HONG KONG — The USA and China introduced a 90-day pause on most of their current tariffs on each other, fueling hopes on Wall Street of a cooldown within the commerce conflict between the world’s two largest economies.

The mixed U.S. tariff fee on Chinese language imports will probably be minimize to 30% from 145%, whereas China’s levies on U.S. imports will fall to 10% from 125%, the countries said early Monday morning.

Officers met in Geneva over the weekend for his or her first face-to-face talks since President Donald Trump’s shock tariff rollout on April 2, when he imposed 84% duties on Chinese language imports, adjusted them to to 125% quickly afterward, and hiked them additional to 145% a day later.

The brand new 30% fee is the sum of the 20% responsibility Trump imposed early in his second time period over alleged Chinese language failures to curb fentanyl flows and the ten% common tariff he has utilized to just about all international imports.

Markets surged on information of the detente. The broad-based S&P 500 was buying and selling 3.1% increased Monday afternoon, and the Dow Jones Industrial Common added greater than 1,100 factors, a roughly 2.7% achieve. The tech-focused Nasdaq surged 4.1%.

European indexes posted modest features Monday. Markets throughout Asia had upbeat classes as properly forward of the information, anticipating some type of commerce settlement and in addition welcoming a ceasefire between India and Pakistan that largely appears to be holding. Hong Kong’s Grasp Seng Index soared on information of the U.S.-China settlement, closing greater than 3% increased.

But some analysts have urged warning, noting that tariffs stay far increased than earlier than Trump regained workplace. That means many consumer goods — from cars and groceries to fireworks — are set to see worth hikes. Federal information is ready to supply a recent inflation snapshot on Tuesday morning.

“The complete set of U.S. tariffs would nonetheless be significantly increased and broader than anticipated by markets in the beginning of the yr,” Goldman Sachs analysts wrote in a be aware to shoppers Monday, noting that the 90-day countdown “ought to hold uncertainty excessive for each buyers and companies.”

The U.S.’s efficient tariff fee would now be 17.8%, the best since 1934, which Yale Budget Lab researchers estimated Monday would dent households’ annual buying energy by $2,800.

The USA has a bigger items commerce deficit with China than with another nation, and Trump has typically accused it of “ripping off” the U.S. by way of unfair commerce practices. In contrast to different U.S. buying and selling companions, Beijing responded by imposing retaliatory tariffs and different countermeasures that escalated right into a dizzying game of one-upmanship.

The dueling import taxes have been “the equal of an embargo,” which neither aspect needed, mentioned Treasury Secretary Scott Bessent. “We do need commerce, we would like extra balanced commerce, and I feel that each side are dedicated to reaching that,” he mentioned.

Bessent, who represented the U.S. within the talks with Beijing together with Commerce Consultant Jamieson Greer, rejected strategies that negotiating immediately would have been extra productive than triggering a tariff spat that caused global financial turmoil, saying {that a} “enterprise as traditional” effort to rebalance commerce wouldn’t have labored.

The U.S. and China now have “a mechanism to keep away from the upward tariff strain,” Bessent instructed CNBC Monday. “I’d think about that within the subsequent few weeks we will probably be assembly once more to get rolling on a extra fulsome settlement,” he added.

Greer famous that separate discussions on fentanyl have been “on a really constructive observe.

The Chinese language Commerce Ministry mentioned the settlement was an “vital step” and “creates favorable situations for additional narrowing variations and deepening cooperation.”

“It’s hoped that the U.S. will construct on the inspiration of this assembly, proceed to work in the identical path with China” and “fully appropriate its unilateral tariff practices,” a spokesperson mentioned.

Bessent emphasised that the U.S. doesn’t desire a broad-based “decoupling” from China, preferring as a substitute a “strategic decoupling, as a result of we realized throughout Covid that environment friendly provide chains weren’t safe provide chains,” he instructed MSNBC. “So with metal, with semiconductors, with medicines, with a few different strategic classes, we’re going to must develop into self-reliant once more.”

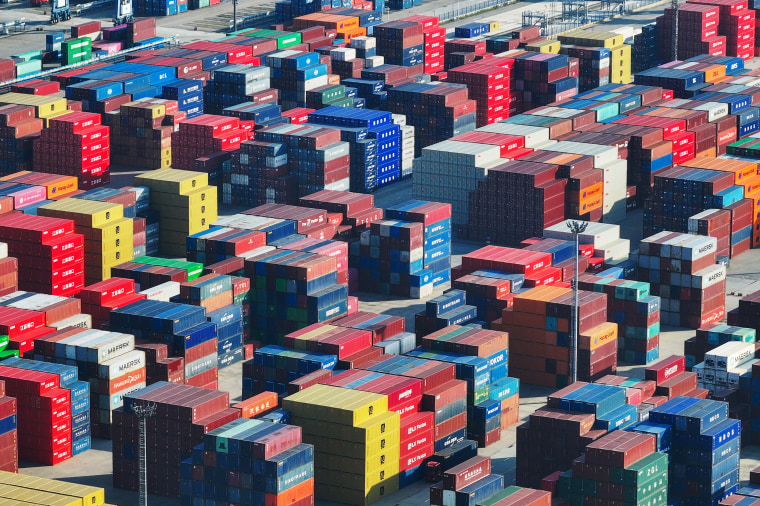

Tariff impacts are already being felt throughout the USA, with shipping volumes from China falling sharply since early April. Danish delivery large A.P. Moller-Maersk mentioned Monday that the 90-day reprieve was “a step in the fitting path” that it hoped may “create the long-term predictability our clients want.”

The settlement can also be excellent news for small and medium-sized companies “on each side of the Pacific,” mentioned Tianchen Xu, a Beijing-based economist on the Economist Intelligence Unit, a monetary forecasting service. It ought to be “a really large reduction for struggling small Chinese language exporters, a few of which have already misplaced U.S. orders for weeks,” whereas American patrons are gaining some respiratory room over surging prices, he mentioned in emailed feedback.

The settlement exceeded expectations and has “rekindled world hope,” mentioned Wang Wen, dean of the Chongyang Institute for Monetary Research at Renmin College of China. However Xu and Wang each cautioned that many tough points stay to be resolved.

“This case is a serious take a look at of the political knowledge and negotiation functionality of the decision-makers in each China and the U.S.,” Wang mentioned.

Forward of the bilateral talks in Geneva, Trump had expressed willingness to slash tariffs on Chinese language imports from 145% to 80%, saying that stage “appears proper” however leaving the choice to Bessent.

“You’ll be able to’t get any increased,” Trump instructed reporters late final week. “It’s at 145, so we all know it’s coming down.”