Discovering a enterprise that has the potential to develop considerably shouldn’t be simple, however it’s attainable if we take a look at just a few key monetary metrics. One frequent method is to try to discover a firm with returns on capital employed (ROCE) which might be rising, along with a rising quantity of capital employed. Finally, this demonstrates that it is a enterprise that’s reinvesting earnings at rising charges of return. So on that notice, NetEase Cloud Music (HKG:9899) appears to be like fairly promising with regard to its developments of return on capital.

Return On Capital Employed (ROCE): What Is It?

If you have not labored with ROCE earlier than, it measures the ‘return’ (pre-tax revenue) an organization generates from capital employed in its enterprise. Analysts use this method to calculate it for NetEase Cloud Music:

Return on Capital Employed = Earnings Earlier than Curiosity and Tax (EBIT) ÷ (Whole Property – Present Liabilities)

0.11 = CN¥1.1b ÷ (CN¥14b – CN¥3.3b) (Based mostly on the trailing twelve months to December 2024).

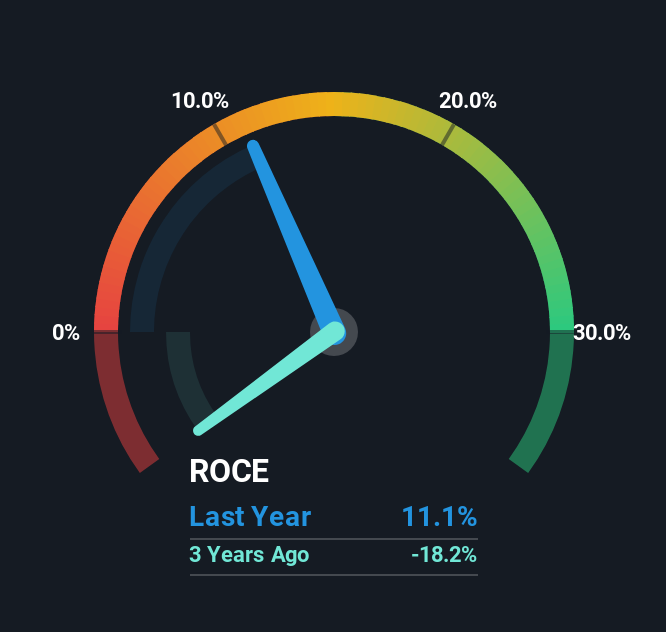

Due to this fact, NetEase Cloud Music has an ROCE of 11%. By itself that is a traditional return on capital and it is in step with the business’s common returns of 11%.

See our latest analysis for NetEase Cloud Music

Within the above chart we have now measured NetEase Cloud Music’s prior ROCE towards its prior efficiency, however the future is arguably extra vital. If you would like, you may check out the forecasts from the analysts covering NetEase Cloud Music for free.

What Does the ROCE Pattern For NetEase Cloud Music Inform Us?

NetEase Cloud Music has not too long ago damaged into profitability so their prior investments appear to be paying off. Shareholders would little doubt be happy with this as a result of the enterprise was loss-making 5 years in the past however is is now producing 11% on its capital. Not solely that, however the firm is using 31% extra capital than earlier than, however that is to be anticipated from an organization attempting to interrupt into profitability. This may inform us that the corporate has loads of reinvestment alternatives which might be capable of generate larger returns.

On a facet notice, we seen that the advance in ROCE seems to be partly fueled by a rise in present liabilities. Successfully which means suppliers or short-term collectors are actually funding 24% of the enterprise, which is greater than it was 5 years in the past. Preserve a watch out for future will increase as a result of when the ratio of present liabilities to complete belongings will get notably excessive, this may introduce some new dangers for the enterprise.

In Conclusion…

To the delight of most shareholders, NetEase Cloud Music has now damaged into profitability. Because the inventory has returned a staggering 258% to shareholders during the last three years, it appears to be like like buyers are recognizing these modifications. Due to this fact, we expect it will be value your time to test if these developments are going to proceed.

On the opposite facet of ROCE, we have now to contemplate valuation. That is why we have now a FREE intrinsic value estimation for 9899 on our platform that’s undoubtedly value trying out.

For individuals who prefer to spend money on strong corporations, take a look at this free list of companies with solid balance sheets and high returns on equity.

Valuation is advanced, however we’re right here to simplify it.

Uncover if NetEase Cloud Music could be undervalued or overvalued with our detailed evaluation, that includes truthful worth estimates, potential dangers, dividends, insider trades, and its monetary situation.

Have suggestions on this text? Involved concerning the content material? Get in touch with us straight. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is basic in nature. We offer commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles are usually not supposed to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary state of affairs. We intention to deliver you long-term targeted evaluation pushed by elementary information. Observe that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.