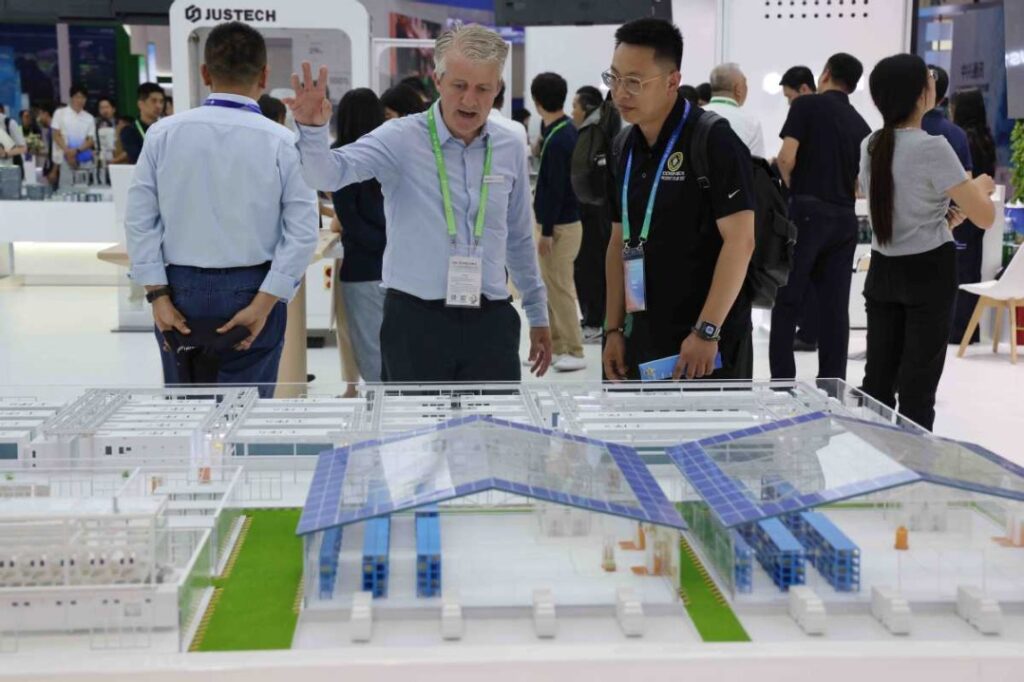

BEIJING — Throughout final month’s third China Worldwide Provide Chain Expo (CISCE), abroad exhibitors made up 35 p.c of members — up 3 proportion factors on 2024 and 9 factors on the inaugural 2023 version — with trade giants like Honeywell, GE Healthcare and Siemens already securing their spots for subsequent 12 months, underscoring international companies’ rising dedication to China.

As a serious nationwide platform for world industrial collaboration, the CISCE embodies the enduring attraction of the Chinese language market throughout its 14th 5-Yr Plan interval (2021-25), marked not solely by elevated international funding but in addition by important shifts in funding fields that replicate China’s broader financial transformation.

Onerous-won good points

The expo’s momentum echoes wider developments. By June 2025, China’s precise utilized international direct funding reached $708.73 billion since 2021, hitting the 14th 5-Yr Plan goal of $700 billion six months forward of schedule.

In the identical interval, 229,000 new foreign-invested enterprises have been launched, 25,000 greater than within the 2016-20 interval.

Regardless of fluctuations in FDI lately, China’s skill to keep up regular international capital inflows stands out in a difficult world atmosphere.

Based on the United Nations, world FDI fell 11 p.c in 2024, marking the second straight 12 months of decline after a pointy drop in 2023. Early knowledge from the primary quarter of 2025 supply little optimism, suggesting a potential third consecutive 12 months of contraction.

“Weak world direct funding has weighed on China’s FDI, however a better look reveals resilience,” mentioned Fan Penghui, a senior researcher with the Chinese language Academy of Worldwide Commerce and Financial Cooperation, a assume tank with the Ministry of Commerce. “A periodic slowdown after a peak is regular. Funding cycles ebb and move.”

Excessive-tech focus

In reality, China’s high-tech industries and repair sectors have seen steady progress in international funding, which underscores that international capital is using on the event wave of China’s new high quality productive forces, Fan mentioned.

In 2024, high-tech industries attracted 34.6 p.c of international funding, up 6 proportion factors from 2020. The primary half of 2025 accelerated this shift. Excessive-tech sectors attracted 127.87 billion yuan ($17.8 billion) in international capital, with e-commerce companies surging 127.1 p.c, chemical prescription drugs up 53 p.c, and aerospace tools manufacturing rising 36.2 p.c.

For a lot of multinational companies, China has advanced past a gross sales market right into a hub for progress and innovation, prompting elevated analysis and growth funding to faucet into the nation’s innovation potential.

Based on Leng Yan, govt vice-president of Mercedes-Benz China, the corporate has poured over 10.5 billion yuan into Chinese language R&D over 5 years, and with its Shanghai R&D middle, the corporate’s native innovation now “leads world growth”.

Holding regular

China’s success in attracting international funding is underpinned by a deliberate coverage push to maintain international funding regular, together with opening extra fields to international companies and making a extra welcoming atmosphere.

The damaging checklist for international funding has been steadily shortened, with all manufacturing restrictions eradicated in 2024. Pilot applications are additionally opening up companies like value-added telecom and biotechnology.

To construct belief and reduce crimson tape, a roundtable session system for international companies was established. Since 2023, the Ministry of Commerce has held over 30 conferences, resolving greater than 1,500 operational points raised by international companies.

Plans are in movement to develop these efforts. A revised catalogue of industries inspired for international funding is within the works. The up to date checklist will information extra international capital towards superior manufacturing, fashionable companies, high-tech, vitality conservation and environmental safety sectors, in addition to into central, western and northeastern areas, in keeping with the nation’s prime financial regulator.

“As China continues to develop institutional opening-up, international funding is predicted to combine extra deeply into home innovation and provide chains, placing a brand new stability with rising emphasis on high quality,” Fan mentioned.

Xinhua