Key Factors

- Stephen Saad’s wealth surged by $44 million as Aspen Pharmacare’s inventory rose on the Johannesburg Inventory Trade in January.

- Saad’s 12.8% stake in Aspen, now valued at $550 million, marks a restoration after a $113.8 million loss in 2024.

- Aspen’s 2024 income elevated 10%, pushed by a 25% rise in manufacturing income and a 4% enhance in its pharmaceutical division.

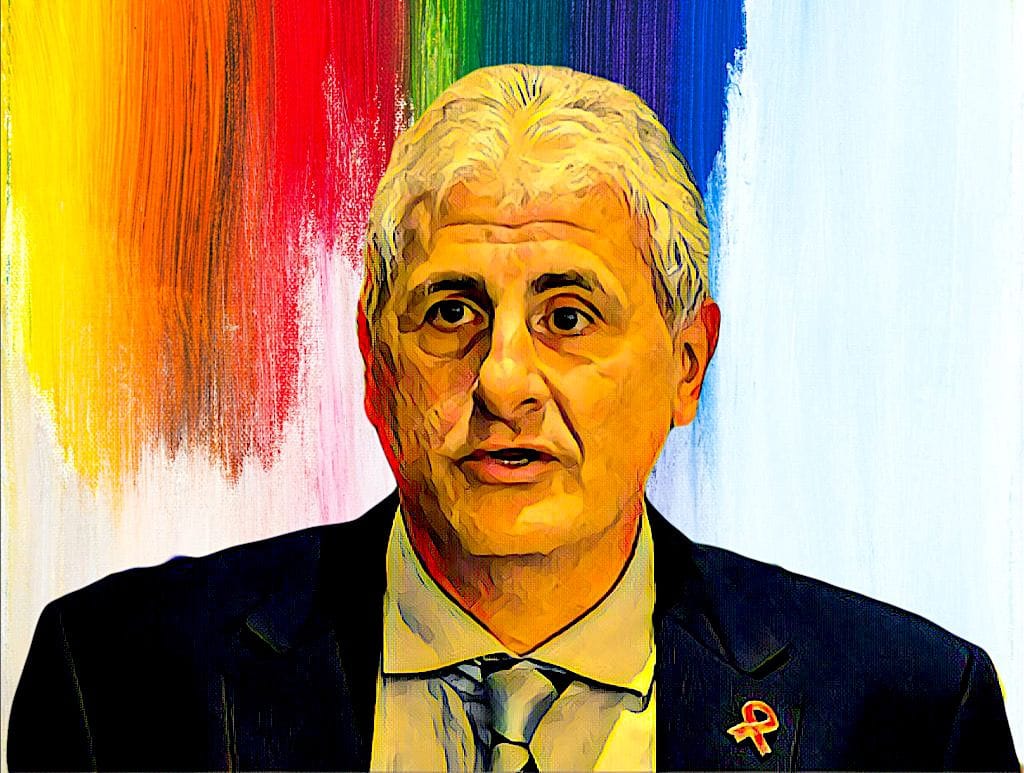

Stephen Saad, the South African pharma tycoon and CEO of Aspen Pharmacare, has seen his wealth rebound with a $44 million enhance within the worth of his stake within the firm. This surge is pushed by an increase in Aspen’s share value on the Johannesburg Inventory Trade (JSE) in January.

As CEO of Aspen, Saad holds a 12.8 % stake within the firm, equal to 57,221,750 shares. With the current rise in Aspen’s inventory value, the worth of his holdings has crossed $550 million, marking a restoration after a difficult 2024.

Final 12 months, Saad noticed the worth of his stake drop by R2.21 billion ($113.8 million), from R11.64 billion ($619.6 million) at first of 2024 to R9.43 billion ($505.8 million) by the top of December. Nevertheless, the current uptick in share costs has helped to reverse a few of these losses.

Aspen’s income jumps 10% in 2024

Aspen Pharmacare, based by Saad in 1997, has develop into a key participant in South Africa’s pharmaceutical trade and has considerably contributed to his wealth. With operations in over 115 nations, the corporate has seen spectacular development beneath Saad’s management.

In its 2024 fiscal year, Aspen reported a ten % enhance in income, rising to R44.7 billion ($2.42 billion) from R40.7 billion ($2.2 billion) in 2023. This was largely pushed by a 25 % rise in manufacturing income, whereas its business prescribed drugs division grew by 4 %.

Saad’s Aspen stake rebounds to $550 million

Because the begin of 2025, Aspen’s inventory value has climbed by 8.76 %, from R164.85 ($8.83) to R179.29 ($9.6). This has lifted the corporate’s market capitalization above $4.2 billion, rewarding traders and strengthening Aspen’s place within the pharmaceutical sector.

Consequently, Saad’s stake in Aspen is now valued at R10.26 billion ($550.1 million), representing a major restoration for the businessman. This rise in his fortune additional cements his position as a key determine in South Africa’s enterprise world, reaffirming his management and Aspen’s prominence within the international pharmaceutical market.