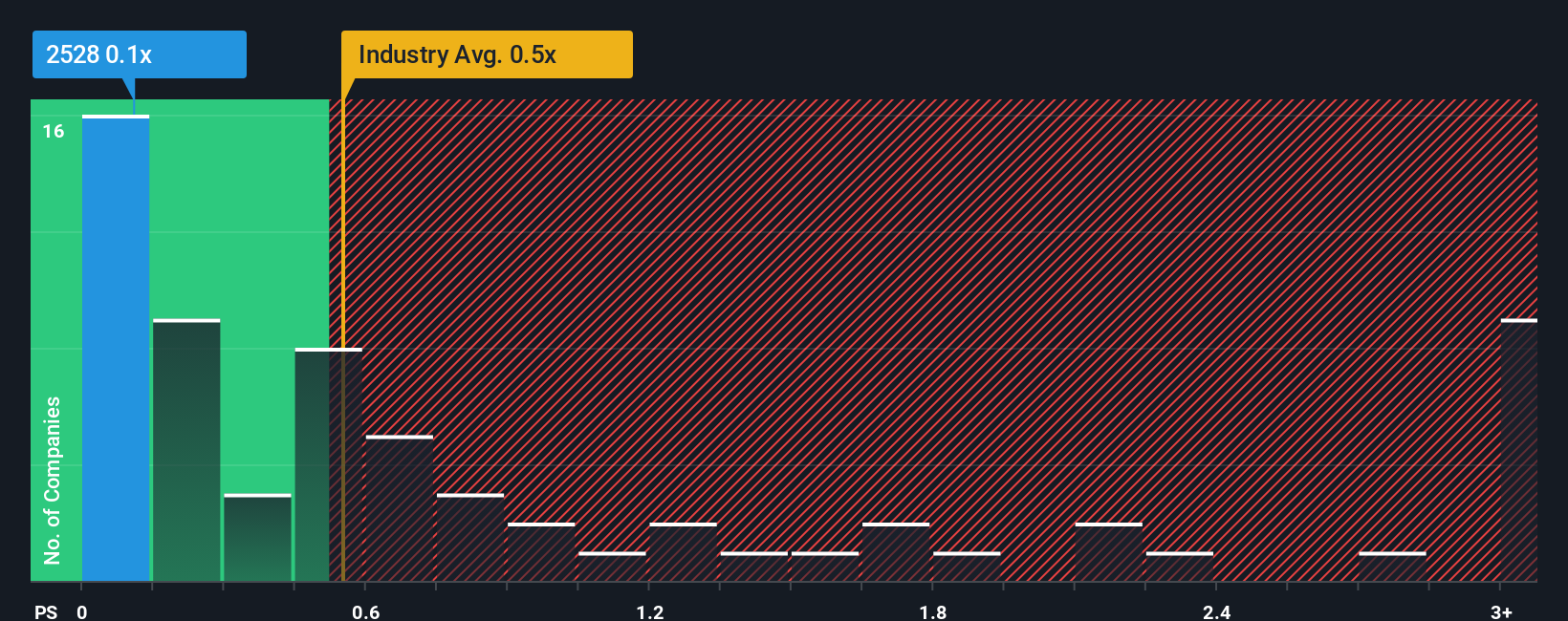

It is not a stretch to say that Ahead Trend (Worldwide) Holdings Firm Restricted’s (HKG:2528) price-to-sales (or “P/S”) ratio of 0.1x proper now appears fairly “middle-of-the-road” for corporations within the Specialty Retail business in Hong Kong, the place the median P/S ratio is round 0.5x. Though, it is not smart to easily ignore the P/S with out rationalization as buyers could also be disregarding a definite alternative or a expensive mistake.

View our latest analysis for Forward Fashion (International) Holdings

What Does Ahead Trend (Worldwide) Holdings’ P/S Imply For Shareholders?

For instance, take into account that Ahead Trend (Worldwide) Holdings’ monetary efficiency has been poor these days as its income has been in decline. Maybe buyers imagine the current income efficiency is sufficient to maintain in keeping with the business, which is preserving the P/S from dropping off. In case you like the corporate, you’d at the very least be hoping that is the case in order that you possibly can probably decide up some inventory whereas it is not fairly in favour.

Though there are not any analyst estimates obtainable for Ahead Trend (Worldwide) Holdings, check out this free data-rich visualisation to see how the corporate stacks up on earnings, income and money circulation.

How Is Ahead Trend (Worldwide) Holdings’ Income Progress Trending?

There’s an inherent assumption that an organization must be matching the business for P/S ratios like Ahead Trend (Worldwide) Holdings’ to be thought-about cheap.

Retrospectively, the final yr delivered a irritating 5.9% lower to the corporate’s high line. Because of this, income from three years in the past have additionally fallen 17% general. Due to this fact, it is truthful to say the income progress just lately has been undesirable for the corporate.

Evaluating that to the business, which is predicted to ship 44% progress within the subsequent 12 months, the corporate’s downward momentum based mostly on current medium-term income outcomes is a sobering image.

With this in thoughts, we discover it worrying that Ahead Trend (Worldwide) Holdings’ P/S exceeds that of its business friends. It appears most buyers are ignoring the current poor progress charge and are hoping for a turnaround within the firm’s enterprise prospects. There is a good probability current shareholders are setting themselves up for future disappointment if the P/S falls to ranges extra in keeping with the current unfavorable progress charges.

What Does Ahead Trend (Worldwide) Holdings’ P/S Imply For Traders?

Sometimes, we might warning towards studying an excessive amount of into price-to-sales ratios when selecting funding selections, although it will possibly reveal a lot about what different market members take into consideration the corporate.

Our take a look at Ahead Trend (Worldwide) Holdings revealed its shrinking revenues over the medium-term have not impacted the P/S as a lot as we anticipated, given the business is about to develop. Once we see income heading backwards within the context of rising business forecasts, it’d make sense to count on a doable share value decline on the horizon, sending the reasonable P/S decrease. Except the current medium-term circumstances enhance markedly, buyers can have a tough time accepting the share value as truthful worth.

We do not need to rain on the parade an excessive amount of, however we did additionally discover 1 warning sign for Forward Fashion (International) Holdings that it’s essential be conscious of.

If sturdy corporations turning a revenue tickle your fancy, you then’ll need to take a look at this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Inventory Screener & Alerts

Our new AI Inventory Screener scans the market day-after-day to uncover alternatives.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Shopping for

• Excessive progress Tech and AI Corporations

Or construct your personal from over 50 metrics.

Have suggestions on this text? Involved in regards to the content material? Get in touch with us immediately. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is basic in nature. We offer commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles usually are not supposed to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary scenario. We goal to deliver you long-term targeted evaluation pushed by elementary information. Observe that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.