Key Factors

- South Africa’s Brait SE is in search of consumers for UK-based trend chain New Look to repay debt and simplify its portfolio.

- CEO Peter Hayward-Butt says Brait will provide New Look’s e-commerce platform and chosen worthwhile shops to potential acquirers.

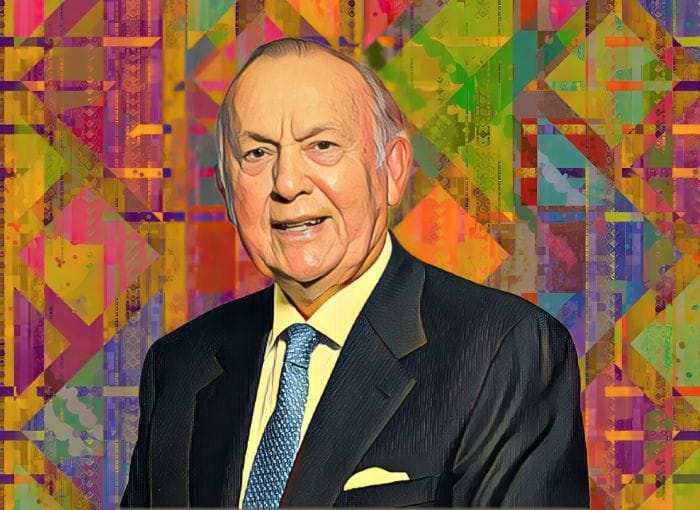

- Backed by billionaire Christo Wiese, Brait posted R1.02 billion ($53.94 million) revenue and is eyeing a Virgin Energetic IPO inside 18 months.

Brait SE, the South African funding agency backed by billionaire Christo Wiese, is seeking to offload its UK retail chain, New Look, throughout the subsequent yr. The transfer is a part of a broader effort to simplify its portfolio, repay debt, and return capital to shareholders.

Brait prepares sale of New Look

Chief Government Officer Peter Hayward-Butt confirmed that Brait has began partaking with potential consumers. New Look, which operates round 400 shops throughout the UK, is narrowing its focus to a stronger on-line presence whereas step by step cutting down its bodily footprint.

“The digital platform, together with a collection of worthwhile shops, is the bundle we’d prefer to promote,” Hayward-Butt mentioned, providing the clearest image but of what’s on the desk. Brait has been paring down its holdings since late 2019, when it first signaled plans to exit non-core belongings like New Look and Virgin Energetic.

The sale of New Look has taken longer than anticipated. Lately, the style chain entered a UK courtroom course of designed to assist struggling firms restructure debt and decrease prices. That helped stabilize the enterprise and made it extra enticing to potential consumers. Hayward-Butt famous that the most probably suitor could be both a longtime UK trend model seeking to enhance efficiencies or a brand new participant eager on getting into the market.

Wiese-backed Brait sharpens funding focus

Based in 1976, Brait has lengthy targeted on delivering worth by way of a hands-on funding strategy. Its portfolio contains stakes in Premier Group, Virgin Energetic, and Consol. Wiese, who owns a 28.5 % share, stays a central determine in Brait’s technique to strengthen returns.

That technique confirmed indicators of paying off. Within the first half of 2025, Brait posted a internet revenue of R1.02 billion ($53.94 million), greater than double the determine from a yr earlier. Final November, Brait sold a portion of its stake in Premier Group, trimming its curiosity to 19.4 %. The sale was a part of a broader plan to streamline its investments and unlock money for different makes use of.

Earlier this yr, Brait also completed a bond buyback worth $5.3 million, additional shoring up its steadiness sheet. With its monetary footing improved, the corporate is now higher positioned to climate financial headwinds and concentrate on long-term development. Trying forward, Brait plans to take Virgin Energetic public throughout the subsequent 18 months.