TOKYO, Nov 18 (News On Japan) –

Nissan has introduced a serious restructuring plan involving the elimination of 9,000 jobs worldwide, triggered by worsening enterprise efficiency.

This transfer has drawn important consideration from activist traders, sometimes called “shareholder activists,” signaling elevated strain on the automaker to overtake its operations. Moreover, the broader Japanese automotive trade is bracing for potential shifts underneath the brand new Trump administration, with implications for commerce insurance policies that will favor Toyota whereas disadvantaging Honda.

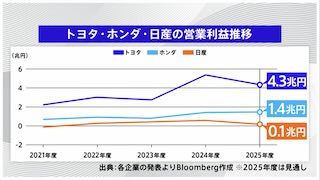

Nissan’s announcement on November seventh highlighted plans to chop international manufacturing capability by 20%, a response to declining profitability in key markets like the USA and China. The corporate cited elevated promotional prices in U.S. dealerships and intensified competitors in China as key challenges. Nissan additionally revised its international gross sales forecast downward by 250,000 items, now projecting a complete of three.4 million autos for the fiscal 12 months. Its working revenue forecast was drastically decreased from 500 billion yen to 150 billion yen, falling far beneath market expectations.

On November twelfth, Bloomberg reported {that a} fund linked to the previous Murakami Fund had acquired a 2.5% stake in Nissan, igniting hypothesis a couple of potential push for adjustments in company governance. The main focus is on Nissan’s subsidiary, Nissan Shatai, which some argue ought to be totally built-in into the guardian firm.

Trade analysts recommend that Nissan’s struggles are rooted in sluggish adaptation to market traits, notably in electrical autos (EVs) and hybrids. Whereas rivals like Toyota and Honda have capitalized on these segments, Nissan has lagged in introducing aggressive fashions, with some new applied sciences nonetheless years away from market readiness.

Wanting forward, challenges stay important for Nissan, with the specter of commerce coverage adjustments underneath Trump’s administration including to the uncertainty. Whereas corporations with established manufacturing bases in North America, like Toyota, might discover benefits, these relying closely on imports from Mexico or China might face greater prices.

As activist traders push for restructuring, Nissan faces mounting strain to revitalize its operations amidst a quickly altering international automotive panorama.

Supply: TBS