-

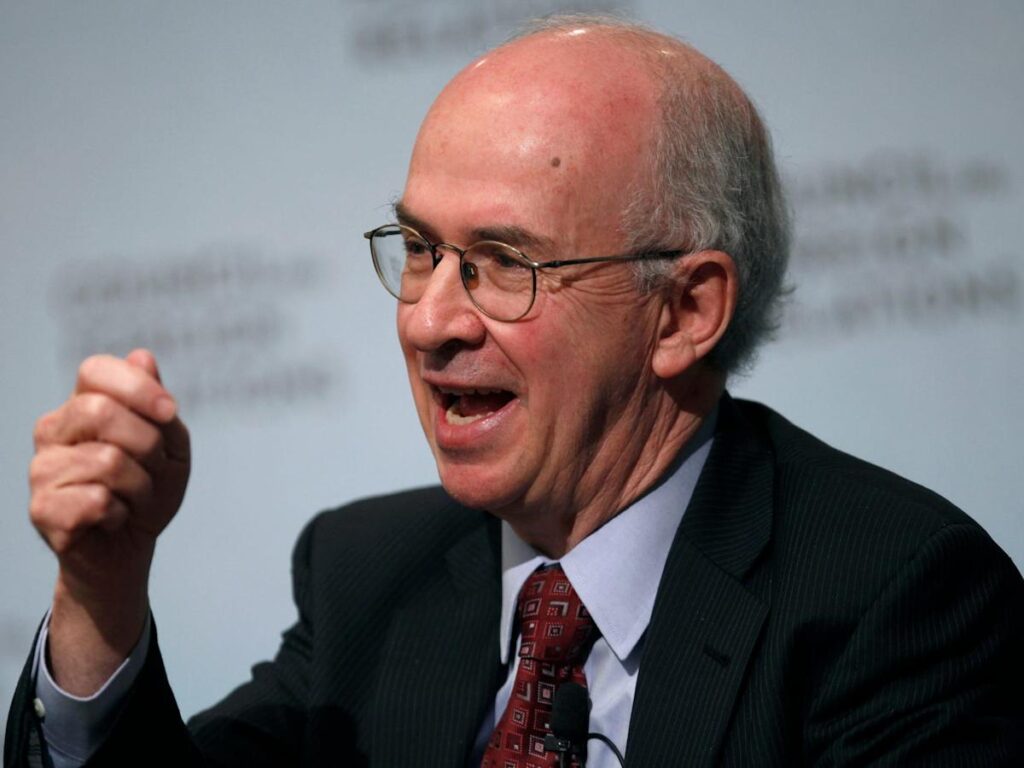

Trump’s financial insurance policies pose the danger of inflation and recession, says former IMF official Desmond Lachman.

-

He’s amongst a refrain of consultants which have expressed concern over Trump’s proposed tariffs and tax cuts.

-

Rising inflation and bond yields on account of these insurance policies may harm shares, Lachman warns.

Like a protagonist in a Greek tragedy, President Donald Trump is exhibiting a regarding degree of hubris in his dealing with of the US financial system, former IMF official Desmond Lachman worries.

Regardless of warnings from credible sources — like Fed Chair Jerome Powell, JPMorgan CEO Jamie Dimon, and BlackRock CEO Larry Fink — about what tariffs would imply for inflation and progress, and what his tax cut bill would mean for bond yields and the US greenback, Trump is doubling down on these insurance policies, Lachman mentioned in a June 10 publish for the American Enterprise Institute, the place he’s a senior fellow.

Except Trump adjustments course, Lachman mentioned, he may find yourself reigniting inflation, pushing up long-term bond yields, additional tanking the US greenback, and sending the US financial system into recession.

“To Trump, these warnings are like water off a duck’s again. As an alternative of dialing again his tariff coverage, Trump has just lately raised the import tariff on all aluminum and metal imports to a staggering 50%,” Lachman wrote.

He continued: “On the similar time, as an alternative of developing with belt-tightening income and spending measures to handle the nation’s gaping funds deficit of 6.25% of GDP, Trump is making each effort to safe the passage of his budget-busting One Massive Lovely Invoice.”

To this point, inflation has been tame and the labor market has held up as companies have began to digest tariffs. However Lachman mentioned the US financial system is just not out of the woods but. Since companies stockpiled stock to arrange for Trump’s tariffs, their results will not begin to present up till the second half of the yr, he informed Enterprise Insider on Friday.

“The truth that you are not seeing it within the Could, June, July knowledge, it doesn’t suggest something,” Lachman mentioned.

Here is the US commerce deficit exhibiting a surge in international items shopping for from US companies in late 2024 and early 2025.

However tariffs aren’t the one inflationary issue probably at play. Lachman mentioned that if you happen to add the implications of Trump’s tax invoice on the worth of the US greenback because the the nationwide debt and funds deficit develop, shoppers may find yourself paying even increased costs. With the greenback’s worth down 10%, for instance, it means international items are costlier along with the ten% tariffs, or extra, already being paid.