Briefly within the information this morning in Aotearoa’s political economic system round housing, poverty and local weather:

-

The Lead: The NZIER’s September quarter survey of enterprise confidence discovered a hunch in expectations concerning the wider economic system and companies’ personal exercise within the subsequent three months. Companies reported they shed extra workers in the course of the quarter and have been no extra assured about using extra within the December quarter.

-

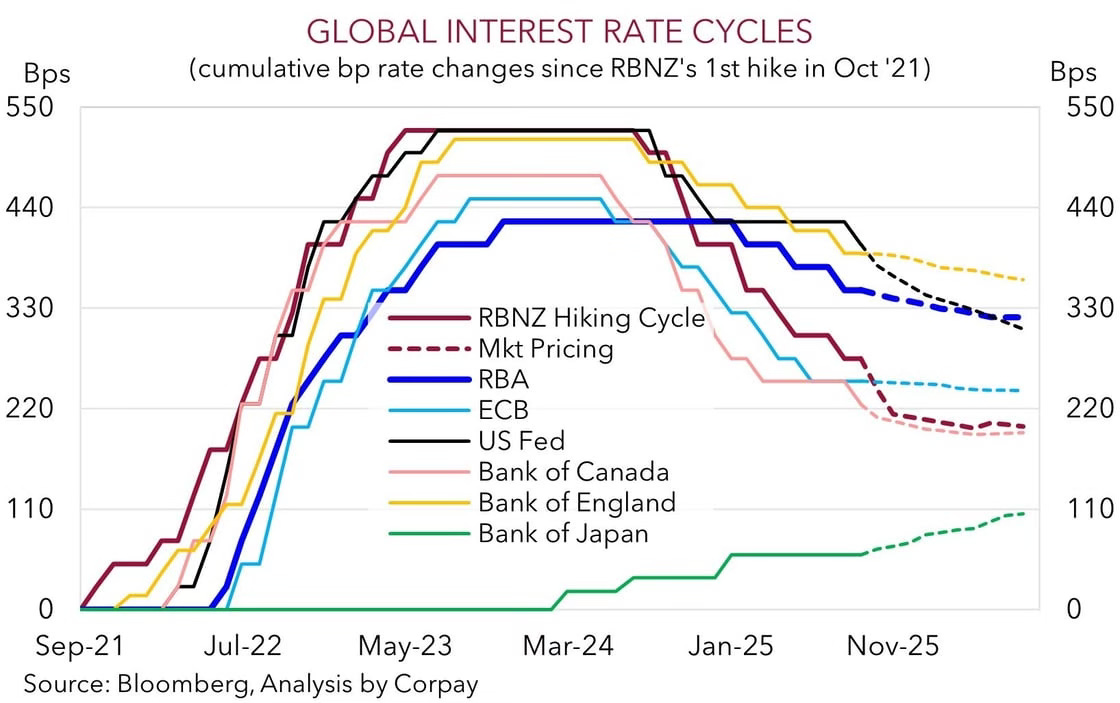

The Sidebar: The survey outcomes elevated the probabilities the Reserve Financial institution would minimize the Official Money Fee (OCR) by a ‘bazooka’-sized 50 foundation factors to 2.5% at 2pm immediately, somewhat than the 25 foundation factors most economists had beforehand anticipated. The Kiwi greenback fell 0.6% to 58.07 USc and one-year wholesale rates of interest fell three foundation factors to 2.51% yesterday. BNZ and TSB minimize extra fastened mortgage charges late yesterday to convey them into line with the others.

-

The Scoop of the Day is from Susan Edmunds at RNZ documenting that about 3000 individuals obtain NZ Tremendous who usually are not but 65, and three who’re underneath 30.

-

The Investigation of the Day is from Paula Penfold at Stuff on the human distress brought on by playing.

-

The Deep-Dive of the Day is from Layla Bailey-McDowell for RNZ on what youth homelessness specialists in Auckland are saying concerning the Jobseeker adjustments.

-

The Interview of the Day is by Pheobe Utteridge for Stuff with jobless man Robert Buy, who has utilized for 8,000 jobs in two years. It’s all about clear slate reform on previous convictions.

Subscribe in full as a paying subscriber for extra element and evaluation within the full video and podcast above. There’s a two-minute free preview for browsers. Paying subscribers assist my work being performed within the public curiosity right here and by way of my appearances on different media equivalent to RNZ & 1News. Paying subscribers additionally get early and full entry to our webinars, our chat room, my morning ‘Early Bird’ post with the complete ‘Picks n’ Mixes’ digests of stories hyperlinks, and may touch upon articles.

The information from the economic system obtained worse for the Authorities yesterday. It is going to be praying for the Reserve Financial institution to chop the Official Money Fee by 50 foundation factors at 2pm. That’s seen as extra probably after a dire enterprise confidence survey for the September was launched yesterday by the NZIER.

It discovered a hunch in expectations concerning the wider economic system and companies’ personal exercise within the subsequent three months. Companies reported they shed extra workers in the course of the quarter and have been no extra assured about using extra within the December quarter.

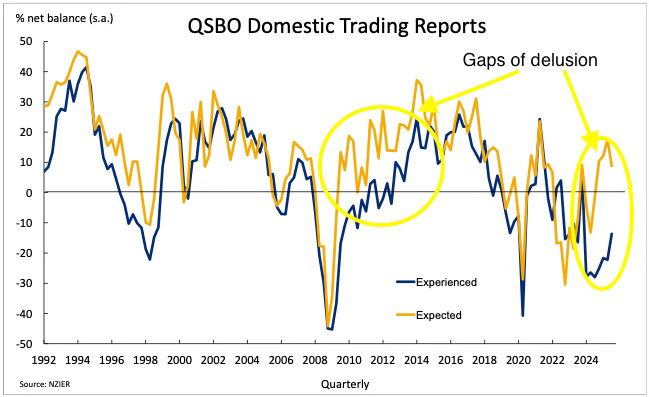

“The economic system might have turned a nook, however we’re failing to achieve traction to get out of this gap – the wheels are spinning within the mud.” ASB Senior Economist Jane Turner on the QSBO survey.

The survey discovered:

-

Companies reporting decrease exercise within the three months, with a internet 14% down in Q3 vs a internet 22% down in Q2;

-

Enterprise expectations concerning the subsequent three months worsened, with a internet 9% anticipating enchancment vs the web 18% who stated in Q2 they anticipated enchancment in Q3;

-

But once more, the precise skilled exercise (-14%) was a lot worse than anticipated (+18%);

-

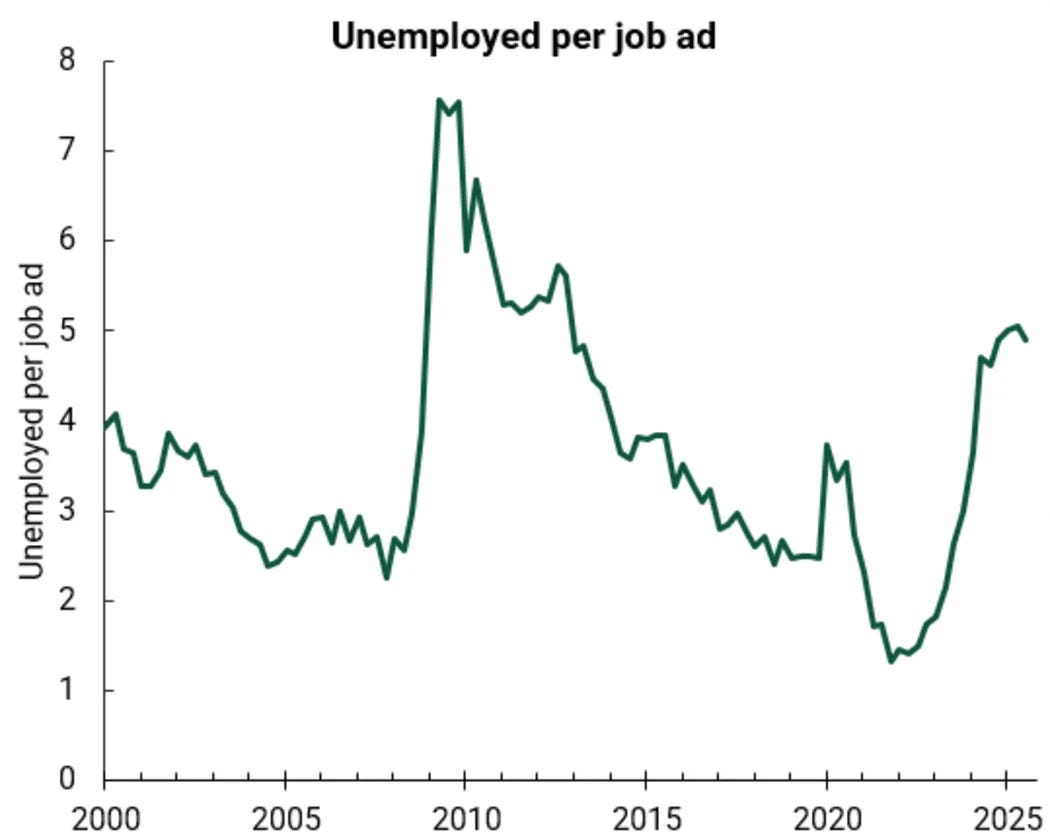

Companies reported shedding jobs within the final quarter, with a internet 23% chopping employees, up from a internet 12% chopping jobs within the June quarter;

-

Enterprise expectations for hiring within the subsequent quarter was caught at a internet 4% anticipating to rent extra;

-

Outcomes for jobs in Q3 (-23%) have been once more a lot worse than the +4% anticipated for the quarter when companies have been surveyed in Q2.

-

Funding intentions for plant & equipment deteriorated to -13% vs +8% within the June quarter

-

Funding intentions for buildings slumped to -20% vs -1% within the June quarter.

The survey outcomes elevated the probabilities the Reserve Financial institution would minimize the Official Money Fee (OCR) by a ‘bazooka’-sized 50 foundation factors to 2.5% at 2pm immediately, somewhat than the 25 foundation factors most economists had beforehand anticipated.

The Kiwi greenback fell 0.6% to 58.07 USc and one-year wholesale rates of interest fell three foundation factors to 2.51% yesterday. BNZ and TSB minimize extra fastened mortgage charges late yesterday to convey them into line with the others.

“Extra assist is required, the RBNZ must get there quicker and ship a 50 foundation level minimize or threat delivering the stimulus too late to matter to households and companies. We count on a comply with up minimize of two.25% in November.” ASB Senior Economist Jane Turner in a note.

-

The Lead: Mandy Te for Curiosity: Economy ‘spinning in the mud’ – 50 point cut to the OCR ‘needed’

-

The Sidebar: Gyles Beckford for RNZ: Weaker business survey tips odds towards bigger rate cut

-

Scoop of the day: Susan Edmunds for RNZ: The 20-somethings getting the pension

-

Investigation of the day: Paula Penfold for Stuff: ‘Gnawing on dog bones to survive’: The lonely addiction where no one ever wins

-

Deep-dive of the day: Layla Bailey-McDowell for RNZ: Jobseeker changes ‘out of touch’, youth homelessness group warns

-

Interview of the day: Pheobe Utteridge for Stuff with jobless man Robert Buy: Almost 8000 applications, no job: Man still haunted by what he did 28 years ago

Full paying subscribers can see the complete record of Picks n’ Mixes in my Early Bird post on Substack this morning.

Ka kite ano

Bernard

PS: Right here is the PDF of my presentation within the Refrain video above.