Explore Gaming Realms’s Fair Values from the Community and select yours

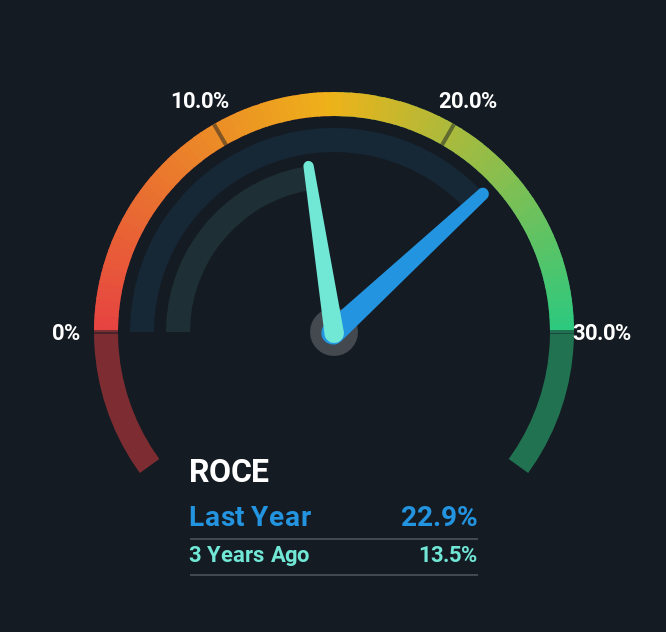

To discover a multi-bagger inventory, what are the underlying traits we should always search for in a enterprise? Firstly, we’ll need to see a confirmed return on capital employed (ROCE) that’s rising, and secondly, an increasing base of capital employed. This reveals us that it is a compounding machine, in a position to regularly reinvest its earnings again into the enterprise and generate greater returns. Talking of which, we observed some nice modifications in Gaming Realms’ (LON:GMR) returns on capital, so let’s take a look.

Understanding Return On Capital Employed (ROCE)

For people who aren’t positive what ROCE is, it measures the quantity of pre-tax income an organization can generate from the capital employed in its enterprise. The formulation for this calculation on Gaming Realms is:

Return on Capital Employed = Earnings Earlier than Curiosity and Tax (EBIT) ÷ (Complete Belongings – Present Liabilities)

0.23 = UK£8.0m ÷ (UK£39m – UK£4.1m) (Based mostly on the trailing twelve months to December 2024).

So, Gaming Realms has an ROCE of 23%. In absolute phrases that is a fantastic return and it is even higher than the Leisure business common of 12%.

Check out our latest analysis for Gaming Realms

Within the above chart we now have measured Gaming Realms’ prior ROCE towards its prior efficiency, however the future is arguably extra necessary. If you would like, you possibly can check out the forecasts from the analysts covering Gaming Realms for free.

So How Is Gaming Realms’ ROCE Trending?

The truth that Gaming Realms is now producing some pre-tax income from its prior investments may be very encouraging. Shareholders would little doubt be happy with this as a result of the enterprise was loss-making 5 years in the past however is is now producing 23% on its capital. Not solely that, however the firm is using 111% extra capital than earlier than, however that is to be anticipated from an organization attempting to interrupt into profitability. We like this pattern, as a result of it tells us the corporate has worthwhile reinvestment alternatives out there to it, and if it continues going ahead that may result in a multi-bagger efficiency.

Our Take On Gaming Realms’ ROCE

To the delight of most shareholders, Gaming Realms has now damaged into profitability. And a exceptional 114% whole return during the last 5 years tells us that buyers predict extra good issues to come back sooner or later. In mild of that, we expect it is price trying additional into this inventory as a result of if Gaming Realms can hold these traits up, it might have a shiny future forward.

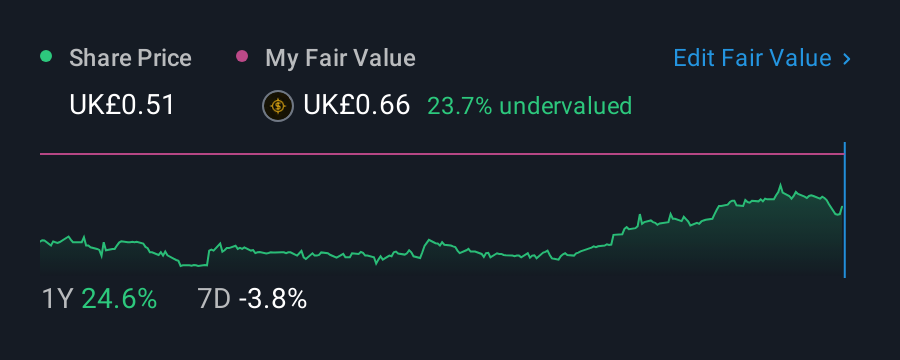

Whereas Gaming Realms appears spectacular, no firm is price an infinite worth. The intrinsic value infographic for GMR helps visualize whether or not it’s presently buying and selling for a good worth.

If you would like to see different corporations incomes excessive returns, try our free list of companies earning high returns with solid balance sheets here.

New: Handle All Your Inventory Portfolios in One Place

We have created the final portfolio companion for inventory buyers, and it is free.

• Join a limiteless variety of Portfolios and see your whole in a single foreign money

• Be alerted to new Warning Indicators or Dangers through electronic mail or cell

• Monitor the Truthful Worth of your shares

Have suggestions on this text? Involved concerning the content material? Get in touch with us instantly. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles are usually not supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary state of affairs. We purpose to convey you long-term centered evaluation pushed by elementary information. Notice that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.