Optimus, are addressing labor shortages in elder care. With 182,000 models projected to be deployed by 2030, these improvements should not solely enhancing care high quality but in addition driving effectivity. Tesla’s inventory has surged 300% in three years, reflecting investor confidence in its robotics division.

Traders ought to take into account AI-driven biotech companies and robotics builders. Corporations leveraging AI for drug discovery, akin to these focusing on age-related illnesses, supply high-growth potential. Moreover, robotics companies with scalable elder care options are well-positioned to profit from this structural shift.

Retirement Finance: Reimagining Wealth Administration for Longevity

The getting old inhabitants controls 75% of U.S. wealth, making a surge in demand for retirement finance options. Conventional pension methods are beneath pressure, however fintech improvements are filling the gap. The U.S. annuities market alone reached $430 billion in 2025, with AI-driven robo-advisors like Betterment and Wealthfront integrating longevity analytics into portfolio methods.

The AI finance market, valued at $38.36 billion in 2024, is anticipated to develop to $190.33 billion by 2030. Blockchain-based platforms and fairness launch markets (e.g., reverse mortgages) are additionally gaining traction, with the latter projected to succeed in $56 billion by 2035.

Traders ought to prioritize fintech companies specializing in longevity threat administration and blockchain-based retirement options. These corporations are redefining how retirees navigate monetary uncertainty, providing each stability and scalability.

Senior Housing and Actual Property: Assembly the Demand for Age-Pleasant Residing

The demand for senior housing is surging, with actual property funding trusts (REITs) like Ventas and Welltower reporting 92% occupancy by 2030. Age-friendly housing, reminiscence care services, and assisted dwelling complexes have gotten important parts of the longevity economic system.

The worldwide senior housing market is anticipated to broaden exponentially because the inhabitants of these aged 80+ grows. REITs with diversified portfolios on this sector supply defensive development and regular money move.

Traders ought to take into account REITs with a give attention to adaptive housing and mixed-use developments. These property not solely cater to getting old populations but in addition profit from long-term occupancy traits.

Automation and Robotics: Bridging the Care Hole

Automation is addressing labor shortages in elder care and logistics. Humanoid robots, AI-powered caregiving instruments, and sensible residence applied sciences are enhancing productiveness and decreasing prices. Tesla’s Optimus and comparable platforms are projected to dominate this area, with 182,000 models shipped by 2030.

The AI in aged care market is rising at a 21.2% CAGR, reaching $322.4 billion by 2034. Traders ought to goal robotics companies with scalable options and partnerships in healthcare and actual property.

Strategic Funding Alternatives and Actionable Steps

The longevity economic system is a structural megatrend with compounding development throughout sectors. To capitalize on this shift, buyers ought to:

1. Diversify throughout healthcare, fintech, and actual property to hedge in opposition to sector-specific dangers.

2. Prioritize AI-driven improvements in diagnostics, robotics, and personalised medication.

3. Put money into REITs with age-friendly housing portfolios to profit from long-term occupancy traits.

4. Monitor fintech companies redefining retirement finance, significantly these leveraging blockchain and AI.

The longevity economic system will not be a fleeting development however a everlasting transformation. By aligning with this megatrend, buyers can safe their portfolios in opposition to demographic shifts whereas tapping right into a $70 trillion alternative. The time to behave is now—earlier than the market totally reorients round getting old populations.