Wall Avenue skilled a resurgence in risk appetite on Thursday as optimism grew round commerce negotiations. President Donald Trump expressed confidence in reaching agreements with each the European Union and China.

On Thursday, the Dow Jones Industrial Common fell 1.3% to shut at 39,142.23. The Nasdaq dipped 0.13%, ending at 16,286.45. In the meantime, the S&P 500 edged up 0.13%, ending the day at 5,282.70.

These are the highest shares that gained the eye of retail merchants and traders all through the day:

Netflix Inc. NFLX

Netflix shares rose by 1.19% to shut at $973.03, reaching an intraday excessive of $984.70 and a low of $956. The inventory’s 52-week vary is $542.01 to $1064.50. Within the after-hours buying and selling, shares spiked 3.5% to $1,006.79. The streaming big reported its first-quarter monetary outcomes, emphasizing efforts to improve and expand its choices. The corporate continues to give attention to enhancing its content material library and person expertise. For the interval, income got here in at $10.54 billion, a spike of 12.5% on a year-over-year foundation. Earnings per share had been reported at $6.61, beating the estimate of $5.74.

UnitedHealth Group Inc. UNH

UnitedHealth’s inventory plummeted by 22.38% to $454.11, with a each day excessive of $489.79 and a low of $447.10. The 52-week vary stands at $438.50 to $630.73. The healthcare big confronted a steep decline after reporting disappointing quarterly outcomes, attributed to rising healthcare prices. CEO Andrew Witty acknowledged that the present price construction is unsustainable, resulting in a downward revision of earnings steerage. UnitedHealth minimize fiscal 2025 earnings steerage and expects it to come back within the vary of $26 to $26.50 from the sooner vary of $29.50 to $30 per share.

See Additionally: Mark Cuban Says This Trump Healthcare Order ‘Could Save Hundreds Of Billions’

Novo Nordisk A/S NVO

Novo Nordisk shares fell by 7.63% to $58.08, with an intraday excessive of $59.06 and a low of $57.28. The inventory’s 52-week vary is $57.28 to $148.15. An analyst from BMO Capital Markets downgraded the inventory, citing issues about its efficiency within the cardiometabolic space in comparison with opponents like Eli Lilly.

Trump Media & Know-how Group Corp. DJT

Trump Media’s inventory surged by 11.65% to $22.04, hitting a excessive of $22.77 and a low of $19.82. The 52-week vary is $11.75 to $56.55. The corporate noticed its shares rise after submitting a criticism with the SEC relating to potential market manipulation and weird buying and selling patterns.

Tesla Inc. TSLA

Tesla’s inventory edged down by 0.07% to shut at $241.38, with a excessive of $244.34 and a low of $237.68. The 52-week vary is $138.80 to $488.54. Regardless of a decline in new automobile registrations in California, Tesla stays a major participant within the electric vehicle market, in response to latest information.

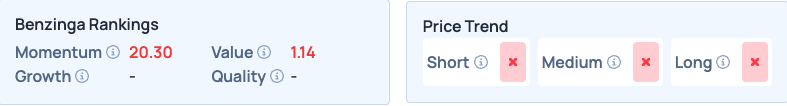

Trump Media or Netflix? Find out how they stack up when it comes to Momentum and Development with Benzinga Edge Inventory Rankings.

Picture Sutthiphong Chandaeng by way of Shutterstock

Put together for the day’s buying and selling with top premarket movers and news by Benzinga.

Learn Subsequent:

This story was generated utilizing Benzinga Neuro and edited by Shivdeep Dhaliwal

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.