Rahul Munjal, chairman and managing director, Hero Future Energies. Picture: Madhu Kapparath

Rahul Munjal, chairman and managing director, Hero Future Energies. Picture: Madhu Kapparath

Even as this problem of Forbes India hits the stands, Rahul Munjal might be a tad nearer to the inauguration of a small inexperienced hydrogen plant at an aluminium smelting manufacturing facility, slated to go reside earlier than the 12 months is out. Munjal, chairman and managing director of Hero Future Energies (HFE), declined so as to add specifics previous to the opening of the plant, nevertheless it’s the most recent instance of how the renewable vitality enterprise he’s constructed is increasing and pursuing the founder’s decarbonisation agenda.

Industrial and industrial initiatives, C&I because the sector is known as, at present a nascent operation at HFE, symbolize an enormous alternative for the corporate to increase into, Munjal tells Forbes India. This entails establishing renewable vitality operations for giant factories in sectors akin to cement manufacturing or iron and metal. And inexperienced hydrogen is extensively seen as a promising supply of vitality for such factories. The wind photo voltaic hybrid mission at Manvi, Karnataka, run by HFEThe one which HFE is opening shortly is a pilot plant, at a manufacturing facility in South India, Munjal says. It should exhibit that the expertise works. The plan is to make use of industrial-grade electrolysers on web site to generate hydrogen, which is then blended with PNG (piped pure gasoline) and LNG (liquified pure gasoline) as gas to supply warmth for a smelter, he says. “That’s how you’ll find yourself decarbonising the method to some extent. Clearly, it nonetheless makes use of PNG and LNG, nevertheless it’s at the least a begin in the appropriate course,” he provides.

The wind photo voltaic hybrid mission at Manvi, Karnataka, run by HFEThe one which HFE is opening shortly is a pilot plant, at a manufacturing facility in South India, Munjal says. It should exhibit that the expertise works. The plan is to make use of industrial-grade electrolysers on web site to generate hydrogen, which is then blended with PNG (piped pure gasoline) and LNG (liquified pure gasoline) as gas to supply warmth for a smelter, he says. “That’s how you’ll find yourself decarbonising the method to some extent. Clearly, it nonetheless makes use of PNG and LNG, nevertheless it’s at the least a begin in the appropriate course,” he provides.

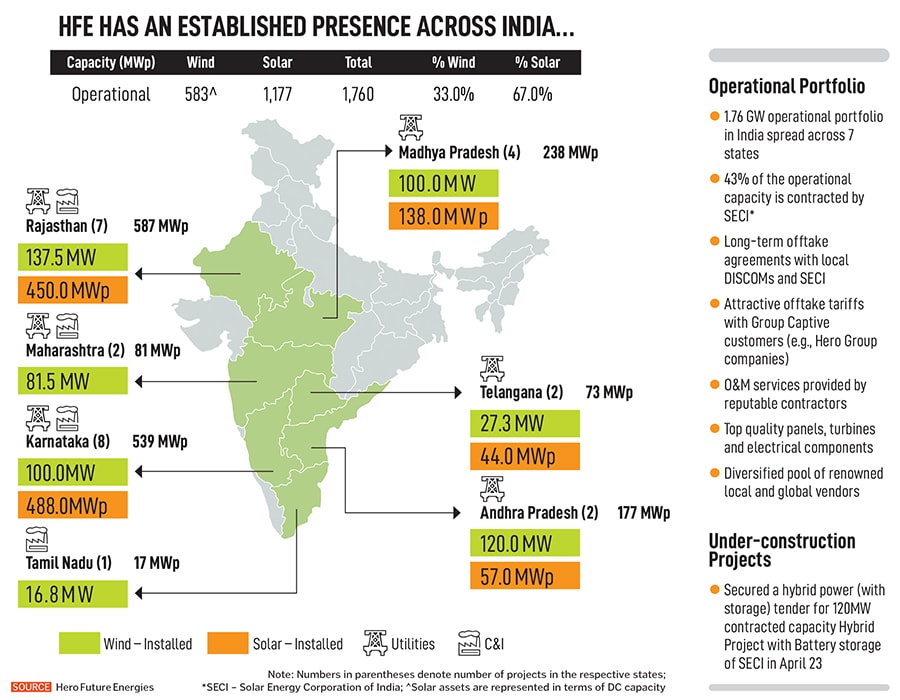

Munjal, 48, who began HFE in 2012, foraying into wind turbines-based energy era with a small 20 MW mission, has since expanded into photo voltaic, hybrid and now inexperienced hydrogen. General, the Delhi-based firm has about 1.9 GW of capability at present. Most of it’s in India, the place HFE operates wind, photo voltaic and hybrid services in states, together with Rajasthan, Maharashtra, Madhya Pradesh, Karnataka, Tamil Nadu, Andhra Pradesh and Telangana.

The corporate can also be actively pursuing abroad alternatives, together with in Vietnam, Britain and Ukraine. HFE additionally has contracts in Bangladesh, the place the corporate’s operations will step up as soon as the present political turmoil there’s resolved. Over the subsequent three years or so, Munjal is working to get to just about 5 GW total capability.

Within the C&I sector, “pushed by the necessity for companies to cut back operational prices and meet sustainability objectives, the market has seen a surge in renewable vitality adoption”, Srivatsan Iyer, HFE’s US-based international CEO, instructed PowerLine, an business journal, in July. Reducing price of photo voltaic panels and advances in battery storage coupled with authorities incentives and better consciousness round local weather change amongst company prospects have all contributed to the acceleration in adoption of renewables, he added.

On the tech entrance, Iyer expects HFE to take a position extra in areas, together with long-duration vitality storage—storage techniques that may maintain and provide energy for greater than 10 hours, which helps to buttress intermittent renewables, making the grid extra resilient, and, subsequently, lowering dependence on fossil fuel-based energy. Inexperienced hydrogen is one other space of funding for the corporate.

HFE’s revenues in FY23 have been Rs 1,539 crore versus Rs 1,430 for the earlier 12 months. Losses for the 12 months ended March 31, 2023, have been Rs 325 crore versus Rs 576 crore for FY22, in response to a ranking improve observe by Crisil. Within the March observe, Crisil, a credit standing supplier, upgraded its ranking of HFE from A/Steady to A+/Steady, citing the power and continued backing of the Hero Group as an necessary cause. Crisil additionally famous that there was a 3 p.c enchancment within the efficiency of HFE’s renewables portfolio in FY23 versus FY22.

The Hero Group, based by the Munjal household, is among the world’s largest makers of bikes and scooters. The group’s flagship is the $11.9 billion Hero MotoCorp. HFE, a part of the group, will probably solely develop in significance, taking part in its position in India’s transition to wash vitality over the subsequent two to 3 a long time.Additionally learn: How the Rs 1,000-crore Paramount Cables is rewiring its strategy

HFE’s main shareholders at present are the Munjal household, US-based international funding firm Kohlberg Kravis Roberts & Co (KKR) and Worldwide Finance Company. It has raised $725 million in fairness funding thus far, together with a $450 million Sequence D spherical in September 2022, with participation from KKR and Hero Group, in response to Tracxn, a supplier of personal markets intelligence.

Mint reported in February that the corporate is getting ready for an preliminary public providing (IPO), and likewise in search of $200 million pre-IPO investments. Munjal declined to remark.

HFE is starting to make a mark in decarbonising grids, he says. “We’ve performed our bit as a renewables firm to have the ability to say decarbonising the grid is right here and it may be performed.” The subsequent huge alternative is to decarbonise the C&I sector. “And after that, in all probability concentrate on decarbonising the transportation sector,” he says.

That he comes from a revered enterprise household “brings large benefits”, he says. For instance, the household’s credibility on the again of what they’ve achieved helps to clarify plans and persuade necessary stakeholders, he says. The flip facet can also be that “it’s a fantastic duty” to do the rightthing.

“I’ve at all times been captivated with revenue for objective. This can be a worth that we acquired from our grandfather Brijmohan Munjal,” he says. The late Brijmohan Lall Munjal was born in 1923 at Kamalia, in Punjab of present-day Pakistan. At 20, he got here to Amritsar together with his three brothers. After a number of years working on the Indian Ordnance Manufacturing facility, he and his brothers began a bicycle components enterprise in 1954, which grew to become Hero Cycles in 1956. Over the subsequent 20 years, the corporate grew to become the most important bicycle maker in India and, by 1986, on the planet.

Munjal began a scooters and moped enterprise in 1984, after which struck a cope with Japan’s Honda to begin Hero Honda and make bikes in Haryana. That firm is at present Hero MotoCorp, which by 2023 had offered greater than 200 million two wheelers. Brijmohan Munjal died in 2015.

Rahul Munjal’s father Raman Kant Munjal, who had helped Brijmohan construct Hero Honda died all of a sudden in 1991. Pawan Munjal, Rahul’s uncle, is the present chairman and CEO of Hero MotoCorp. “Brijmohan was extraordinarily captivated with giving again to the world,” Rahul Munjal says. “I realised you would additionally do enterprise the place you would do revenue for objective or you would be in influence enterprise… being third era, it’s virtually an ethical responsibility for us to do one thing the place we may give again to the neighborhood. On the identical time, it ought to undoubtedly be a enterprise.”