Shares will drop.

How’s that for a headline? This isn’t clickbait. This isn’t a forecast for the remainder of 2025. Neither is it about whether or not shares are at the moment priced honest, low cost, or costly.

That is widespread funding data. You’ll be able to’t say I didn’t warn you.

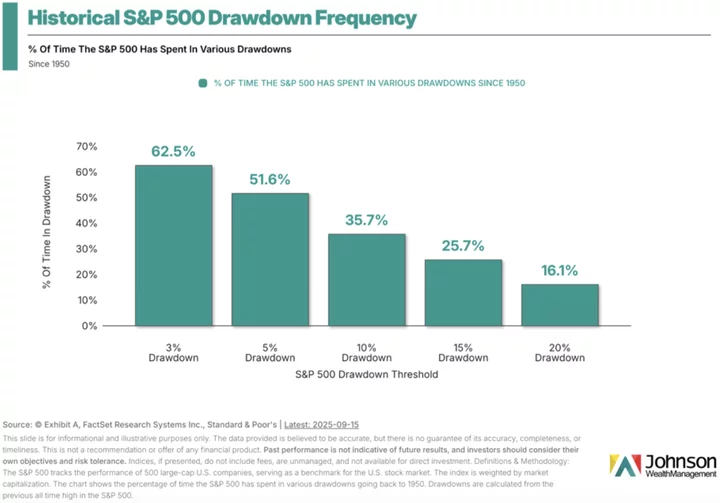

In reality, since 1950, the S&P 500 spends most of its time without work of its highs.

This implies the most important corporations on Wall Road are in a 3% drawdown greater than 60% of the time and in a 5% decline greater than half the time.

The extra worrisome corrections occur about one-third of the time, and horrible bear markets about 16% of the time.

Say it once more with me, shares go down.

That is a vital fact to understand as a long-term investor. What’s extra important than that’s to acknowledge that the pathway prior to now to experiencing development within the inventory market is to endure it anyway.

You realize what else is true? Regardless that shares have normally been down from their highs and recessions have occurred all through the many years, shares are up huge for the reason that Fifties.

Residing by worry is never the reply to something in life, not to mention investing.

To paraphrase a quote attributed to famed investor Peter Lynch, making ready for, and appearing on the worry of dropping cash within the inventory market has misplaced extra money than being invested within the inventory market itself.

Many know the issue with traders panic-selling primarily based on worry throughout speedy market declines. However there’s additionally one other downside that may plague some traders: the wait-and-see method (additionally primarily based on worry) throughout market features.

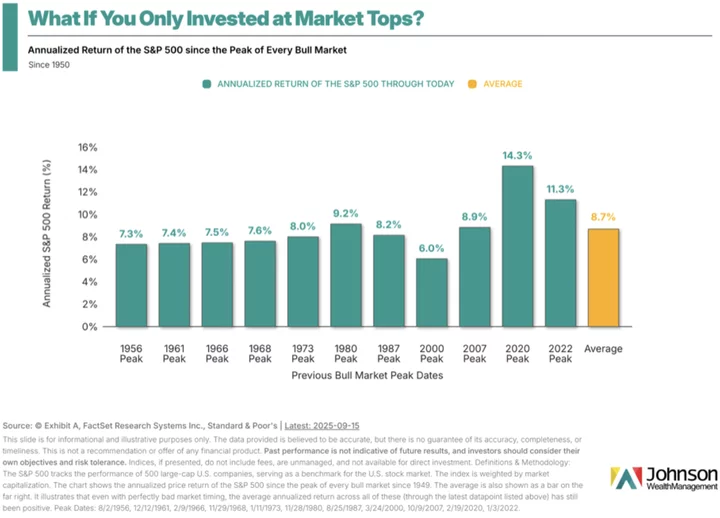

Here’s a stunning statistic. Do you know that those that invested at each inventory market peak since 1950 have averaged an 8.7% funding return?

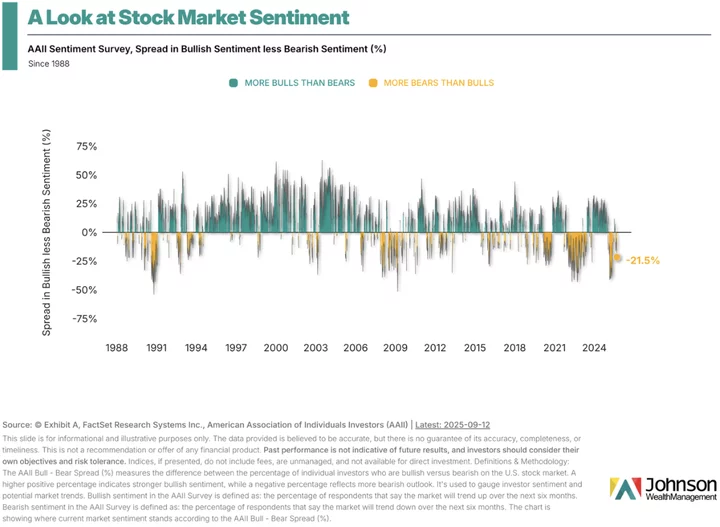

Why are you speaking a lot about worry? Isn’t the market at or close to all-time highs? As of mid-way via September 2025, sure.

What can also come as a shock: in response to one common survey, there’s nonetheless extra bears then bulls proper now.

None of this implies it’s best to go headfirst into shares. Funding allocation and danger administration go hand in hand.

It does imply that getting cash over the long run within the inventory market usually requires remaining appropriately invested and investing whereas the inventory market goes down.

I don’t know when the subsequent drop may come.

However I do know it should.

The query shouldn’t be merely what’s going to you do together with your cash when it occurs, however what are you doing with it whilst you wait?

Make investments primarily based on one thing extra vital than dopamine hits from headlines juiced by greed, envy, or worry.

In an consideration financial system you should know that many headlines you examine investing aren’t geared towards you or your loved ones’s long-term monetary success, however for clicks and income. It’s really easy to be distracted and to have your consideration on issues which will really feel pressing within the short-term however aren’t to your long-term profit.

Educate your self about investing and/or discover a trusted monetary advisor who can assist.

# # #

Brandon Stockman has been a Wealth Advisor licensed with the Sequence 7 and 66 for the reason that Nice Monetary Disaster of 2008. He has the privilege of serving to handle accounts all through america and works within the Fortuna workplace of Johnson Wealth Management. You’ll be able to sign up for his weekly newsletter on investing and monetary schooling or subscribe to his YouTube channel. Securities and advisory providers provided via Prospera Monetary Providers, Inc. | Member FINRA, SIPC. This shouldn’t be thought-about tax, authorized, or funding recommendation. Previous efficiency is not any assure of future outcomes.