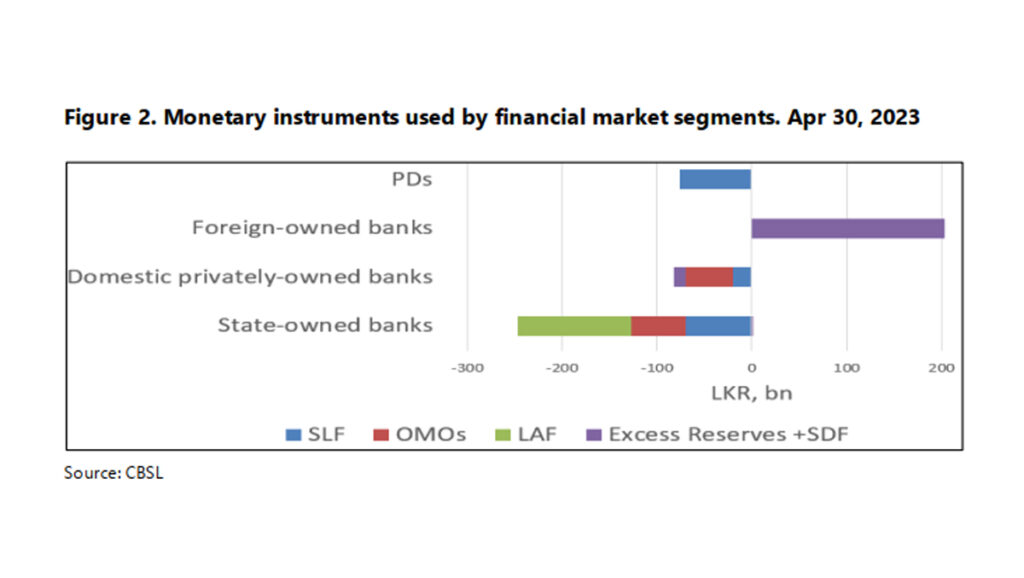

ECONOMYNEXT – Sri Lanka’s main sellers are making extreme use of the central financial institution’s standing amenities to fund their authorities securities portfolios although they’ve been lower off from liquidity auctions, an Worldwide Financial Fund report stated.

“Non-bank main sellers for presidency LKR debt have entry to standing amenities and routinely use Standing Lending Facility (SLF) to fund their portfolios,” the report said.

“The share of non-bank main sellers in SLF accounts for about 46 % or about 76 bn LKR as of end-April 2023,”

“Central Financial institution of Sri Lanka ought to begin phasing out the use financial devices to assist LKR bond market growth.

“Financial coverage devices ought to subsequently not be made accessible to non-bank main sellers to assist their exercise in LKR bond market.”

Major sellers are already lower off from open market operation auctions.

Central banks of low inflation international locations (with floating trade charges, together with the US) present liquidity amenities to sellers.

The usage of central financial institution standing amenities ought to solely be used to clear transactions on a single day and will not be anticipated for use for days or perhaps weeks on finish, analysts say.

Ideally any such borrowings must be cleared earlier than the subsequent public sale by promoting the securities to actual buyers.

In Sri Lanka as a result of peculiar means Treasury payments are bought, together with necessary dumping of Treasuries on sellers in subsequent phases after the preliminary public sale, sellers don’t have any cash to pay for them.

Memento mori

In a reserve gathering central financial institution, it’s irrelevant whether or not inflationary open market operations present cash to banks, financial institution main sellers, or non-bank main sellers or the federal government immediately.

The stability of funds will go into deficit and the federal government will lose the power to repay maturing debt regardless to which counterparty liquidity is injected to mis-target charges.

Within the case of personal credit score being re-financed by the open market operations, imports could also be generated quicker than by the federal government, since most authorities bills are home in nature.

Banks which get central financial institution credit score additionally lend with out deposits to clients, triggering exterior imbalance, forex depreciation, exporter holdback, importer early overlaying, main a spike in home credit score and extra injections.

State-owned banks have historically been the worst customers of such amenities, whereas overseas banks typically have extra reserves.

If there was no coverage charge, or a narrowly focused name charge extra reserves results in an computerized rise in overseas reserves of a tough pegged financial authority, because it did earlier than the central financial institution was arrange in 1950.

Earlier than 1950 any authorities deposits within the financial authority additionally led to an increase in overseas reserves.

When a soft-pegged central financial institution (a central financial institution which creates power foreign exchange shortages and depreciation on account of an already flawed working framework and imposes trade controls) injects cash deeming there’s a ‘structural scarcity’ (often after intervening in foreign exchange markets), it results in a everlasting lack of overseas reserves.

Any cash banks that get by promoting Treasury payments time period or outright to the central financial institution can even re-finance home credit score and main depreciation (or a lack of reserves).

One benefit of permitting main sellers to entry auctions, nevertheless is the market credit score situations are rapidly communicated to the central financial institution and the re-financing can rise faster to to the ceiling charge and chase away stability of funds deficits.

Hello bid charges by main sellers, can even sign the necessity to elevate the ceiling coverage charge in a reserve gathering central financial institution to cease the erosion of reserves.

Stability of funds troubles began to emerge in Western nations after the Federal Reserve invented the coverage charge and open market operations within the Nineteen Nineties.

International locations like Singapore, Hong Kong and recently Cambodia and GCC nations have averted forex depreciation, extreme banking crises, social unrest and political upheavals by not having a coverage charge. (Colombo/Sept28/2024)