Key Factors

- Italtile’s FY 2024 income barely dipped by 0.79%, reaching R9.06 billion ($509.1 million) amid difficult financial circumstances.

- Revenue declined by practically 10%, dropping to R1.51 billion ($84.6 million), reflecting the influence of sluggish progress and inflation.

- Whole belongings rose by 6.91% to R10.44 billion ($587.71 million), signaling the corporate’s adaptability in a tricky market.

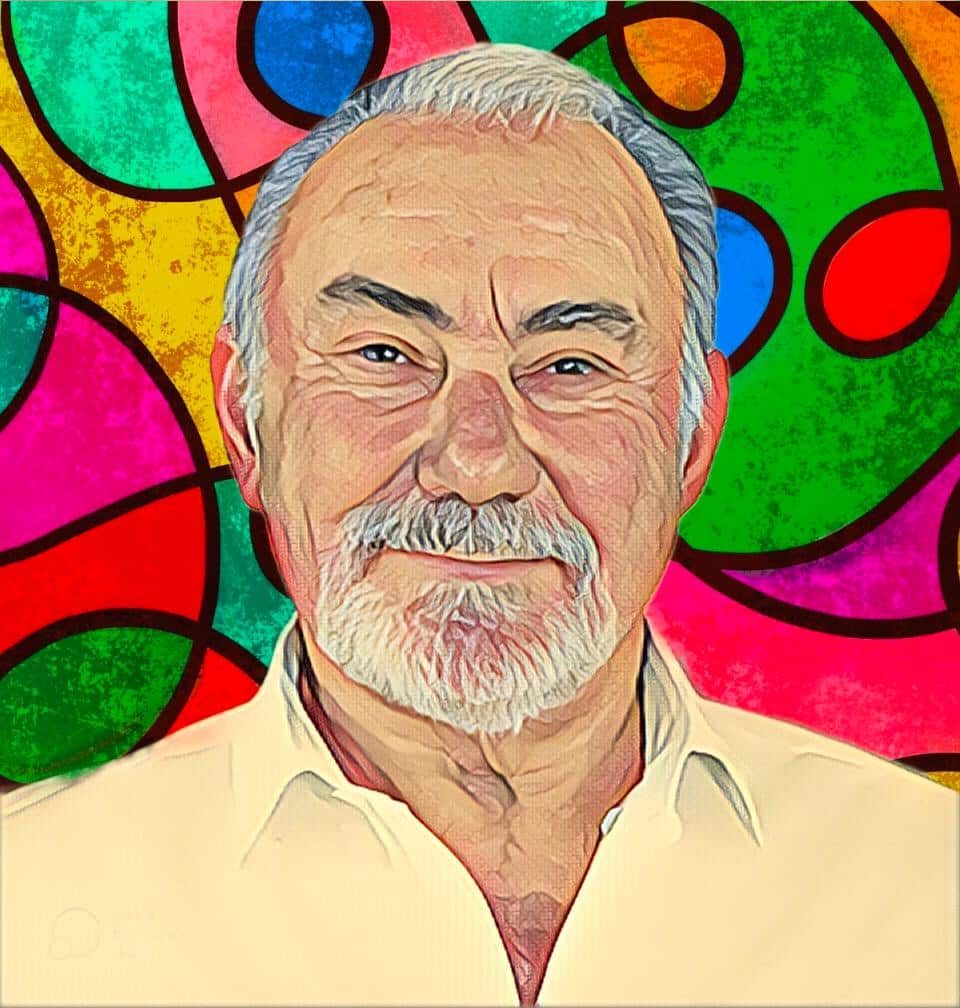

Italtile, a number one Gauteng-based retailer and producer of toilet and residential merchandise managed by South African businessman Giovanni Ravazzotti, launched its monetary outcomes for the total yr 2024, revealing a combined efficiency amid a tricky working setting.

In line with its recently published financial results for the fiscal year ended June 30, 2024, the corporate, noticed its income dip barely to R9.06 billion ($509.1 million), down 0.79 p.c from R9.14 billion ($513.09 million) within the earlier yr.

Revenue drops practically 10 p.c as financial pressures mount

The modest decline in income displays the resilience regardless of difficult financial circumstances, together with sluggish progress, excessive rates of interest, inflation, and an oversupply within the tile manufacturing business. Italtile’s key manufacturers—CTM, Italtile Retail, and TopT—demonstrated constant retail turnover throughout this era, underscoring the corporate’s market place.

Nonetheless, Italtile confronted better challenges on the earnings entrance, with revenue declining by 9.89 p.c, from R1.65 billion ($92.83 million) in 2023 to R1.51 billion ($84.6 million) in 2024. CEO Lance Foxcroft reiterated the corporate’s dedication to sustaining its business management by enhancing its retail and manufacturing capabilities. “Our major focus is on enhancing the Group’s aggressive place to retain our business management via our strong retail and manufacturing belongings and groups,” Foxcroft acknowledged.

Italtile’s Whole belongings enhance by 6.91 p.c, signaling adaptability

Italtile, listed on the Johannesburg Inventory Change and comprising well-known manufacturers comparable to Italtile Retail, CTM, TopT, and U-Mild, serves as a bellwether for assessing client expenditure well being in South Africa. Giovanni Ravazzotti, who based the corporate in 1969 and holds a 33.9 p.c stake, stays one of many nation’s wealthiest people.

Regardless of the challenges, Italtile’s complete belongings grew by 6.91 p.c, rising from R9.77 billion ($551.5 million) as of June 30, 2023, to R10.44 billion ($587.71 million) as of June 30, 2024. The corporate’s retained earnings additionally elevated from R4 billion ($225.8 million) to R4.9 billion ($276.6 million), signaling adaptability in a tricky market.

Trying forward, Italtile is concentrated on increasing its footprint with new TopT shops, enhancing CTM’s efficiency, and rising its on-line gross sales. Whereas the near-term buying and selling setting stays difficult, the corporate’s robust manufacturers, devoted groups, and main merchandise place it properly to navigate these difficulties and maintain its success within the South African market.