ECONOMYNEXT – In a bid to repair interbank charges to inside a number of foundation factors, which results in extra liquidity, exterior instability and brings a second sovereign default nearer, Sri Lanka’s central financial institution has claimed that the Financial institution of England had a ‘single coverage price’ since its inception.

“The Financial institution Fee of the Financial institution of England, one of many oldest coverage charges on the earth, has remained a single coverage rate of interest since its inception in 1694,” the central financial institution says in its Market Operations report of December 2024.

Oh My Gosh

That assertion is so fallacious on so many counts over so many centuries, that this columnist doesn’t know even the place to start.

There was no such factor as a coverage price wherever earlier than open market operations have been invented by the Fed in 1923, resulting in a peacetime credit score bubble and Nice Despair and everlasting inflation and accompanying political unrest within the ensuing years because the Treasury ran finances surpluses.

The Financial institution of England was prohibited by its personal convertibility enterprise to gold coin at its inception from having a coverage price, single or in any other case.

It was legally barred from 1844 by the Financial institution Constitution Act from defending a sample of rates of interest and creating steadiness of funds deficits or runs by itself reserves.

The coverage price as we all know it now was the brainchild of John Legislation, an concept which was defeated in England and his personal Scotland which had an exceptionally well-run free banking system.

Scotland was exempted from the Financial institution Constitution Act which utilized to England and Wales, which then prohibited any type of single coverage price in any way because the notice subject was strictly restricted.

It was applied in France, which went right into a meltdown like Sri Lanka.

Quick ahead to the Eighties.

When the Thatcher administration, backed by Alan Walters and Peter Middleton, took inflation by its brief hairs.

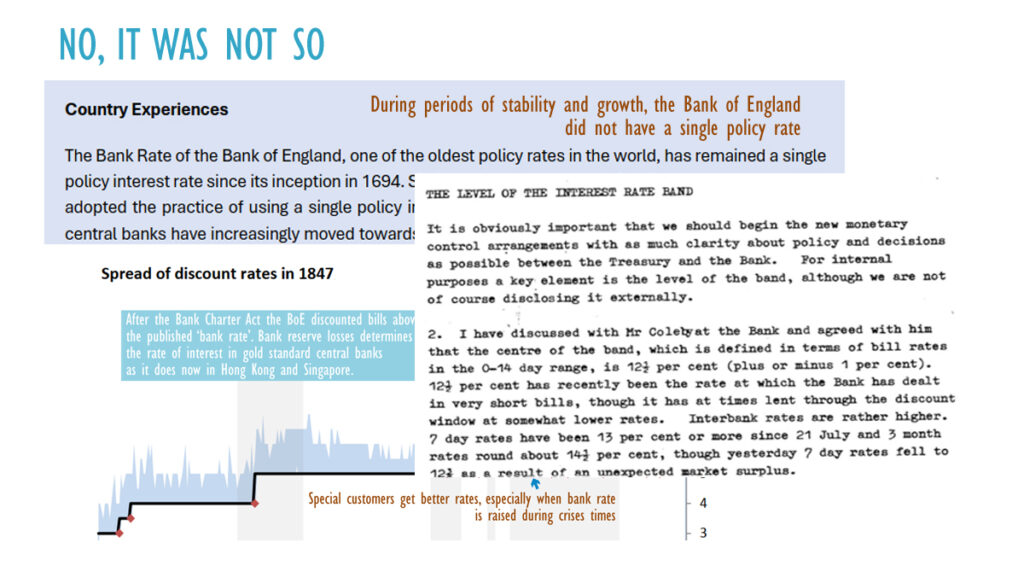

In addition they made the Financial institution of England run an undisclosed band, known as the Band 1 Dealing Fee, which is way, removed from a ‘single coverage price’ as claimed by Sri Lanka’s central financial institution.

The speed started to be known as ‘financial institution price’ solely just lately.

Depoliticize Charges

The vast margin allowed the interbank markets to work and ‘depoliticize’ rates of interest in line with its architects within the Thatcher administration.

Actually, there have been 4 bands. It was executed by buying brief expiring securities, personal securities additionally, in order that the cash routinely expired. There have been 4 bands to accommodate extra securities, Band 1, Band 2, Band 3 and Band 4.

On August 20, 1981 the minimal lending price (MLR) of the Nice Inflation years ended.

It was the vast margin that’s what made it doable to finish Nice inflation and Stagflation put the UK on the trail to stability and development, though the general working framework was not so nice because the anchor was inferior to the gold commonplace and so they have been struggling to discover a higher one.

Lets take 1694

Rewind to 1694. In 1694, the Financial institution of England was so tiny, that it had no skill to affect rates of interest within the UK and it had no political ideology of its personal to both increase development, employment or inflation, like central banks do now. It was not likely a central financial institution in any respect.

Its solely concept was to make some income by financing the federal government and financing personal debtors within the invoice low cost market.

It was so small that it didn’t matter a lot within the general scheme of issues within the UK till a couple of century later. Even then the nation ran on gold cash of the royal mint and financial institution notes of London, nation and Scottish banks which have been underneath convertibility undertakings to gold.

Sri Lanka’s central financial institution has set itself two political objectives, potential output and a 5 % inflation tax on an harmless and helpless citizenry’s salaries and financial savings, whereas the nation’s parliament sat like a plum pudding and allowed it to take action.

With out political aims the Financial institution of England didn’t want a coverage price, single or in any other case. Nonetheless it had one drawback, that was the usury price, which put a ceiling.

If we take the revealed price, from one other central financial institution just like the Fed system, the UK coverage price appears to be like like this.

It appears to be like as if the speed was flat over an extended interval. Actually, it is because the UK had a Usury price.

Financial institution of England researchers who went by the ledgers discovered that the precise charges and which loans got – principally commerce payments of retailers have been discounted – have been vastly completely different.

And market charges, together with very lengthy charges of market devices together with authorities perpetuals and East India Firm bonds have been decrease or greater. Greater when there was a disaster.

No Political Transmission Mechanism

There was no political ‘transmission mechanism’ set by the parallel cupboard of the financial coverage committee to realize their very own ends which was instantly reverse to the curiosity of the general public who needed no inflation.

The financial institution additionally had Consols in its books as anybody who learn Lombard Avenue will see.

After Usury Legal guidelines have been lifted and the Financial institution Constitution Act got here in, Financial institution of England researchers discovered, the payments have been discounted above the revealed price.

After the Financial institution Constitution Act particularly, the BoE’s affect within the metropolis turned stronger as new opponents couldn’t come.

This was not a ground price that was enforced for political functions of the Court docket of Administrators of the Financial institution of England like now, however a price at which officers of the Banking Division of Financial institution of England refused to lend. Beneath the regulation the difficulty and banking division was separated.

So, it was a price like the fashionable forex boards have, Fed plus 50 foundation factors plus system.

Some prospects appear to have obtained particular therapy through the disaster because the revealed financial institution price was lifted.

An additional complication is that the Financial institution of England took deposits from the inception.

Now it’s foolish to think about that it obtained deposits and discounted payments on the identical price. There needed to be a two-way price to make income. Which it did. David Ricardo mentioned that each farthing ought to go to the Exchequer as a result of Constitution.

Actually, in a trick to increase its 11 12 months first constitution, the Financial institution of England gave curiosity free loans to the English authorities, and lowered the speed of its authentic price sharply.

There isn’t any level in going by each decade to point out what occurred. Suffice to say the Financial institution of England suspended the gold commonplace in 1914 on the eve of World Conflict 1.

Everlasting Inflation

The rationale inflation is created is principally as a result of lack of expertise about inflation and banks of subject, that engulfs parliaments and the chief additionally.

Mercantilists and what we name macro-economists have emerged now and again, however they have been at all times defeated by legislators (who have been attorneys for essentially the most half) and classicals who obtained themselves elected.

One of many peculiar information about classical economists was that they have been very effectively versed in regulation. That’s the reason they didn’t permit central banks to play politics with coverage charges and set them on a zero inflation rule.

The mistaken concepts about central banking or the operation of a ‘financial institution of subject’ that now exist, unfold from the US. The Fed additionally was arrange on a restricted Constitution.

The Fed invented open market operations and created the Nice Despair as Andrew Mellon, Treasury Secretary, ran finances surpluses. He was de facto chair of the Federal Reserve however he couldn’t do something about it.

After the US financial system collapsed from open market operations, Mellon refused to do stimulus and he was sacked and threatened with impeachment. The congressional inquiry failed to carry central bankers accountable, in contrast to within the nineteenth century.

That’s how macro-economists received the sport and misled the Congress and everlasting inflation was upon the individuals. Earlier than that, classical economists, who obtained themselves elected to parliament, at all times held central banks accountable.

The controversy within the Home of Commons through the Gold Customary Act of 1925, confirmed little of the private conviction with parliamentary fee studies and monographs have been written by nineteenth century legislators cum classical economists.

Legislators have been already deferring to the tutorial inflationists by 1925, Hansard data present. And Part 1 (2) of that Act contained a deadly flaw. A member of the general public with a small quantity of notes may now not demand gold cash from the Financial institution of England to regulate BoE and drive up the low cost price.

A lot of the dangerous concepts in subsequent come from Cambridge (Keynes) and US Universities like Harvard (Hansen). The try to rebuild the system by the Bretton Woods was flawed as its architects, from Cambridge and Harvard needed to maintain the coverage price.

All this got here to a head within the Seventies as oil and meals costs soared and the idea of ‘core inflation’ was invented.

The statistical craze mixed with post-Keynesianism was taken to new heights by lecturers of MIT, an engineering school.

The inflationism doesn’t come from politicians. It comes from the peculiar ideology held by macroeconomists and econometricians that unfold within the final century. It issues little whether or not they’re within the central financial institution, Treasury or is the Finance Minister himself.

The important substances are to brush apart classical economics, imagine that there was salvation in optimistic inflation and that it must be two % or greater.

Then, each time the 2 % goal was missed resulting from concentrating on core inflation, believing that some mysterious a part of the inflation was not ‘demand pushed’ which the central financial institution couldn’t management, all hell broke free.

Tackling the Nice Inflation

All this inflation and rise of macro-economists in controlling the individuals, began within the Thirties, briefly halted after World Conflict II until round 1959 and quickly worsened within the Sixties.

The important thing ideology of the macroeconomists was there was a trade-off between inflation and employment adopted by others together with that the unions created inflation (wage-spiral inflation).

Ideas like ‘actual’ rates of interest and inflation indices got here into being as inflation turned optimistic over an extended interval. Within the classical interval of the economic revolution there was no want for inflation indices, as a result of there was none. Any inflation from a credit score bubble, reversed as convertibility kicked in.

All this got here to a head in 1971, after the Bretton Woods collapsed, and Nice Inflation was upon the world.

Within the Seventies, through the Nice Inflation when macro-economists drove every little thing haywire, there was certainly a coverage price known as the minimal lending price (MLR), on the Financial institution of England.

When Margarat Thatcher obtained elected, her advisors, particularly Alan Walters, and likewise Peter Middleton, Deputy Secretary to the Treasury and Beneath Secretary N J Monck, negotiated with the Financial institution of England to cease printing cash and finish the minimal lending price.

The MLR ended on August 20, 1981, together with reserve ratios.

Within the letter reproduced above, written by Monck to Middleton exhibits {that a} 12.5 %, plus or minus 100 foundation factors was the plan for the primary day.

Knowledge at the Bank of England, exhibits that Beneath Secretary Monck was spot on.

The rate of interest quoted because the Financial institution Fee on August 25, is 12.69 %. Then it modifications to 14.00 in September, to fifteen,00 % and 15.13 % in October, 15.06 %, 14.63 % and 14.56 %, on the times which can be reported.

The present financial institution price operates another way.

The central financial institution’s Financial Operations Report says many different peer central banks like “Pakistan and Bangladesh additionally use a single coverage rate of interest within the technique of financial coverage communication.”

Phrases fail this columnist.

How does one reply to an announcement like that? If that’s the path down which Sri Lanka’s central financial institution needs to go, and needs to benchmark in opposition to, then there may be nothing extra to be mentioned.

Thailand is talked about. The Financial institution of Thailand for a few years has had damaging home belongings, so there isn’t a comparability. There isn’t any time to dwell on Malaysia and India. Following the RBI has obtained us into severe difficulties previously. Territories that went in the other way, like Dubai and Qatar and Maldives have prospered.

When the RBI did get it proper by concentrating on a Wholesale Value Index, till 2011, Sri Lanka didn’t comply with. Although there’s a lot to say, now isn’t the time.

Financial Fantasy

Financial coverage modernization promoted by the IMF is nothing aside from new and modern methods to print cash, underneath the very eyes of the legislature.

The only coverage price is a option to print giant volumes of cash, by an considerable reserve regime as was seen from October to December and implement a non-market rate of interest on the credit score system, and set off imports and exterior stress.

{That a} financial ‘cupboard’ is aware of the rate of interest of a complete credit score system and may ‘sign’ a price is pure fantasy and omniscience bordering on faith.

If ‘signalling’ occurs with out printing cash, then it’s not so damaging. That may occur provided that the ground coverage is greater than the credit score demand. If not, charges can fall by psychology and the assumption that the central financial institution is aware of higher than the market.

Any such fall, out of line with credit score demand, nevertheless will result in mis-allocation of credit score and ache later, even when the ‘heavy lifting’ isn’t executed by extra liquidity instantly. Messing round with the value system has dangerous penalties.

Fee displays all types of dangers and asset allocation necessities.

It’s not the identical as fixing trade charges, which is an attribute of cash.

Many tutorial papers on financial coverage (the correct phrase is probably inflationism) is absolute financial fiction.

And these papers are cited by subsequent writers with out reality checking. Statements from central banks with trade controls and excessive inflation taxes are absolute fantasy.

After a number of years one can’t separate fiction from reality.

It’s higher to learn Hardy boys.

Studying IMF’s employees papers on financial coverage (with some honorable exceptions) and technical recommendation on ‘financial coverage modernization’ is like studying Nancy Drew with mathematical formulae.

Monetary media is not any higher. The issue is that individuals in authorities who do issues appropriately, don’t clarify.

A few of the paperwork quoted on this column within the UK, have been declassified, a few years later.

The bottomline is that this.

Sri Lanka has a central financial institution which has imposed trade controls and import controls on the individuals to maintain its operational framework going. Which means the OF is flawed.

The OF is driving hundreds of thousands of individuals to nations which have cash with fundamental attributes of trade price stability ( a retailer of worth and a method of deferred cost), together with the Maldives.

Folks have a proper to dwell within the nation they’re born in. Sri Lanka doesn’t should be a remittance incomes nation.

All of the latest pyrotechnics about automobiles import management will not be required if the central financial institution’s working framework and discretion (versatile) is tightly managed by regulation.

Sri Lanka may be an outward remitting nation that imports labour inside a decade, and all of the moms and daughters can begin to come residence, if the parliament is daring sufficient to tame the central financial institution and its lethal working framework, which is progressively worsened by ‘financial coverage modernization’.

Sri Lanka defaulted as soon as, and the central financial institution has executed an exceptionally good job up between September to December 2024, when the working framework plunged into an considerable reserve regime with authorities liquidity forecasts.

However until Sri Lanka operates a scarce reserve framework with a large hall, with a ‘depoliticized’ price, the second default will come. (Colombo/Feb13/2025)