Expertise reporter

Getty Pictures

Getty PicturesNatWest says it has now fastened a problem which left prospects unable to make use of the financial institution’s cell app, leaving some unable to entry their accounts.

Prospects reported issues together with being unable to make purchases or pay employees.

NatWest apologised to prospects “for any inconvenience prompted”, having beforehand stated its web-based on-line banking service was nonetheless working usually – nevertheless some prospects disputed this.

“We have now resolved the problems inflicting this and prospects at the moment are in a position to log in and make funds as regular,” a spokesperson stated.

Issues started to be reported on outage-checking website Downdetector at 0910 GMT.

BBC/NatWest

BBC/NatWestProspects then took to social media to complain concerning the affect the IT failure was having on them.

One individual stated they needed to “put again my purchasing due to it”, whereas one other stated they had been “ready to buy groceries” however could not switch cash to take action.

Prospects had been suggested to entry their accounts in different methods if they will – reminiscent of by way of on-line banking.

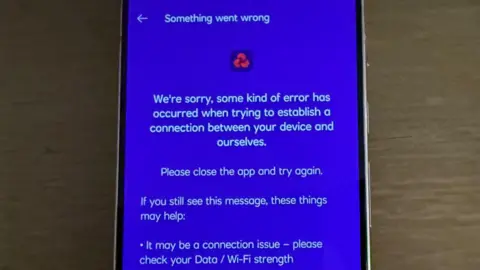

Nonetheless, some individuals reported issues with NatWest’s on-line service too, with one sharing an error message which they stated was displayed after they tried to make a fee.

Others have expressed frustration with the financial institution’s response, with one saying it was “disgraceful” there was no timeframe given for resolving the issue, whereas one other known as it “very poor service“.

“What I do not get is the financial institution closes a great deal of branches ‘to economize’ and forcing individuals to depend on the app and on-line banking… however clearly hasn’t invested in a system that works correctly,” one angry customer said.

A recurring downside

That is the newest in an extended line of banking outages.

In May, a number of major banks disclosed that 1.2m individuals had been affected by them within the UK in 2024.

According to a report in March, 9 main banks and constructing societies have had round 803 hours – the equal of 33 days – of tech outages since 2023.

Inconvenient for patrons, outages come at a value to the banks, too.

The Commons Treasury Committee discovered Barclays may face compensation funds of £12.5m over outages since 2023.

Over the identical interval, Natwest has paid £348,000, HSBC has paid £232,697, and Lloyds has paid £160,000.

Different banks have paid smaller sums.