Key Insights

- The appreciable possession by retail buyers in Focus Media Data Know-how signifies that they collectively have a larger say in administration and enterprise technique

- 50% of the enterprise is held by the highest 18 shareholders

- Insiders own 24% of Focus Media Information Technology

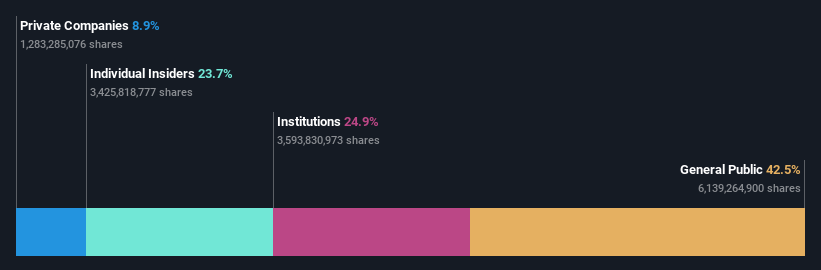

Each investor in Focus Media Data Know-how Co., Ltd. (SZSE:002027) ought to pay attention to essentially the most highly effective shareholder teams. And the group that holds the most important piece of the pie are retail buyers with 43% possession. In different phrases, the group stands to achieve essentially the most (or lose essentially the most) from their funding into the corporate.

Establishments, alternatively, account for 25% of the corporate’s stockholders. Giant corporations often have establishments as shareholders, and we often see insiders proudly owning shares in smaller corporations.

Let’s delve deeper into every sort of proprietor of Focus Media Data Know-how, starting with the chart beneath.

See our latest analysis for Focus Media Information Technology

What Does The Institutional Possession Inform Us About Focus Media Data Know-how?

Institutional buyers generally examine their very own returns to the returns of a generally adopted index. So they typically do take into account shopping for bigger corporations which can be included within the related benchmark index.

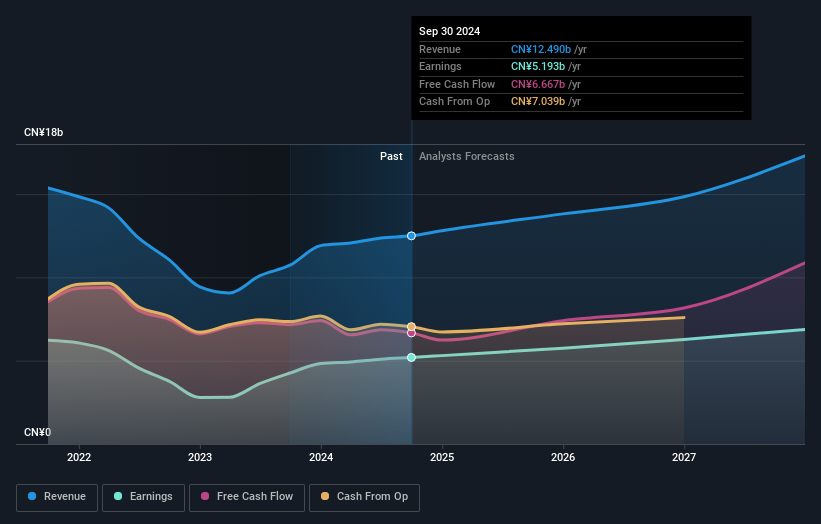

Focus Media Data Know-how already has establishments on the share registry. Certainly, they personal a decent stake within the firm. This means some credibility amongst skilled buyers. However we won’t depend on that truth alone since establishments make unhealthy investments generally, identical to everybody does. It isn’t unusual to see an enormous share value drop if two giant institutional buyers attempt to promote out of a inventory on the identical time. So it’s value checking the previous earnings trajectory of Focus Media Data Know-how, (beneath). After all, remember the fact that there are different components to think about, too.

Focus Media Data Know-how just isn’t owned by hedge funds. The corporate’s largest shareholder is Nanchun Jiang, with possession of 24%. In the meantime, the second and third largest shareholders, maintain 6.1% and a pair of.5%, of the shares excellent, respectively.

After performing some extra digging, we discovered that the highest 18 have the mixed possession of fifty% within the firm, suggesting that no single shareholder has important management over the corporate.

Whereas learning institutional possession for an organization can add worth to your analysis, additionally it is a superb apply to analysis analyst suggestions to get a deeper perceive of a inventory’s anticipated efficiency. There are many analysts overlaying the inventory, so it may be value seeing what they’re forecasting, too.

Insider Possession Of Focus Media Data Know-how

Whereas the exact definition of an insider will be subjective, nearly everybody considers board members to be insiders. Firm administration run the enterprise, however the CEO will reply to the board, even when she or he is a member of it.

Most take into account insider possession a constructive as a result of it will probably point out the board is nicely aligned with different shareholders. Nonetheless, on some events an excessive amount of energy is concentrated inside this group.

It appears insiders personal a major proportion of Focus Media Data Know-how Co., Ltd.. Insiders personal CN¥24b value of shares within the CN¥102b firm. That is fairly significant. Most would say this reveals a superb diploma of alignment with shareholders, particularly in an organization of this measurement. You’ll be able to click here to see if those insiders have been buying or selling.

Common Public Possession

Most people– together with retail buyers — personal 43% stake within the firm, and therefore cannot simply be ignored. This measurement of possession, whereas appreciable, is probably not sufficient to vary firm coverage if the choice just isn’t in sync with different giant shareholders.

Non-public Firm Possession

Our knowledge signifies that Non-public Firms maintain 8.9%, of the corporate’s shares. It may be value trying deeper into this. If associated events, equivalent to insiders, have an curiosity in one in every of these personal corporations, that needs to be disclosed within the annual report. Non-public corporations may additionally have a strategic curiosity within the firm.

Subsequent Steps:

I discover it very fascinating to take a look at who precisely owns an organization. However to actually acquire perception, we have to take into account different data, too. As an illustration, we have recognized 1 warning sign for Focus Media Information Technology that try to be conscious of.

In case you are like me, you might wish to take into consideration whether or not this firm will develop or shrink. Fortunately, you may examine this free report showing analyst forecasts for its future.

NB: Figures on this article are calculated utilizing knowledge from the final twelve months, which consult with the 12-month interval ending on the final date of the month the monetary assertion is dated. This is probably not in line with full yr annual report figures.

New: AI Inventory Screener & Alerts

Our new AI Inventory Screener scans the market day-after-day to uncover alternatives.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Shopping for

• Excessive progress Tech and AI Firms

Or construct your individual from over 50 metrics.

Have suggestions on this text? Involved in regards to the content material? Get in touch with us instantly. Alternatively, e mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary state of affairs. We goal to convey you long-term targeted evaluation pushed by basic knowledge. Word that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.