Administrator Isabella Casillas Guzmán, director of the U.S. Small Enterprise Administration (SBA), just lately introduced new information exhibiting the quantity, price and proportion of loans backed by the SBA, exhibiting that gross sales to Hispanic-owned companies have elevated considerably.

Casillas Guzmán mentioned in a press launch:

America’s greater than 5 million Latino-owned small companies create jobs, ship over $800 billion to our economic system yearly, and add to our nation’s world competitiveness—and so they might do much more if we invested in them equitably.

In line with info shared by the SBA, below the Biden Administration the U.S. has skilled a historic small enterprise growth led by ladies and folks of coloration.

Since his possession, 13.6 million new industrial functions have been filed, a price 65% sooner than the pre-pandemic common.

Likewise, this small enterprise growth has seen the quickest price of creation of Hispanic-owned companies in additional than a decade—greater than 20% sooner than pre-pandemic ranges.

“Since day one of many Biden-Harris Administration, the SBA has been dedicated to increasing entry to capital and addressing historic gaps in small enterprise lending to this extremely entrepreneurial group and this 1.5x enhance in loans to Latino-owned small companies,” highlighted Casillas Guzmán.

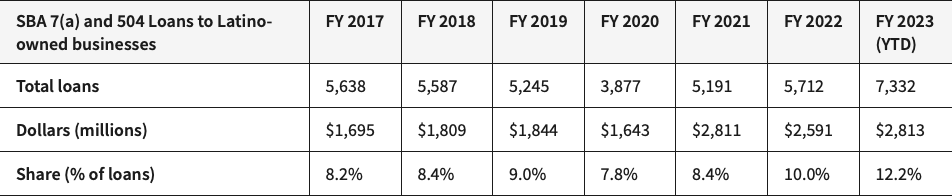

In line with SBA information, the company has accredited almost 7,300 loans to Latino-owned companies to this point in fiscal 12 months 2023 by the 7(a) and 504 programs.

“We’re seeing a small enterprise growth and the quickest creation price of Latino-owned companies in over a decade. We’re on the proper path and we’ll proceed to do extra to ship the wanted funding to advance alternatives for all,” added Casillas Guzmán.

There are 5 million Hispanic-owned small companies that assist energy America’s economic system! Be taught extra in regards to the financial affect of Latino and Latina entrepreneurs and have fun #HispanicHeritageMonth: https://t.co/axm7bOmC0N https://t.co/PxSTDNLshh

— SBA (@SBAgov) September 26, 2023

Complete {dollars} in loans ($2.8 billion) and the general share of loans accredited by the SBA (12.2%) to Latino-owned companies have elevated greater than 1.5 occasions for the reason that begin of the Biden administration.

These are a few of the measures the SBA has taken to extend entry to its capital packages amongst Latino entrepreneurs:

- Increasing the Neighborhood Benefit Program, which helps lending to small companies in underserved communities by mission-driven, group lenders, and making mission-oriented lending a everlasting a part of the SBA mortgage program by the Neighborhood Benefit Small Enterprise Lending Firm license

- Deploying the $100 million Neighborhood Navigator Pilot Program funded below President Biden’s American Rescue Plan

- Launching the Biden-Harris Administration’s cross-country Latino Prosperity Tour

- Greater than tripling the variety of Ladies’s Enterprise Facilities at Hispanic-Serving Establishments

- Implementing new reforms to deal with persistent capital entry gaps

“Whereas there’s a lengthy method to go to totally guarantee equal alternative for all Latino small companies, the SBA and Biden Administration initiatives have allowed extra Latino small enterprise homeowners throughout America to entry much-needed capital,” identified Rep. Nanette Barragán, chair of the Congressional Hispanic Caucus.

SBA has backed greater than 4,300 loans to Black-owned companies to this point in FY 23 by the 7(a) & 504 packages. Complete mortgage {dollars} ($1.3 billion) & total share of SBA-approved loans (7.5%) to Black-Owned companies have additionally greater than doubled since 2020. https://t.co/QFaTq5M14E https://t.co/uAMNYL3u59 pic.twitter.com/iSej3zJD7Z

— SBA (@SBAgov) September 22, 2023

The SBA additionally reported that it has accredited greater than 4,300 loans to Black-owned companies to this point in FY23 by the 7(a) and 504 packages.

Complete loans ($1.3 billion) and the general share of SBA-approved loans (7.5%) to Black-owned companies have additionally greater than doubled since 2020.

“Right this moment’s benchmark mortgage numbers present our work below President Biden’s Investing in America agenda making inroads to help extra of America’s Black small enterprise homeowners,” stressed Casillas Guzmán.

The SBA 7(a) mortgage is the SBA’s major enterprise mortgage program. Gives ensures to lenders supporting small enterprise financing for working capital and quite a lot of different makes use of, as much as $5 million.

The SBA 504 mortgage, in the meantime, supplies long-term fixed-rate financing of as much as $5.5 million for giant mounted asset purchases by small companies.

The SBA assure permits lenders to supply credit score to companies that may not in any other case qualify. SBA lenders should adjust to rate of interest caps and charge restrictions.

There are 5 million Latino-owned companies in america that contribute greater than $800B a 12 months to the American economic system. Find out about assets to assist small companies in each group begin and develop: https://t.co/yR58RgV7jG #HispanicHeritageMonth #USHCCOrlando23 https://t.co/3sopOAlmHz

— SBA (@SBAgov) September 25, 2023

Full SBA mortgage information for FY23 might be obtainable after the top of the fiscal 12 months.

“Financial mobility and success are important to reaching the American dream, however for much too lengthy small companies owned by Black Individuals have confronted roadblock after roadblock on that path,” mentioned Congressman Steven Horsford (NV-04), chair of the Congressional Black Caucus.