Enterprise reporters, BBC Information

Getty Pictures

Getty PicturesThe UK jobs market has weakened as wage development slows and the unemployment charge rises, official statistics present.

The annual charge of pay development within the three months between March and Could slowed to five%, the Workplace for Nationwide Statistics (ONS) mentioned.

In the meantime, the unemployment charge rose to 4.7%, its highest in 4 years, although the ONS has mentioned the determine must be handled with warning on account of issues with how the info is collected.

Economists say a weaker labour market makes it extra seemingly the Financial institution of England will reduce rates of interest in an try to spice up the economic system at its assembly subsequent month.

Earlier this week, in an interview with the Occasions, the Bank of England governor Andrew Bailey indicated there could possibly be bigger cuts to rates of interest if the roles market confirmed indicators of slowing down.

Most economists are predicting a reduce – although some say it would be unwise to encourage spending while inflation is still rising.

Others have mentioned that April’s rise in employer nationwide insurance coverage contributions (NICs) has discouraged companies from hiring.

The ONS information exhibits the variety of folks on PAYE payroll has fallen in seven of the eight months since Chancellor Rachel Reeves introduced the NICs rise.

Paul Dales, chief economist at Capital Economics, mentioned this pattern “clearly exhibits companies are offsetting the rises of their prices by decreasing headcounts”.

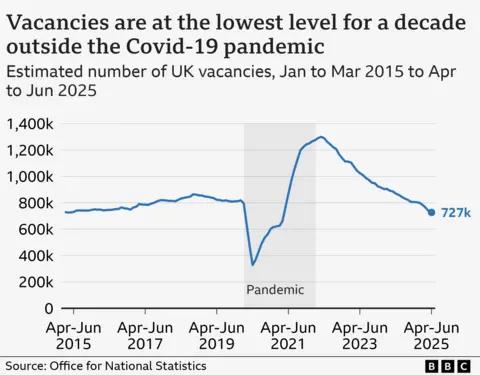

The ONS mentioned the variety of vacancies fell once more to 727,000 for the April to June interval, marking three steady years of falling job openings.

It added that survey information advised that some companies will not be recruiting new employees or changing ones who’ve left.

The variety of job vacancies is now at its lowest in 10 years, excluding the plunge seen through the pandemic when lockdowns stopped companies from hiring.

Yael Selfin, chief economist at KPMG UK, mentioned the “slowing pay development opens the door for an rate of interest reduce in August”.

“The affect of April’s tax and administrative adjustments has led to a marked slowdown in hiring exercise amongst companies,” she added.

“With home exercise remaining sluggish, the [Bank of England] will seemingly need to present help through looser coverage to forestall a extra vital deterioration within the labour market.”

‘We’re managing by the pores and skin of our enamel’

Andrew Teebay

Andrew TeebayPeter Kinsella runs two Spanish eating places in Liverpool Metropolis centre and says that is the hardest interval for the enterprise for the reason that monetary disaster in 2008.

He says the rise in employer nationwide insurance coverage contributions has “actually impacted our recruitment. We make use of fewer folks than we did in March.”

Peter has reduce staffing hours, decreased opening occasions, and invests much less in repairs within the restaurant to earn money go additional.

“We’re managing, however by the pores and skin of our enamel”, he says.

He is additionally being extra cautious about hiring new employees, usually reluctantly not changing individuals who go away the enterprise.

“It is a unbelievable factor to take folks on, to offer them work. So we need to keep away from in any respect prices these issues which have an actual affect on folks’s lives, however we have had no selection”.