Troy Info Expertise Co., Ltd. (SZSE:300366) shareholders can be excited to see that the share worth has had an incredible month, posting a 31% acquire and recovering from prior weak point. Taking a wider view, though not as robust because the final month, the complete 12 months acquire of 11% can be pretty affordable.

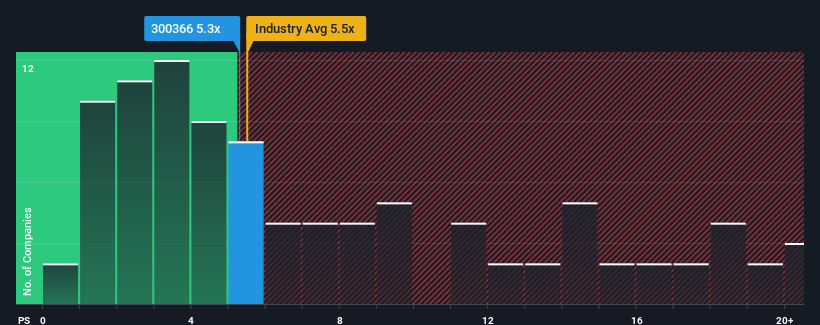

Despite the agency bounce in worth, you may nonetheless be forgiven for feeling detached about Troy Info Expertise’s P/S ratio of 5.3x, because the median price-to-sales (or “P/S”) ratio for the IT trade in China can be shut to five.5x. Whereas this may not increase any eyebrows, if the P/S ratio shouldn’t be justified traders could possibly be lacking out on a possible alternative or ignoring looming disappointment.

View our latest analysis for Troy Information Technology

What Does Troy Info Expertise’s Latest Efficiency Look Like?

As an illustration, income has deteriorated at Troy Info Expertise during the last 12 months, which isn’t supreme in any respect. It may be that many count on the corporate to place the disappointing income efficiency behind them over the approaching interval, which has saved the P/S from falling. In the event you like the corporate, you’d at the very least be hoping that is the case in order that you may probably choose up some inventory whereas it is not fairly in favour.

We do not have analyst forecasts, however you’ll be able to see how current tendencies are organising the corporate for the long run by trying out our free report on Troy Information Technology’s earnings, income and money circulate.

Do Income Forecasts Match The P/S Ratio?

There’s an inherent assumption that an organization must be matching the trade for P/S ratios like Troy Info Expertise’s to be thought-about affordable.

Having a look again first, the corporate’s income progress final 12 months wasn’t one thing to get enthusiastic about because it posted a disappointing decline of 33%. Because of this, income from three years in the past have additionally fallen 42% general. Subsequently, it is honest to say the income progress lately has been undesirable for the corporate.

In distinction to the corporate, the remainder of the trade is anticipated to develop by 17% over the following 12 months, which actually places the corporate’s current medium-term income decline into perspective.

In gentle of this, it is considerably alarming that Troy Info Expertise’s P/S sits in step with nearly all of different firms. It appears most traders are ignoring the current poor progress price and are hoping for a turnaround within the firm’s enterprise prospects. There is a good likelihood current shareholders are setting themselves up for future disappointment if the P/S falls to ranges extra in step with the current detrimental progress charges.

The Key Takeaway

Its shares have lifted considerably and now Troy Info Expertise’s P/S is again inside vary of the trade median. Utilizing the price-to-sales ratio alone to find out when you ought to promote your inventory is not wise, nonetheless it may be a sensible information to the corporate’s future prospects.

Our take a look at Troy Info Expertise revealed its shrinking revenues over the medium-term have not impacted the P/S as a lot as we anticipated, given the trade is about to develop. Though it matches the trade, we’re uncomfortable with the present P/S ratio, as this dismal income efficiency is unlikely to assist a extra constructive sentiment for lengthy. Until the the circumstances surrounding the current medium-term enhance, it would not be incorrect to count on a a troublesome interval forward for the corporate’s shareholders.

There are additionally different very important danger elements to contemplate earlier than investing and we have found 1 warning sign for Troy Information Technology that you need to be conscious of.

If firms with strong previous earnings progress is up your alley, you could want to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complicated, however we’re right here to simplify it.

Uncover if Troy Info Expertise may be undervalued or overvalued with our detailed evaluation, that includes honest worth estimates, potential dangers, dividends, insider trades, and its monetary situation.

Have suggestions on this text? Involved in regards to the content material? Get in touch with us immediately. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is basic in nature. We offer commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles will not be meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary scenario. We purpose to carry you long-term targeted evaluation pushed by elementary knowledge. Word that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.