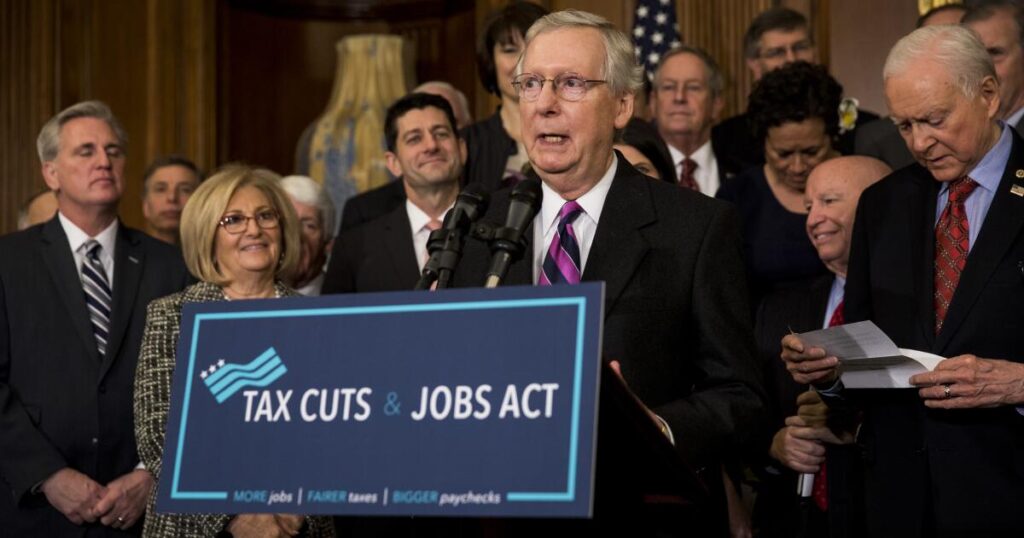

America approaches a crucial juncture. Many provisions of the Tax Cuts and Jobs Act of 2017 are set to run out this yr. Congress might allow them to lapse, however that might imply a big, economically damaging tax hike for many Individuals. Lawmakers might make all of the cuts everlasting, however with out income offsets that might deepen the nation’s disastrous debt load.

There’s a extra focused and accountable method to cope with this fiscal dilemma.

It’s a standard, politically fueled mistake to speak about slicing taxes with out additionally speaking about our fiscal scenario. We’re $37 trillion in debt — happening $59 trillion in a decade — and after years of alarming development, the annual spending deficit is roughly $2 trillion. We additionally should grapple with the looming entitlement disaster, and curiosity funds on authorities debt are the fastest-growing price range merchandise. Instances are altering, making fiscal duty extra essential than ever.

Whereas the upfront price of the tax cuts again in 2017 was $1.5 trillion, on paper, to make them everlasting might price $4.6 trillion. The precise price ought to be cheaper, as projections underestimate a probable enhance in taxable earnings, funding and development. However we shouldn’t deny that there’s a vital price.

There are additionally loads of classes to be discovered from the 2017 reform. The primary is that not all tax cuts are equally pro-growth. As such, we should always make everlasting solely probably the most pro-growth provisions and permit others to run out or be prolonged on a short-term foundation.

To the extent that the 2017 cuts spurred development and better income, that was principally the product of the everlasting discount of the company tax charge from 35% to 21%. This offered companies with long-term certainty, encouraging funding, capital formation and wage development. In contrast to non permanent tax cuts, which result in short-term boosts however create uncertainty, a everlasting decrease charge lets corporations plan, develop operations and enhance productiveness.

Paired with the soon-to-expire provision that enables corporations to fully expense their investments, the everlasting company cuts attracted extra home and overseas funding, resulting in larger financial output and job creation over time.

A brand new Hoover Establishment study reveals that companies are extra aware of company tax adjustments than beforehand thought. Analyzing the 2017 cuts, Kevin Hassett (the Nationwide Financial Council’s new director), Jon Hartley and Josh Rauh discovered {that a} one-percentage-point discount in the price of capital can enhance funding charges by as much as 2.4%, surpassing earlier estimates.

Congress ought to therefore prioritize making full expensing of capital funding everlasting. It might additionally prolong it to investments in constructions.

Equally, the cuts to people’ tax charges ought to be made everlasting. This provision encourages work, financial savings and investments, particularly for top earners, fostering a extra dynamic and resilient economic system. Current research by Rauh and Ryan Shyu on California tax will increase reveals how way more delicate high-income filers are to charge adjustments than most analysis usually assumes. The economists checked out taxpayers’ responses after Proposition 30 elevated marginal tax charges by as much as three share factors for high-income households. An additional 0.8% of those taxpayers left the state because of this, and those that stayed lowered taxable earnings, eroding as much as 61% of anticipated income inside two years. This sensitivity to excessive tax charges and our progressive federal tax code imply that letting particular person tax cuts expire could have a much bigger affect than projected, and lengthening them could have a smaller deficit affect than most concern.

Whereas the economics are simple, congressional guidelines usually are not. Funds reconciliation is a particular course of permitting Congress to go tax, spending and debt-related payments with a easy Senate majority, bypassing the filibuster. But it surely’s restricted to budgetary issues by the Byrd Rule and can’t enhance the deficit past a 10-year window with out offsets.

That leads us to the second lesson: Legislators ought to make everlasting the 2017 measure’s revenue-raising provisions and reduce some spending as properly.

Extending the boundaries placed on the state and native tax (SALT) deduction and mortgage curiosity deduction, and the removing of the non-public exemption (a $4,050-per-household-member exclusion from taxable earnings) would generate vital income — greater than overlaying the price of probably the most growth-oriented tax cuts. Congress additionally must take away different tax breaks comparable to the company SALT deduction, vitality subsidies and incentives for stadiums, simply to call a couple of, and reduce different spending to make it work.

Lastly, all the opposite, costlier and fewer pro-growth (although fashionable) provisions ought to be prolonged on a brief foundation. These embody the Little one Tax Credit score enlargement, the bigger customary deduction and different minimal tax reductions, which could possibly be set to run out in a couple of years as a substitute of being made everlasting. That may assist handle deficits whereas giving time for Congress to debate each.

The same strategy might apply to Trump’s proposed new tax breaks on suggestions, time beyond regulation pay and Social Safety advantages, which aren’t pro-growth and will cost $5 trillion over a decade.

A one-vote Republican Home majority makes the method of extending the tax cuts even by means of reconciliation difficult. Setting strict priorities and pointers ought to assist get the job executed. Nonetheless, the important thing to success will probably be supporting development of the economic system with out ballooning the deficit and the debt.

Veronique de Rugy is a senior analysis fellow on the Mercatus Heart at George Mason College.