Do you know there are some monetary metrics that may present clues of a possible multi-bagger? Ideally, a enterprise will present two developments; firstly a rising return on capital employed (ROCE) and secondly, an rising quantity of capital employed. In case you see this, it usually means it is an organization with an important enterprise mannequin and loads of worthwhile reinvestment alternatives. Talking of which, we observed some nice modifications in Metso Oyj’s (HEL:METSO) returns on capital, so let’s take a look.

Return On Capital Employed (ROCE): What Is It?

For individuals who do not know, ROCE is a measure of an organization’s yearly pre-tax revenue (its return), relative to the capital employed within the enterprise. The method for this calculation on Metso Oyj is:

Return on Capital Employed = Earnings Earlier than Curiosity and Tax (EBIT) ÷ (Complete Belongings – Present Liabilities)

0.16 = €721m ÷ (€7.2b – €2.9b) (Based mostly on the trailing twelve months to June 2025).

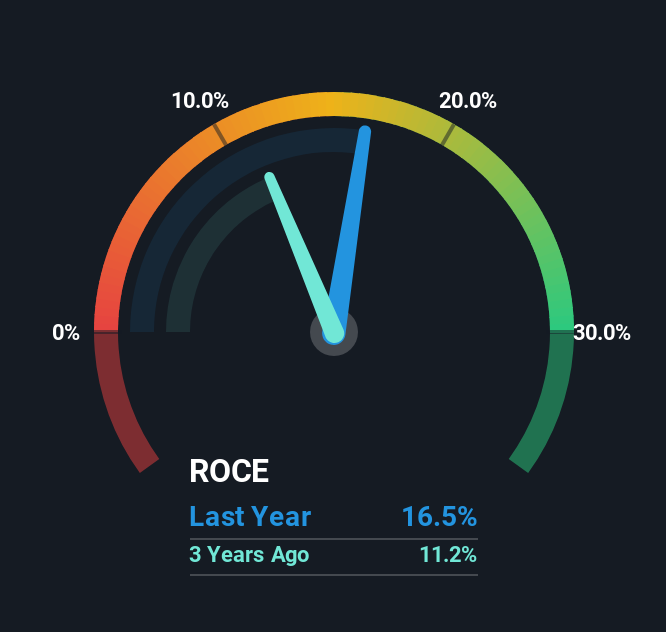

Thus, Metso Oyj has an ROCE of 16%. In absolute phrases, that is a fairly regular return, and it is considerably near the Equipment trade common of 18%.

See our latest analysis for Metso Oyj

Within the above chart we’ve measured Metso Oyj’s prior ROCE in opposition to its prior efficiency, however the future is arguably extra essential. If you would like to see what analysts are forecasting going ahead, it’s best to take a look at our free analyst report for Metso Oyj .

The Pattern Of ROCE

Traders could be happy with what’s taking place at Metso Oyj. The info exhibits that returns on capital have elevated considerably during the last 5 years to 16%. Principally the enterprise is incomes extra per greenback of capital invested and along with that, 28% extra capital is being employed now too. The rising returns on a rising quantity of capital is frequent amongst multi-baggers and that is why we’re impressed.

In Conclusion…

In abstract, it is nice to see that Metso Oyj can compound returns by persistently reinvesting capital at rising charges of return, as a result of these are a few of the key elements of these extremely wanted multi-baggers. For the reason that inventory has returned a staggering 130% to shareholders during the last 5 years, it appears to be like like buyers are recognizing these modifications. Subsequently, we predict it will be value your time to examine if these developments are going to proceed.

Yet another factor to notice, we have recognized 2 warning signs with Metso Oyj and understanding these needs to be a part of your funding course of.

For individuals who wish to spend money on stable firms, take a look at this free list of companies with solid balance sheets and high returns on equity.

New: Handle All Your Inventory Portfolios in One Place

We have created the final portfolio companion for inventory buyers, and it is free.

• Join a limiteless variety of Portfolios and see your whole in a single foreign money

• Be alerted to new Warning Indicators or Dangers by way of e-mail or cell

• Observe the Honest Worth of your shares

Have suggestions on this text? Involved in regards to the content material? Get in touch with us immediately. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is basic in nature. We offer commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles should not supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary state of affairs. We intention to convey you long-term centered evaluation pushed by basic knowledge. Be aware that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.