Monetary markets have been hit exhausting by one other wave of promoting firstly of buying and selling in Asia on Monday, with buyers and economists grappling with rising odds of a extreme financial downturn brought on by President Trump’s vital new tariffs on imports.

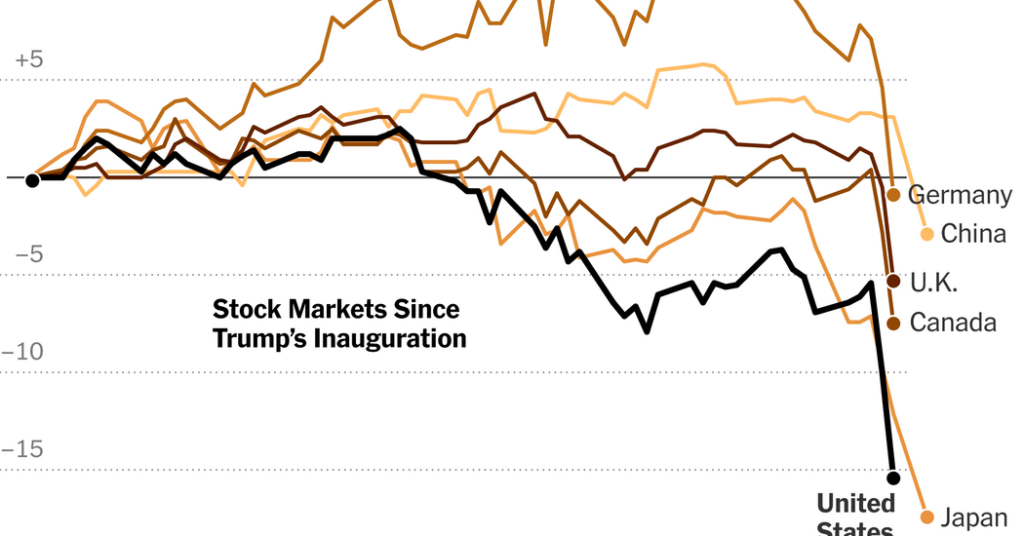

Buying and selling was extraordinarily risky. Shares in Japan plunged over 8 p.c, whereas South Korea tumbled about 5 p.c. In Australia, shares fell greater than 6 p.c.

Over the weekend, analysts circulated notes warning that Asia could possibly be significantly susceptible to a tit-for-tat change of retaliatory tariffs between China and the USA. Many nations within the area, together with Japan and South Korea, depend each nations as their high buying and selling companions.

President Trump doubled down on Sunday night, saying that he wouldn’t ease his tariffs on different nations “until they pay us some huge cash.” He additionally dismissed issues that his steep new taxes on imports will result in greater costs. “I don’t assume inflation goes to be a giant deal,” he informed reporters on Air Power One.

On Friday, China struck back at the USA with a 34 p.c tariff on numerous American exports, matching a 34 p.c tariff that Mr. Trump imposed on China final week.

On Monday, inventory benchmarks in Hong Kong and Taiwan plunged about 10 p.c after they began buying and selling. Shares in mainland China have been down about half that quantity.