NEWNow you can hearken to Fox Information articles!

The identical points that drove the Founders to declare independence from the Crown in 1776 drove 77 million Individuals to the polls in 2024: heavy taxes, weak management, and an overreaching authorities numb to the wants of its residents. President Trump gained in a landslide victory by providing highly effective options to every of those issues. He’s the American individuals’s declaration of independence from enterprise as regular in Washington.

The president seeks to serve “the forgotten women and men of America.” And the One Big, Beautiful Bill, which he indicators into legislation at present, is central to that mission. This historic laws will make life extra reasonably priced for all Individuals by unleashing parallel prosperity—the concept that Important Road and Wall Road can develop collectively.

NEW PROJECTION SIGNALS GOOD NEWS FOR FAMILIES, WORKERS IN TRUMP’S ‘BIG, BEAUTIFUL BILL’

The One Large, Lovely Invoice represents the priorities of the brand new Republican Get together, which incorporates hundreds of thousands of working-class Individuals who as soon as known as themselves Democrats. This invoice builds on the blue-collar renaissance began by President Trump.

Since President Trump took workplace in January, blue-collar wages have elevated 1.7%. This represents the biggest enhance in working-class wages to start out a presidency in additional than 50 years. For comparability, working-class wages decreased throughout the identical interval underneath each single president since Richard Nixon with just one exception—President Trump in his first time period.

Treasury Secretary Scott Bessent believes President Trump’s ‘One Large, Lovely Invoice’ will unleash an financial increase. (Getty Photographs/Photograph illustration)

Key to sparking the president’s second blue-collar increase has been his efforts to finish unlawful immigration. The open-border coverage of earlier administrations accelerated our nation’s affordability disaster. The inflow of hundreds of thousands of unlawful aliens put an unsustainable pressure on healthcare, housing, training and welfare. It additionally supported a black market in labor that artificially suppressed working-class wages for many years. However that ends with the One Large Lovely Invoice.

The One Large Lovely Invoice is greater than only a tax invoice. It really works to make sure that unlawful immigrants will not be making the most of the protection internet created for Individuals. The invoice additionally funds the completion of the border wall and supplies assets to rent 1000’s of further federal brokers to guard our nation in opposition to future unlawful immigration. The purpose is to redirect the estimated $249 billion in annual wages paid to unlawful staff to lawful staff and Americans. Ending the black market of undocumented labor by funding enforcement of our present immigration legal guidelines will end in an enormous pay elevate for the working class.

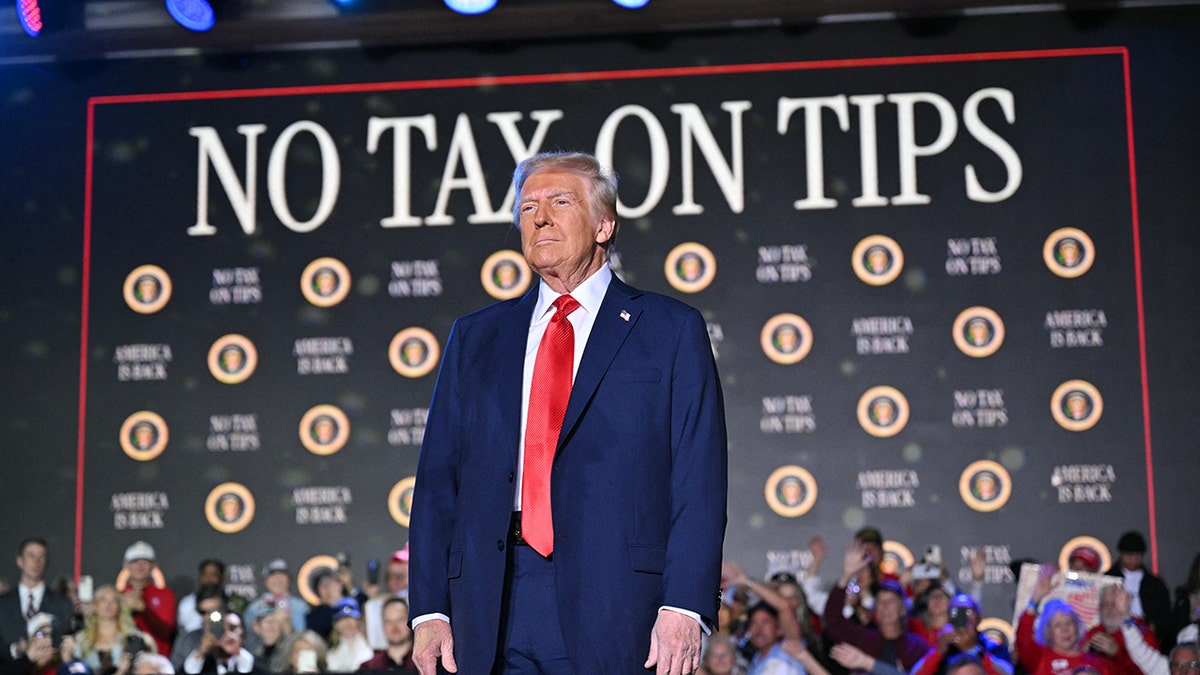

US President Donald Trump arrives to talk on his coverage to finish tax on ideas in Las Vegas, Nevada, on January 25, 2025. After visits to catastrophe websites in North Carolina and California, the Vegas cease is extra of a feel-good victory lap, as he lays out his plans to exclude ideas from federal taxes — an enormously standard transfer in a metropolis constructed on the hospitality trade. (MANDEL NGAN/AFP by way of Getty Photographs)

We now have seen American staff profit from the president’s financial method earlier than. Below President Trump’s 2017 tax cuts, the web value of the underside 50% of households elevated sooner than the web value of the highest 10% of households. That can occur once more underneath the One Large Lovely Invoice.

The invoice prevents a $4.5 trillion tax hike on the American individuals. It will enable the common employee to maintain a further $4,000 to $7,200 in annual actual wages and permit the common household of 4 to maintain a further $7,600 to $10,900 in take-home pay. Add to this the president’s bold deregulation agenda, which could save the common household of 4 a further $10,000. For hundreds of thousands of Individuals, these financial savings are the distinction between having the ability to make a mortgage fee, purchase a automotive, or ship a baby to varsity.

The president is delivering on his promise to seniors as properly. The invoice supplies a further $6,000 deduction for seniors, which will mean that 88% of seniors receiving Social Safety earnings pays no tax on their Social Safety advantages.

The One Large Lovely Invoice additionally codifies no tax on ideas and no tax on additional time pay—each insurance policies designed to offer monetary reduction to America’s working class. These tax breaks will guarantee Important Road staff preserve extra of their hard-earned earnings. And they’ll bolster productiveness by rewarding Individuals who work further hours. All Individuals can find out how President Trump’s tax cuts will affect their lives for the higher with a new White House calculator.

These productivity-enhancing measures dovetail with the second booster within the blue-collar increase: offering 100% expensing for brand spanking new factories and present factories that develop operations, plus automotive mortgage curiosity deductibility to help Made-in-America.

Financial safety is nationwide safety. This grew to become particularly clear throughout COVID, which uncovered obtrusive vulnerabilities in our crucial provide chains. By offering 100% expensing for factories—along with rebalancing commerce to encourage better home manufacturing—President Trump is fortifying our provide chains and reawakening the would possibly of America’s industrial base.

To assist gasoline this effort, the president is unleashing American power by eradicating onerous rules, rising oil and gasoline lease gross sales, eliminating the perverse subsidies of the Inexperienced New Rip-off, and refilling the Strategic Petroleum Reserve. These measures will make life extra reasonably priced for American households by bringing down the prices of gasoline and electrical energy throughout the nation.

CLICK HERE FOR MORE FOX NEWS OPINION

Via the One Large Lovely Invoice, President Trump is taking a bottom-up method to restoring the financial system. To that finish, the invoice makes the 2017 tax cuts everlasting to present companies of all sizes the understanding they should develop, rent, and plan for the long run. It additionally supplies focused reduction for small companies by greater than doubling the cap on total small enterprise expensing. These tax provisions will put billions of {dollars} again within the arms of America’s small enterprise house owners, which they’ll then use to develop their workforce and reinvigorate Important Road.

The intent of all these insurance policies—be it tax cuts for the working class, full expensing for producers, or new deductions for small companies—is identical: to enhance the lives of Individuals on each rung of the financial ladder. With visionary management, President Trump is laying the muse for the Golden Age he promised via tax offers, commerce offers, peace offers, and deregulation.

CLICK HERE TO GET THE FOX NEWS APP

The One Large Lovely Invoice will Make America Reasonably priced Once more. It is going to cement the blue-collar increase, reignite U.S. manufacturing, and unleash the industrial potential of the best financial system on the planet. Right now marks the passage of the biggest tax lower in historical past for our nation’s staff. It’s a tribute to the Founders who demanded decrease taxes themselves and is the proper method to start America’s 250th anniversary celebration.

CLICK HERE TO READ MORE FROM SCOTT BESSENT