Türkiye’s shadow economic system accounted for 16.1% of its gross home product (GDP) in 2023, equal to roughly ₺7 trillion ($179 billion)—considerably exceeding the worldwide common of 11.8%, based on UK-based skilled companies agency Ernst & Younger.

The shadow economic system—additionally known as the casual or unregistered economic system—encompasses all financial actions that aren’t reported to the authorities and due to this fact escape taxation, regulation, and statistical recording. It contains every little thing from unregistered companies and off-the-books employment to underreported company revenues and cash-based transactions that depart no paper path.

Though not all the time unlawful, these actions deprive governments of tax income, distort market competitors, and weaken institutional belief.

Türkiye’s loss from shadow economic system reaches as much as $44 billion

In line with Ernst & Younger’s March 2025 report “Shadow Economic system Uncovered: Estimates for the World and Coverage Paths,” Türkiye’s fiscal loss from shadow economic system exercise is estimated at roughly 3% to 4% of GDP, which corresponds to ₺1.3 trillion to ₺1.7 trillion (or $33 billion to $44 billion) in foregone tax revenues—primarily from value-added tax (VAT), private revenue tax, and company revenue tax.

This determine displays ongoing structural challenges—similar to excessive tax burdens, widespread casual employment, restricted institutional belief, and regulatory inefficiencies—which proceed to hinder Türkiye’s progress towards full financial formalization and forestall the efficient integration of casual exercise into the registered economic system.

A Turkish finance officer paperwork data throughout a discipline inspection as a part of efforts to fight unregistered financial exercise in Türkiye, accessed on Might 18, 2025. (AA Photograph)

Informality is widespread throughout each employment and enterprise transactions, with many firms and people working exterior the official system both intentionally or by ordinary follow.

The report identifies each “lively” informality—the place taxpayers deliberately evade their obligations—and “passive” participation—the place customers could unknowingly interact in unregistered transactions. In Türkiye’s case, lively underreporting is dominant, notably amongst companies searching for to keep away from compliance prices and regulatory burdens.

This persistent informality not solely limits authorities capability to put money into public items like healthcare, schooling, and infrastructure but in addition undermines honest competitors by putting registered corporations at an obstacle.

Türkiye’s digital edge not sufficient by itself

Türkiye has made tangible progress in deploying digital options to handle informality. EY commends the nation’s widespread adoption of digital invoicing, digital archiving techniques, and the combination of monetary and tax authority databases.

These techniques have considerably improved the federal government’s skill to observe and detect unregistered exercise, the report highlighted.

Nonetheless, digital oversight alone just isn’t sufficient, the report cautions. Broader reforms are wanted to simplify tax compliance, enhance labor registration processes, and restore public belief in authorities establishments.

EY emphasizes that youth and ladies, notably in casual sectors similar to agriculture and home companies, must be prioritized in focused coverage interventions.

Türkiye can also be highlighted for instance of how technical capability might be leveraged for reform. Nonetheless, the report concludes that constructing belief and simplifying the formalization course of are crucial to sustaining long-term progress.

International outlook: Informality shrinks, however disparities stay

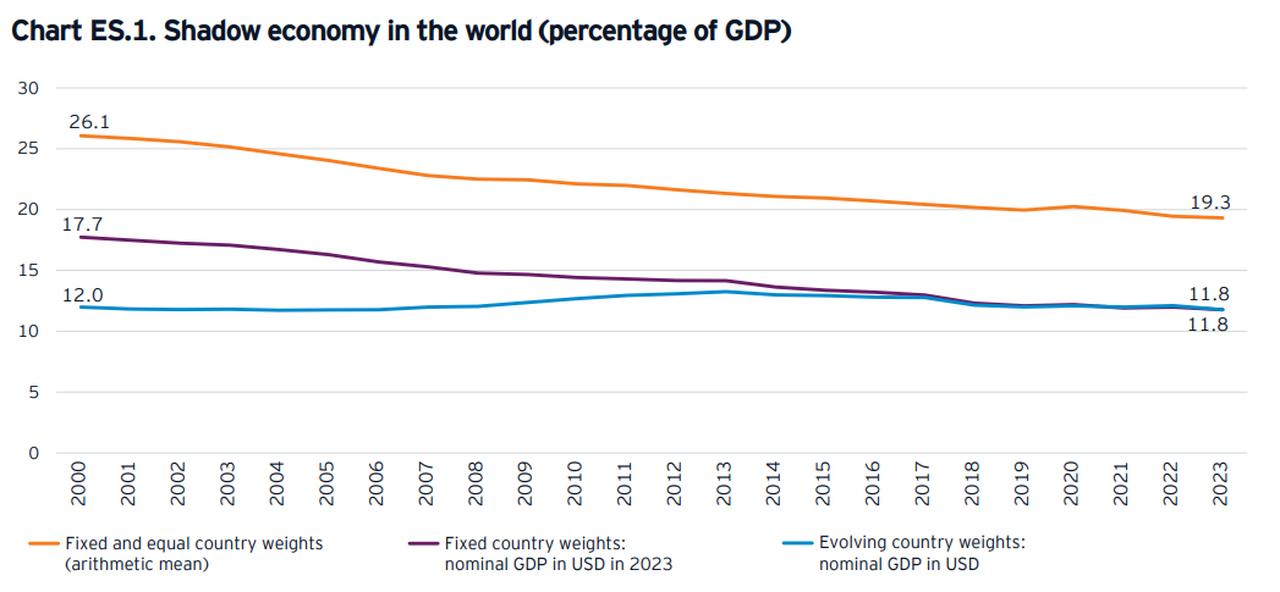

On the world degree, EY estimates the shadow economic system at 11.8% of world GDP in 2023. Nonetheless, the common throughout the 131 nations analyzed was considerably larger—19.3% of gross home product (GDP)—indicating that lower-income nations proceed to wrestle with widespread unregistered exercise.

Line chart illustrates the worldwide trajectory of shadow economic system as a proportion of GDP from 2000 to 2023, accessed on Might 18, 2025. (Chart by way of EY)

The report finds that 119 out of 131 nations have managed to cut back informality since 2000, with notable progress in low-income nations.

In distinction, superior economies have seen comparatively smaller enhancements, as informality there usually takes extra delicate varieties, similar to underreporting by registered corporations.