Skip to content

With the primary FOMC assembly of 2025 on the close to horizon — January 28-29 – Fed policymakers are going to be rigorously parsing the obtainable knowledge on inflation and inflation expectations.

The FOMC will solely have the CPI and PPI for December in hand for the reason that PCE deflator for December received’t be reported till Friday, January 31 at 8:30 ET.

Specifically, the December CPI might incline a Fed policymaker to assume that whereas total inflation is a bit of worse, core inflation is a bit of higher. Parsing out the nuances of the softening – however nonetheless elevated – upward value pressures for companies versus the flattening out in disinflation in commodities is hard. This can be particularly so with each indication that buyers are going to be hit with larger costs for meals and vitality, and massive ticket objects likes motor automobiles and home equipment. Shelter prices could also be edging down total, however occasions just like the widespread destruction of housing in California might imply a big effect on regional rental prices that spills into the nationwide numbers. Bitter chilly and collection of disruptive storms in January will most likely expend inventories of seasonal merchandise which retailers may have much less motive to low cost. Provide chains are having hassle shifting items, which in flip might imply shortages and better prices for different objects.

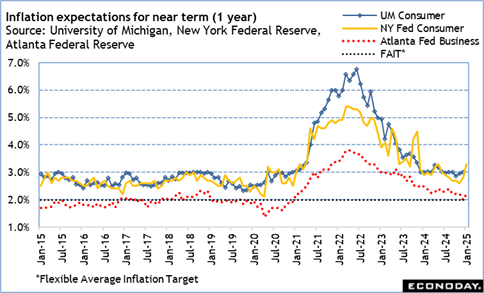

Prospects for additional progress on inflation appear blunted within the close to time period. That is mirrored in some measures of inflation expectations. Whereas total expectations stay according to the final 12 months or so, these are much less favorable and can communicate to the FOMC a couple of want to make sure that there is no such thing as a let up in preventing inflation. Communications from policymakers will reiterate their dedication to bringing inflation all the way down to a sustainable degree and utilizing all their instruments – principally rate of interest coverage and ahead steering – to take action.

Be aware that in January, the Atlanta Fed year-ahead enterprise inflation expectations report had a two-tenths enhance to 2.2 p.c, rising from 2.0 p.c in December which was the bottom since 1.9 p.c in December 2020. The implication is that companies do anticipate the Fed to deliver inflation down, however possibly not as rapidly as beforehand anticipated. The College of Michigan 1-year inflation expectations measure is up five-tenths to three.3 p.c in January and is its highest since 33 p.c in Could 2024. A lot of that’s most likely because of sticker shock on costs for eggs and poultry associated to the outbreak of avian flu. Lower it does point out that buyers see vital erosion of enhancements in inflation.

Brief-term inflation expectations are usually extra unstable and notably react to fluctuations in meals and vitality prices. Policymakers pay extra consideration to these within the medium-term which might be interpreted as a roughly 5-year timeframe.

The College of Michigan 5-year inflation expectations measure is up three-tenths to three.3 p.c in January from December, and has damaged out of the vary of two.9-3.2 p.c that has dominated since October 2022. That is above the three.2 p.c in November 2023 and November 2024. The truth is, that is the very best within the present inflationary episode and can put the FOMC on alert relating to its credibility as an inflation fighter.

Share This Story, Select Your Platform!