Investing within the Nationwide Pension System (NPS) is a long-term dedication, however life doesn’t all the time wait till retirement. What in case you want funds for a medical emergency, your little one’s training, and even to begin a enterprise? Whereas NPS has a strict lock-in interval, the Pension Fund Regulatory & Growth Authority (PFRDA) permits partial withdrawals underneath particular situations—providing a method to entry a few of your financial savings with out breaking the long-term retirement plan.

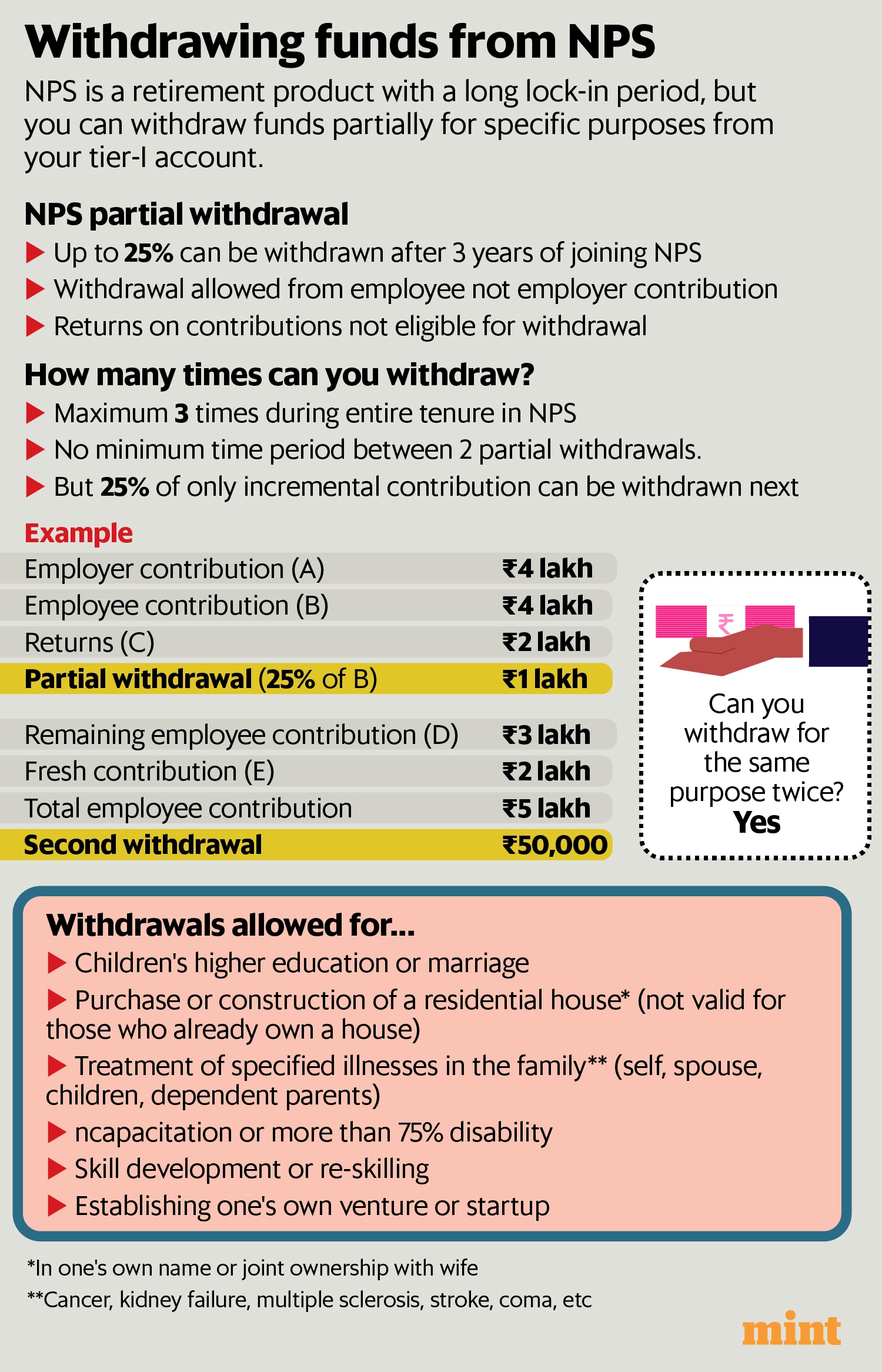

Subscribers can withdraw as much as 25% of their very own contributions after finishing three years within the scheme. This may be performed as much as thrice earlier than exiting NPS. Nonetheless, there’s a catch: solely the principal quantity contributed by the person is eligible for withdrawal, whereas the employer’s contributions and funding returns stay untouched. Understanding how these withdrawals work might help you propose your funds higher and keep away from sudden roadblocks.

Learn this | Should you opt for both NPS and EPF in the new tax regime?

Take an instance: in case your private contribution to NPS is ₹4 lakh and your employer has added the identical quantity, with returns on each contributions totaling ₹2 lakh, you possibly can withdraw solely 25% of your personal ₹4 lakh—which means ₹1 lakh. The employer’s share and the funding positive factors keep locked.

Subsequent withdrawals are calculated primarily based on further contributions made after the primary withdrawal. If, after withdrawing ₹1 lakh, you contribute one other ₹2 lakh, solely 25% of that new contribution— ₹50,000—will likely be obtainable for the second withdrawal.

View Full Picture

When are you able to withdraw?

PFRDA has outlined particular causes for which these withdrawals might be made.

These embrace funding a baby’s increased training or marriage, buying or setting up a home (so long as you don’t already personal one, excluding ancestral property), and masking medical bills for essential diseases reminiscent of most cancers, kidney failure, or main surgical procedures.

Moreover, funds might be withdrawn to assist ability growth, self-improvement programs, and even to ascertain a enterprise or startup. Curiously, the identical goal might be cited for a number of withdrawals, so long as they fall inside the general limits.

For these with an NPS Tier-II account, withdrawals are much more versatile. There aren’t any restrictions—funds might be withdrawn absolutely or partially at any time, making it a extra liquid possibility for individuals who need the tax advantages of NPS whereas sustaining accessibility. Nonetheless, it is essential to notice that Tier-II contributions and positive factors don’t qualify for tax advantages.

Learn this | Slow and steady: How a passive approach to investing secured this Mumbai-based CEO’s retirement future

Within the unlucky occasion of the subscriber’s loss of life, the whole corpus is offered for withdrawal by the nominee or authorized inheritor.

View Full Picture

The way to withdraw funds

The withdrawal course of itself is simple.

Log in to your NPS account utilizing your PRAN (Everlasting Retirement Account Quantity) and password, navigate to the withdrawal part, and provoke a request. The system requires verification of your title and checking account particulars by way of OTP or eSign, however no supporting paperwork are wanted—only a self-declaration stating the aim of withdrawal.

For these preferring an offline technique, PFRDA-appointed factors of presence (PoPs) can facilitate the method.

What about untimely exit?

If you happen to’re contemplating exiting NPS earlier than turning 60, be ready for some restrictions.

Untimely exits are allowed solely after 5 years of membership, and even then, solely 20% of the corpus might be taken as a lump sum. The remaining 80% should be used to buy an annuity, guaranteeing a gradual revenue stream. The one exception is that if the full corpus is lower than ₹2.5 lakh, through which case the whole quantity might be withdrawn.

Additionally learn | Why Sumit Shukla has funds tied up in NPS tier-II, not MFs

Understanding these guidelines might help you propose your NPS withdrawals properly, guaranteeing you profit from your retirement financial savings whereas sustaining monetary flexibility for all times’s main bills.