PAR Technology (PAR), not too long ago introduced the launch of PAR® AI, that includes intelligence layers built-in into its product suite, geared toward enhancing restaurant operations via instruments reminiscent of Coach AI™. This growth aligns with the broader market tendencies, the place AI is experiencing vital demand, as evidenced by Oracle’s 40% share surge linked to AI demand. Regardless of this, PAR’s share worth remained comparatively flat over the previous month. In a market that noticed document highs, such because the Nasdaq’s all-time peak and S&P 500’s robust efficiency, PAR’s AI developments seemingly lent average assist amid prevailing optimistic market actions.

PAR Technology has 1 weakness we think you should know about.

The launch of PAR® AI inside its suite of choices might bolster PAR Know-how’s long-term development technique centred on cloud-native options. By catering to ongoing market demand for AI and operational effectivity, this growth has the potential to reinforce PAR’s recurring income development and profitability outlook. Regardless of this progress, PAR’s share worth has largely remained steady within the quick time period. Over the longer three-year interval, nevertheless, the corporate’s whole shareholder return was 36.42%, underscoring its sustained potential amid slower short-term actions. This efficiency contrasts with PAR’s underperformance relative to the 20.5% rise within the US market over the previous yr.

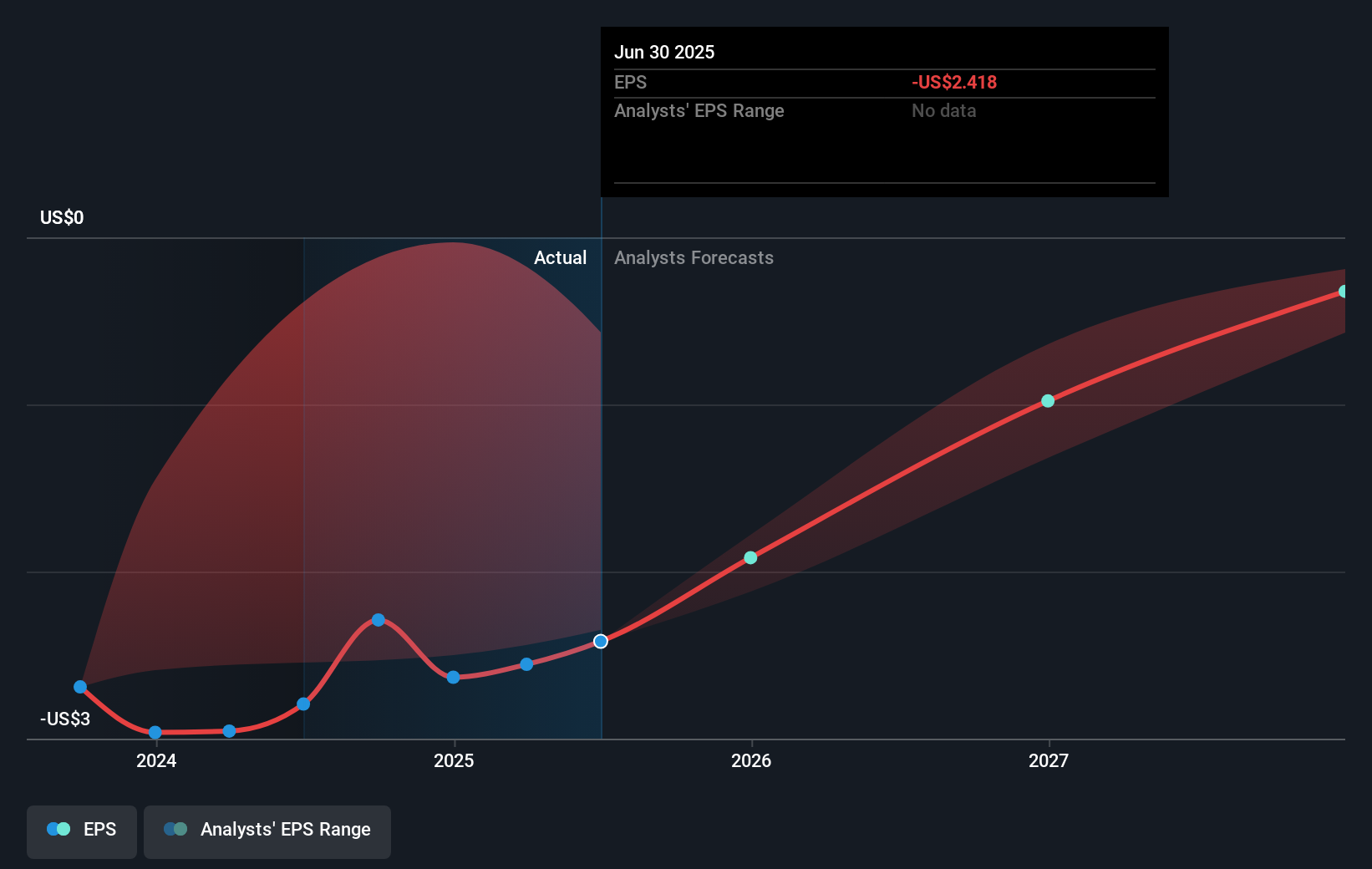

The current AI initiative might affect future income and earnings forecasts by rising cross-sell alternatives and common income per person, particularly with bundled cloud companies. Analysts anticipate a 12.67% annual income development, although profitability stays a problem. As of immediately, PAR’s share worth of US$46.86 is considerably under the consensus analyst worth goal of US$76.0. This hole suggests expectations for improved monetary metrics and market positioning, offering room for potential appreciation if PAR succeeds in executing its world growth and SaaS methods.

Evaluate PAR Technology’s historical performance by accessing our past performance report.

This text by Merely Wall St is basic in nature. We offer commentary based mostly on historic information

and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your goals, or your

monetary state of affairs. We purpose to convey you long-term targeted evaluation pushed by elementary information.

Word that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials.

Merely Wall St has no place in any shares talked about.

New: Handle All Your Inventory Portfolios in One Place

We have created the final portfolio companion for inventory buyers, and it is free.

• Join a limiteless variety of Portfolios and see your whole in a single foreign money

• Be alerted to new Warning Indicators or Dangers by way of e mail or cellular

• Monitor the Truthful Worth of your shares

Have suggestions on this text? Involved in regards to the content material? Get in touch with us instantly. Alternatively, e mail editorial-team@simplywallst.com