Lotte Buying Co., Ltd. (KRX:023530) shares have had a extremely spectacular month, gaining 26% after a shaky interval beforehand. Sadly, the features of the final month did little to proper the losses of the final 12 months with the inventory nonetheless down 13% over that point.

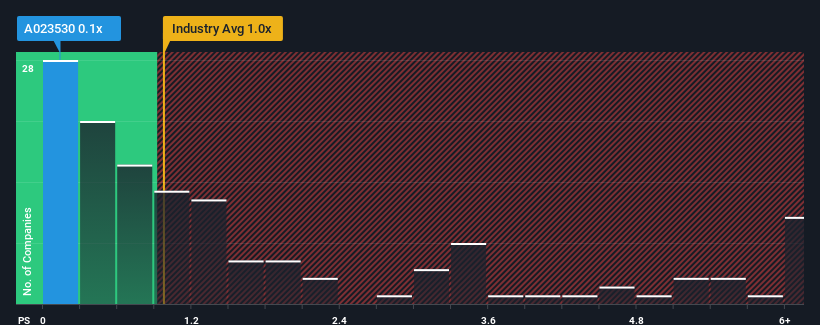

Even after such a big soar in worth, it is nonetheless not a stretch to say that Lotte Buying’s price-to-sales (or “P/S”) ratio of 0.1x proper now appears fairly “middle-of-the-road” in comparison with the Multiline Retail trade in Korea, the place the median P/S ratio is round 0.3x. Nevertheless, buyers may be overlooking a transparent alternative or potential setback if there is no such thing as a rational foundation for the P/S.

See our latest analysis for Lotte Shopping

How Lotte Buying Has Been Performing

Lotte Buying may very well be doing higher as its income has been going backwards recently whereas most different firms have been seeing optimistic income progress. Maybe the market is anticipating its poor income efficiency to enhance, conserving the P/S from dropping. You’d actually hope so, in any other case you are paying a comparatively elevated worth for a corporation with this type of progress profile.

Eager to learn how analysts suppose Lotte Buying’s future stacks up towards the trade? In that case, our free report is a great place to start.

Is There Some Income Progress Forecasted For Lotte Buying?

Lotte Buying’s P/S ratio could be typical for a corporation that is solely anticipated to ship average progress, and importantly, carry out in keeping with the trade.

Retrospectively, the final 12 months delivered a irritating 3.9% lower to the corporate’s high line. The final three years do not look good both as the corporate has shrunk income by 10% in combination. Accordingly, shareholders would have felt downbeat concerning the medium-term charges of income progress.

Turning to the outlook, the subsequent 12 months ought to generate progress of 1.9% as estimated by the analysts watching the corporate. That is shaping as much as be materially decrease than the 5.0% progress forecast for the broader trade.

With this in thoughts, we discover it intriguing that Lotte Buying’s P/S is intently matching its trade friends. It appears most buyers are ignoring the pretty restricted progress expectations and are prepared to pay up for publicity to the inventory. Sustaining these costs shall be tough to realize as this degree of income progress is prone to overwhelm the shares finally.

The Key Takeaway

Its shares have lifted considerably and now Lotte Buying’s P/S is again inside vary of the trade median. We might say the price-to-sales ratio’s energy is not primarily as a valuation instrument however slightly to gauge present investor sentiment and future expectations.

On condition that Lotte Buying’s income progress projections are comparatively subdued compared to the broader trade, it comes as a shock to see it buying and selling at its present P/S ratio. After we see firms with a comparatively weaker income outlook in comparison with the trade, we suspect the share worth is liable to declining, sending the average P/S decrease. A optimistic change is required in an effort to justify the present price-to-sales ratio.

There are additionally different very important danger elements to think about earlier than investing and we have found 1 warning sign for Lotte Shopping that you need to be conscious of.

If robust firms turning a revenue tickle your fancy, then you definately’ll wish to take a look at this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Inventory Screener & Alerts

Our new AI Inventory Screener scans the market each day to uncover alternatives.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Shopping for

• Excessive progress Tech and AI Firms

Or construct your personal from over 50 metrics.

Have suggestions on this text? Involved concerning the content material? Get in touch with us immediately. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles will not be supposed to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary state of affairs. We purpose to convey you long-term centered evaluation pushed by elementary knowledge. Word that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.