-

Income: US$282.7m (up 3.4% from 2Q 2024).

-

Web revenue: US$151.8m (up from US$71.2m loss in 2Q 2024).

-

Revenue margin: 54% (up from internet loss in 2Q 2024).

-

EPS: US$4.18 (up from US$2.00 loss in 2Q 2024).

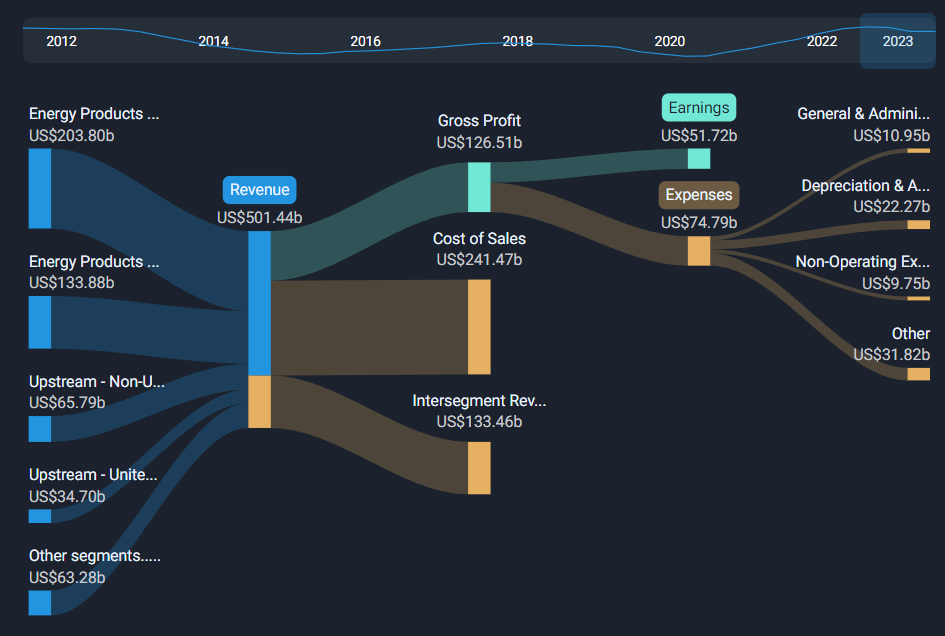

All figures proven within the chart above are for the trailing 12 month (TTM) interval

Income was in keeping with analyst estimates. Earnings per share (EPS) exceeded analyst estimates.

Trying forward, income is forecast to develop 6.7% p.a. on common throughout the subsequent 3 years, in comparison with a ten% progress forecast for the Leisure trade within the US.

Performance of the American Entertainment industry.

The corporate’s shares are down 6.5% from per week in the past.

Earlier than you are taking the subsequent step you must know in regards to the 2 warning signs for Sphere Entertainment (1 cannot be ignored!) that we have now uncovered.

Have suggestions on this text? Involved in regards to the content material? Get in contact with us immediately. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is basic in nature. We offer commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles will not be meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary scenario. We purpose to convey you long-term targeted evaluation pushed by basic information. Notice that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.