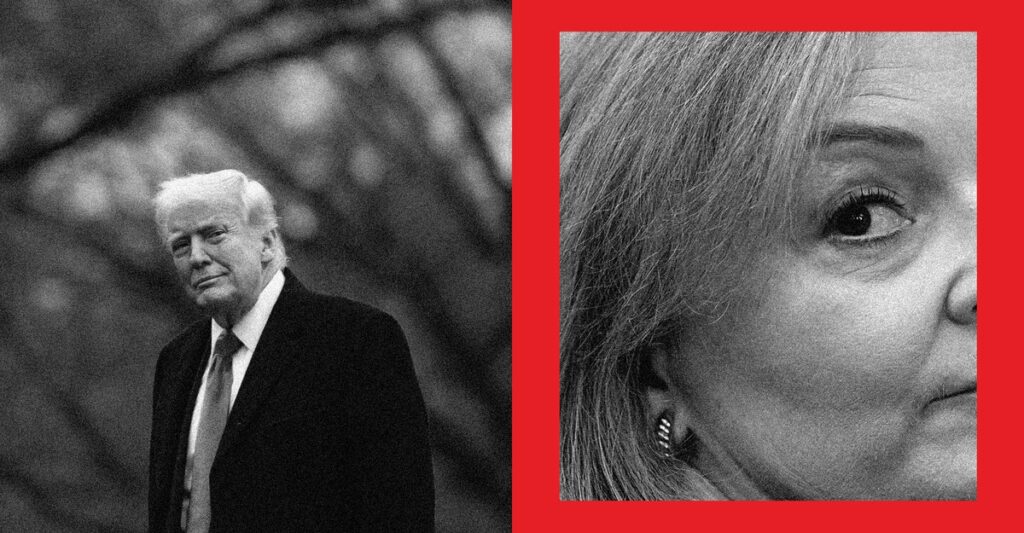

When Donald Trump launched his tariff conflict on April 2, lawmakers in Europe struggled to grasp the technique. Was it a bluff, or did he actually imply to break down international commerce, inventory markets, and the Western alliance in a single reckless recreation of 4-D chess?

On April 9, nonetheless, the president found one thing that we in the UK already know: In opposition to the bond market, there may be solely 2-D chess, and also you all the time lose. As a result of the Brits have been right here earlier than.

In September 2022, after the ousting of Boris Johnson as Conservative chief, the brand new prime minister, Liz Truss, launched an unscheduled Budget statement designed to rip up the rules of fiscal policy. She would enact £160 billion value of tax cuts over 5 years, funded fully by borrowing, in defiance of recommendation from the U.Ok. Treasury’s most senior official, whom she sacked on day considered one of her administration.

The federal government’s fiscal watchdog, set as much as forestall the form of debacle that was about to occur, was sidelined. Commentators, myself included, who warned that the closely indebted nation may face a sudden stop of overseas funding had been ignored.

The results got here quick. The pound slid, the yield on 10-year authorities bonds soared shut to five p.c, and we then found that lenders’ margin calls on leveraged bond trades—demanding a further dedication of capital to prop up the loans—had been forcing pension funds to lift cash by dumping gilt-edged securities right into a falling market.

With key pension schemes close to collapse, Truss reversed your complete bundle; sacked her finance minister whereas he was midair over the Atlantic Ocean on his approach again from an Worldwide Financial Fund assembly in Washington, D.C.; and resigned after simply 45 days in workplace, changing into the shortest-serving prime minister in historical past. Towards the tip, Britain’s tabloid press started livestreaming photographs of a grocery store lettuce, betting that it might outlast Truss’s tenure. It did.

With Trump’s tariff pause, some necessary particulars are totally different. In contrast to the UK, which is uncovered to external liabilities worth more than five times its GDP, the US bears a lot smaller dangers from buyers dumping the greenback and Treasury bonds concurrently. And Truss’s mistake was a easy act of financial hubris fairly than a part of a geopolitical grand technique, as Trump’s commerce coverage claims to be.

But one thing could be discovered from the similarities. In each instances, the essential days noticed equities and bonds fall in tandem—one thing the high-finance textbook says shouldn’t occur. Usually, when inventory markets are falling, buyers change to the protection of presidency bonds. At this time, we’re seeing capital flight from a complete nationwide entity.

Since Truss’s resignation, the U.Ok. has suffered completely larger bond yields and better debt-servicing prices than its European friends. On the identical time, rates of interest on family mortgages have remained painfully excessive—a phenomenon dubbed the “moron premium” by her detractors.

Inflicting ache on U.S. buyers could also be a part of the president’s plan, to point out China that in pursuit of financial decoupling, America is ready to endure. However when you break a posh system, stuff tends to occur that you simply didn’t intend.

As I write, the greenback is falling and—regardless of the 90-day pause on reciprocal tariffs—the yield on a 30-year Treasury bond is close to five p.c. Meaning the price of borrowing for the U.S. authorities is now double what it was 5 years in the past, as a result of buyers are demanding larger returns for holding the most secure debt on the planet. If each of those circumstances persist subsequent week, and start to have an effect on Individuals’ revenue, the moron premium might cross the Atlantic.

Whether or not Trump deliberate to withdraw the reciprocal tariffs inside seven days of imposing them is troublesome to find out, however the proof means that he didn’t. The extra possible interpretation is that he caved underneath strain from each the markets and Republicans in Congress who had been rising anxious in regards to the danger of a recession and what that might do to the social gathering’s electoral prospects.

Trump gave in for a similar purpose Truss did. For the second time in three years, the reckless chief of a significant English-speaking energy has performed thoughts video games with international bond buyers and misplaced. Simply as Truss weakened Britain in the long run, each the type of Trump’s tariff gambit and its end result might have weakened America.

One rationale for Trump’s plan has some legitimacy: If the U.S. needs to reindustrialize, to make sure its personal long-term safety within the face of China’s rise, then forcibly stopping the flood of manufactured items into America is a technique of doing that, albeit brutal and dangerous. However the logical end result of that strategy could be the tip of greenback dominance. The U.S. commerce deficit with the remainder of the world is what creates the demand for foreigners to carry its authorities debt. As soon as that demand is suppressed, the U.S. will stop to develop into the worldwide provider of protected securities. As well as, by treating former geopolitical mates as enemies, he dangers sacrificing the entire premiums that come up from the greenback’s status and stability.

Trump seems to consider he can clear up the latter downside by means of what the Chilly Battle strategist Thomas Schelling called “compellence.” America will strong-arm the remainder of the world to go on lending to it, regardless of the newly unfavourable phrases. It can use the specter of tariffs to drive Europeans to purchase such American meals merchandise as chlorinated chicken and hormone-treated beef—which their governments at the moment ban on health grounds—and the U.S. oil they now not want, by means of a mixture of chaos, disinformation, and chutzpah.

However that’s irrational as a result of it requires Trump and his allies to ascertain an instrumental, political model of “exorbitant privilege,” as a French finance minister as soon as described America’s sway over the worldwide financial order. This may be the appropriate to dictate: to Britain that it ceases jailing individuals who harass girls outdoors abortion clinics; to Germany that it permits free speech for fascists; to Ukraine that it gives away territory. A plan based mostly on coercion of America’s allies, fairly than of its adversaries, appears impossible to work.

At a geopolitical degree, the Trump administration seems torn amongst three methods. The primary was outlined by Protection Secretary Pete Hegseth in Brussels in February: Our focus is the Pacific, so we’re deprioritizing typical navy deterrence in opposition to Russia; it’s as much as the Europeans to hike their protection spending to five p.c and to maintain Ukraine within the combat. That could be a actuality most European nations at the moment are prepared to just accept.

The second, much less palatable technique could be a Twenty first-century model of the Monroe Doctrine: overlook confrontation with China; solidify management over the Americas by subordinating Panama, Canada, and Greenland; and prosper by means of industrial self-sufficiency. A 3rd may contain Trump’s supply of a strategic deal to Russia to interrupt its alliance with China—what some analysts have known as a “Reverse Nixon”—which could enchantment to Vladimir Putin however would successfully finish NATO’s Article V collective-security assure to European nations threatened by Russia.

For Europe’s leaders, choice three would symbolize a lethal menace. And since they worry that every one of those choices are in play, their reactions to the tariff conflict are framed primarily by means of a safety lens, not an financial one. In most European capitals, the US is already seen as an unreliable ally, an unstable democracy, and a damaging drive for financial stability.

The week’s market chaos orchestrated by Trump comes on prime of this. The hazard now’s that, simply as with the Truss fiasco, Individuals can pay a everlasting worth for a crazed gestural occasion. In contrast to what occurred with Truss, who was swiftly deposed by her personal social gathering’s lawmakers, the U.S. has no fast prospect of eliminating the person in cost. Most Europeans know that, if Trump’s aim is to deal with them because the enemy in a commerce conflict and at hand components of the European continent to Vladimir Putin, then Europe, too, has choices. One is to unite the remainder of the West into a world free-trade zone, encompassing not simply Europe itself but additionally Australia and Canada. One other is to make a strategic financial rapprochement with China—and European Union leaders have already arranged to satisfy with China’s chief, Xi Jinping, in a couple of months’ time. A 3rd choice is to close America’s tech and repair firms out of the European market, along with its protection giants.

Any of those choices would have appeared unthinkable till very lately. Now Britain and Europe’s roughly 500 million residents are very a lot desirous about what they could appear to be in observe. Ought to the Western alliance fracture irrevocably, alongside commerce and safety fault traces, the results for the US could be unfavourable in each dimensions.

If America is now getting into a interval of strategic confrontation with China, it might want allies and provide chains spanning continents from the Nordic nations to the Purple Sea. Alliances and provide chains are each constructed on belief. The U.S. reserves of belief simply went approach down.