Discovering a enterprise that has the potential to develop considerably is just not straightforward, however it’s attainable if we take a look at a number of key monetary metrics. Amongst different issues, we’ll need to see two issues; firstly, a rising return on capital employed (ROCE) and secondly, an enlargement within the firm’s quantity of capital employed. In the end, this demonstrates that it is a enterprise that’s reinvesting earnings at rising charges of return. So once we checked out Techno Ryowa (TSE:1965) and its development of ROCE, we actually appreciated what we noticed.

Return On Capital Employed (ROCE): What Is It?

If you have not labored with ROCE earlier than, it measures the ‘return’ (pre-tax revenue) an organization generates from capital employed in its enterprise. To calculate this metric for Techno Ryowa, that is the system:

Return on Capital Employed = Earnings Earlier than Curiosity and Tax (EBIT) ÷ (Whole Belongings – Present Liabilities)

0.17 = JP¥9.6b ÷ (JP¥80b – JP¥24b) (Primarily based on the trailing twelve months to March 2025).

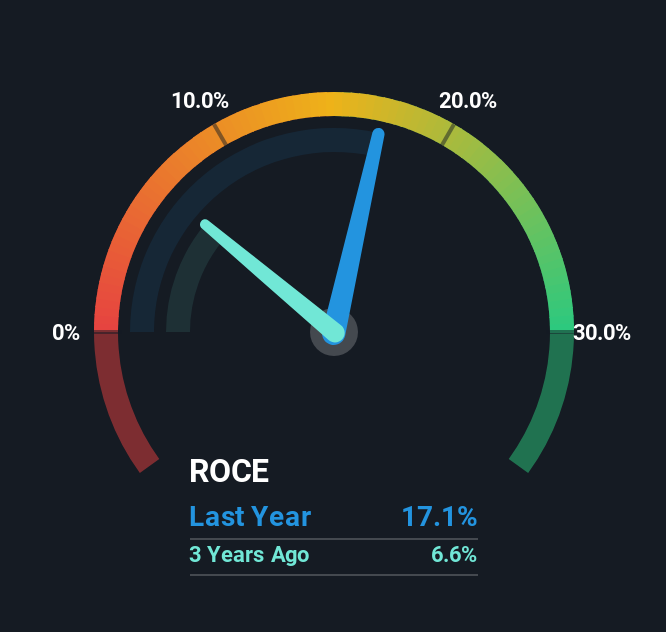

Subsequently, Techno Ryowa has an ROCE of 17%. In absolute phrases, that is a passable return, however in comparison with the Development business common of 9.2% it is significantly better.

View our latest analysis for Techno Ryowa

Historic efficiency is a superb place to start out when researching a inventory so above you may see the gauge for Techno Ryowa’s ROCE in opposition to it is prior returns. If you would like to take a look at how Techno Ryowa has carried out prior to now in different metrics, you may view this free graph of Techno Ryowa’s past earnings, revenue and cash flow.

How Are Returns Trending?

Techno Ryowa is displaying some constructive developments. Over the past 5 years, returns on capital employed have risen considerably to 17%. Mainly the enterprise is incomes extra per greenback of capital invested and along with that, 40% extra capital is being employed now too. So we’re very a lot impressed by what we’re seeing at Techno Ryowa because of its potential to profitably reinvest capital.

In Conclusion…

An organization that’s rising its returns on capital and might constantly reinvest in itself is a extremely wanted trait, and that is what Techno Ryowa has. And with the inventory having carried out exceptionally effectively over the past 5 years, these patterns are being accounted for by buyers. In mild of that, we expect it is value trying additional into this inventory as a result of if Techno Ryowa can preserve these developments up, it might have a vivid future forward.

Another factor, we have noticed 1 warning sign facing Techno Ryowa that you simply may discover fascinating.

Whereas Techno Ryowa could not presently earn the very best returns, we have compiled an inventory of corporations that presently earn greater than 25% return on fairness. Try this free list here.

Valuation is advanced, however we’re right here to simplify it.

Uncover if Techno Ryowa is likely to be undervalued or overvalued with our detailed evaluation, that includes honest worth estimates, potential dangers, dividends, insider trades, and its monetary situation.

Have suggestions on this text? Involved in regards to the content material? Get in touch with us instantly. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is basic in nature. We offer commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles usually are not supposed to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary state of affairs. We intention to convey you long-term targeted evaluation pushed by elementary knowledge. Observe that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.