NEW DELHI

:

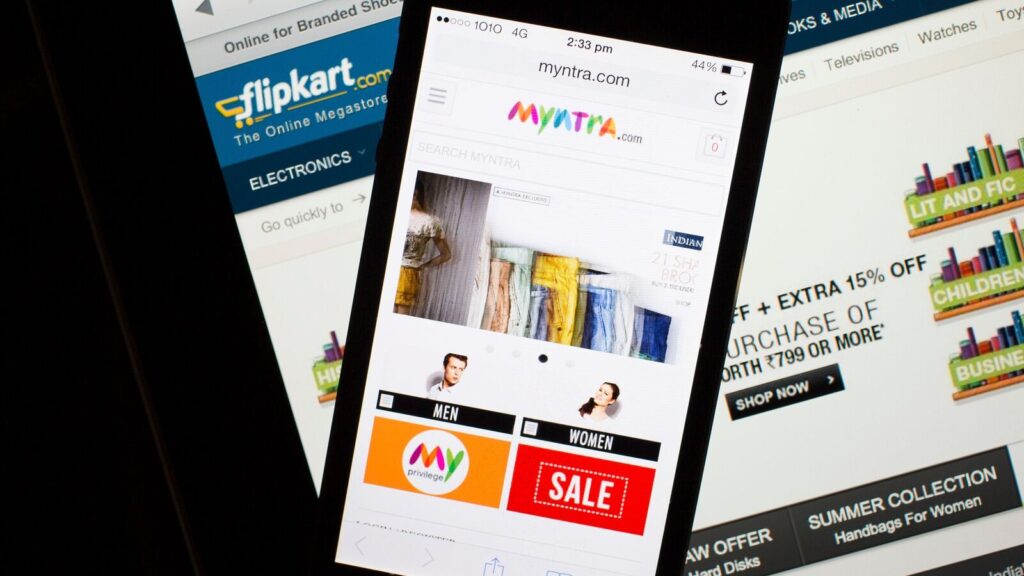

Gen Z customers are protecting vogue retailers on their toes. Over the previous 12 months, retailers like Myntra, Max Style and Madame have launched collections tailor-made to Gen Z preferences. Some have even revamped their platforms to draw this demographic, the oldest of which is 27.

“5 years later, each model might want to cater to this demographic as a result of they’d be a really huge enterprise. We’ve made some progress, going from 8 million Gen Z customers to 16 million now. The longer term for us is how can we go from 16 million and add one other 20 million to 25 million within the subsequent couple of years,” Sunder Balasubramanian, advertising and marketing officer at on-line vogue platform Myntra, advised Mint.

In 2023, the Flipkart-backed retailer launched a separate part referred to as FWD for Gen Z customers. It presents appears to be like curated from the not too long ago launched unique sequence Name Me Bae, together with collections curated underneath “Y2K” and “All about bows”.

Revived by a viral social-media pattern final 12 months, bows have made their technique to vogue runways, with manufacturers like Miu Miu and Dior that includes them of their collections. Searches on Myntra underneath Y2K, one other viral social-media pattern, throw up suggestions for low-rise denims and cargo pants.

Large market

Gen Z customers, born between 1997 and 2012, are fashion-forward customers. India has 60 million Gen Z customers who actively store on-line, accounting for 20-25% of the web life-style market valued at round $4 billion in gross merchandise worth, confirmed an August report by Bain & Co. and Myntra.

Gen Z customers’ signature fashion typically leans towards athleisure, with outsized trousers, t-shirts, sweatshirts (even in summer season), crop tops and sneakers being frequent decisions. They’re additionally closely influenced by social-media traits, that means retailers should reply rapidly.

Apparently, although Gen Z customers spend much less per transaction than millennials (born between 1981 and 1996)—a median of $7-8 as in opposition to millennials’ $14-16—they store extra regularly.

Gen Z customers make purchases 8-9 instances a 12 months, in comparison with the nationwide common of 5-6 instances, in keeping with the report.

It is not simply on-line vogue retailers which are taking word.

In August, worth retailer Max Style, part of Dubai-based Landmark Group, partnered with 26-year-old actor Alaya F to launch a brand new assortment focused at younger customers.

These younger customers store in keeping with their “vibe”, says Sumit Chandna, president at Max Style. Gen Z customers are prompting the retailer—current in India since 2006—to lift its vogue recreation. Earlier this 12 months, it launched a brand new non-public label, Max Urb_n, for children within the 17-22 age bracket.

“This shopper would not store like their predecessors. They’re ceaselessly roaming the market. No matter vibes with them, they are going to decide it up as and after they see it. Because of this, legacy manufacturers should reinvent and reposition themselves constantly,” Chandna advised Mint.

Frequency over spending energy

Myntra’s Balasubramanian agrees that Gen Z’s spending energy remains to be restricted, as many have simply began their careers. Collections curated for Gen Z customers begin at ₹499 to cater to their finances, in comparison with ₹800 for others. Gen Z’s procuring frequency makes up for the low pricing.

They’re additionally susceptible to purchasing extra from online-first manufacturers, which may pose a problem for legacy manufacturers within the coming years.

“This demographic will probably be our future clients within the subsequent 5 years, and we have to catch them early,” mentioned Akhil Jain, government director of Madame.

The ladies’s vogue model roped in actor Shanaya Kapoor final 12 months to talk to a youthful shopper. Gen Z customers are “very experimental”, Jain added. “They’ll stick with us for the following decade, so we now have to reposition ourselves to be a part of their model consideration set.”

The retailer has additionally revamped a few of its shops, permitting extra self-browsing and that includes a younger assortment—say, ripped denims and crop tops.