Shenzhen Tianyuan DIC Data Know-how Co., Ltd. (SZSE:300047) shares have had a extremely spectacular month, gaining 32% after a shaky interval beforehand. The final month tops off a large improve of 105% within the final 12 months.

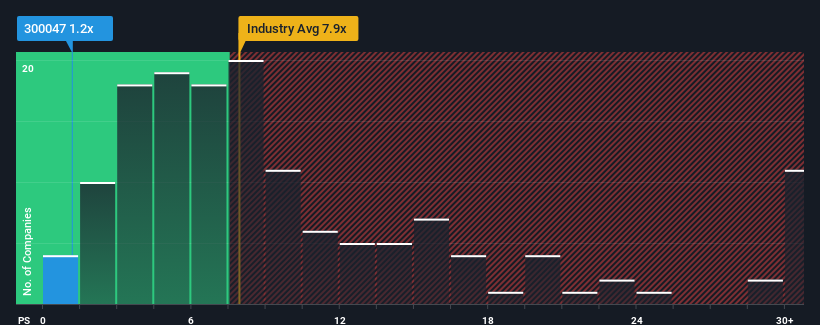

Despite the agency bounce in worth, Shenzhen Tianyuan DIC Data Know-how should still be sending very bullish indicators in the meanwhile with its price-to-sales (or “P/S”) ratio of 1.2x, since nearly half of all corporations within the Software program trade in China have P/S ratios better than 7.9x and even P/S greater than 14x will not be uncommon. Nonetheless, the P/S is likely to be fairly low for a purpose and it requires additional investigation to find out if it is justified.

Check out our latest analysis for Shenzhen Tianyuan DIC Information Technology

How Shenzhen Tianyuan DIC Data Know-how Has Been Performing

Current occasions have been fairly advantageous for Shenzhen Tianyuan DIC Data Know-how as its income has been rising very briskly. Maybe the market is anticipating future income efficiency to dwindle, which has saved the P/S suppressed. If that does not eventuate, then present shareholders have purpose to be fairly optimistic concerning the future course of the share worth.

We do not have analyst forecasts, however you’ll be able to see how latest developments are organising the corporate for the longer term by trying out our free report on Shenzhen Tianyuan DIC Information Technology’s earnings, income and money circulation.

Do Income Forecasts Match The Low P/S Ratio?

Shenzhen Tianyuan DIC Data Know-how’s P/S ratio can be typical for an organization that is anticipated to ship very poor development and even falling income, and importantly, carry out a lot worse than the trade.

Looking again first, we see that the corporate grew income by a powerful 32% final 12 months. The sturdy latest efficiency means it was additionally capable of develop income by 42% in whole during the last three years. So we will begin by confirming that the corporate has completed a fantastic job of rising income over that point.

Evaluating the latest medium-term income developments towards the trade’s one-year development forecast of 28% reveals it is noticeably much less engaging.

In mild of this, it is comprehensible that Shenzhen Tianyuan DIC Data Know-how’s P/S sits under nearly all of different corporations. Apparently many shareholders weren’t comfy holding on to one thing they consider will proceed to path the broader trade.

The Key Takeaway

Shenzhen Tianyuan DIC Data Know-how’s latest share worth soar nonetheless sees fails to carry its P/S alongside the trade median. Utilizing the price-to-sales ratio alone to find out should you ought to promote your inventory is not wise, nonetheless it may be a sensible information to the corporate’s future prospects.

In step with expectations, Shenzhen Tianyuan DIC Data Know-how maintains its low P/S on the weak point of its latest three-year development being decrease than the broader trade forecast. Proper now shareholders are accepting the low P/S as they concede future income most likely will not present any nice surprises. Until the latest medium-term circumstances enhance, they may proceed to type a barrier for the share worth round these ranges.

It is at all times essential to think about the ever-present spectre of funding danger. We have recognized 2 warning signs with Shenzhen Tianyuan DIC Information Technology, and understanding them ought to be a part of your funding course of.

If corporations with strong previous earnings development is up your alley, you could want to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Handle All Your Inventory Portfolios in One Place

We have created the final portfolio companion for inventory buyers, and it is free.

• Join a vast variety of Portfolios and see your whole in a single foreign money

• Be alerted to new Warning Indicators or Dangers through e mail or cellular

• Observe the Honest Worth of your shares

Have suggestions on this text? Involved concerning the content material? Get in touch with us straight. Alternatively, e mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles will not be meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary scenario. We purpose to carry you long-term targeted evaluation pushed by basic knowledge. Notice that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.