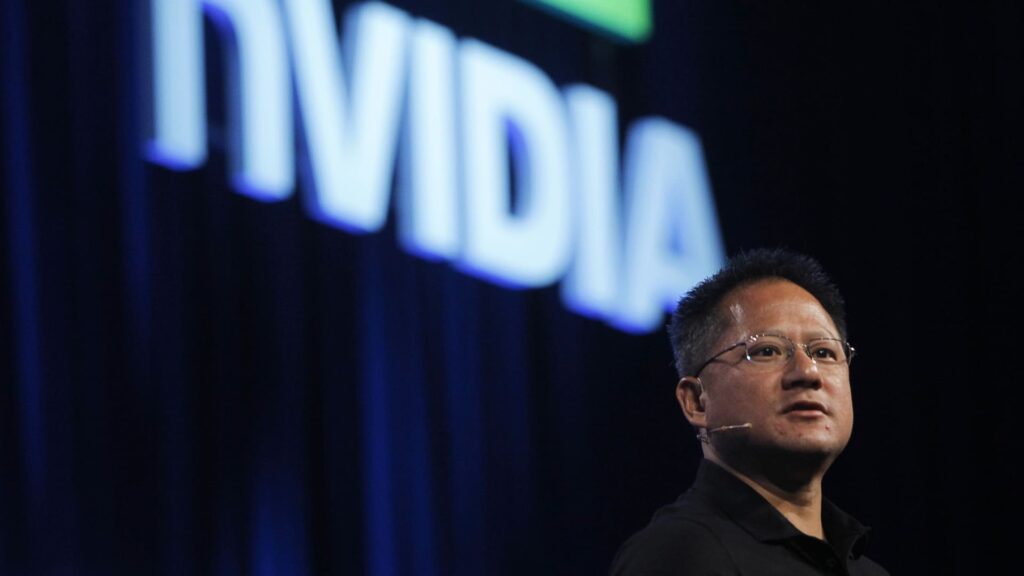

Listed here are the largest calls on Wall Avenue on Monday: Morgan Stanley reiterates Nvidia as chubby Morgan Stanley is sticking with the inventory heading into earnings later this week. ” Nvidia stays our High Decide, and no matter expectations points, the truth that headwinds merely don’t have an effect on the corporate’s sturdy momentum drives our ideas.” Morgan Stanley reiterates Taiwan Semiconductor as chubby Morgan Stanley named the inventory a catalyst-driven thought, calling it a beneficiary of sturdy Nvidia earnings. “We might count on TSMC’s share worth to rise if NVDA’s steerage had been to beat expectations.” Morgan Stanley upgrades Petrobras to chubby from equal weight Morgan Stanley stated the Brazilian oil producer is seeing resilient money circulation. ” PBR’s funding case stays centered on shareholder remuneration, which — for higher or worse — is immediately tied to capital allocation.” JPMorgan upgrades BJ’s Wholesale Membership to impartial from underweight JPMorgan upgraded BJ’s Wholesale Membership following earnings final week. “Wanting forward, we count on modest reflation in grocery whereas the corporate is benefiting from its efforts to drive [market] share by reinvesting within the enterprise whereas we’re squarely on the level the place the channel is seeing a carry from commerce down in a hyper-value searching for shopper surroundings.” Baird names Planet Health a prime choose Baird named the inventory a “bullish recent choose” by year-end. “We’re highlighting PLNT as a gorgeous thought for a slowing development surroundings. New management has addressed unit financial challenges, and we see a number of potential drivers – particularly higher advertising and marketing – lining up for 2025.” Morgan Stanley initiates Summit Supplies at chubby Morgan Stanley stated it is bullish on shares of the cement firm. “Initiating Summit Supplies (SUM) at Chubby with a $51 worth goal (~26% upside).” Wells Fargo reiterates Amazon as chubby Wells stated it is bullish on Amazon’s long-term alternative with its international broadband entry initiative often called Challenge Kuiper however that it is reducing its worth goal to $225 per share from $232. “Heavy upfront prices associated to satellite tv for pc launches, commencing in 2H24, scale back [operating income] forecasts ’25-’27. Engaging oppty long run, however unclear synergy w/ core operations.” Wells Fargo reiterates Microsoft as chubby Wells stated it sees vital upside forward for the inventory. “We nonetheless see a shiny future forward for Microsoft, pushed by continued development prospects in large classes of IT spend, capacity to additional monetize sturdy positioning in a number of finish markets, and a monetary profile that continues to exhibit sturdy margin enlargement.” Financial institution of America initiates Biohaven at purchase The financial institution stated it is bullish on the biotech firm and that its “Neuropsych drug will be best-in-class in giant markets.” “We provoke protection of Biohaven , Ltd. (BHVN) with a Purchase ranking and a $52 worth goal.” Wells Fargo reiterates D.R. Horton as a prime choose Wells stated the homebuilder has a gorgeous danger/reward. ” DHI’s risk-reward is best-calibrated w/ torque on decrease charges however low [average selling prices] supply protection in opposition to rising inventories.” Wells Fargo upgrades Mid-America House Communities to chubby from equal weight Wells stated the true property funding belief has a gorgeous valuation. “We additionally observe MAA is an anti-consensus OW ranking.” Wells Fargo upgrades American Properties 4 Lease to chubby from equal weight Wells stated the true property funding belief has “defensive development” traits. ” AMH provides buyers defensive development.” UBS upgrades PTC Therapeutics to purchase from impartial UBS sees a number of catalysts forward for the pharmaceutical firm. “We resume protection of PTCT with a Purchase ranking and $47 PT.” Gordon Haskett upgrades Ollie’s to purchase from accumulate Gordon Haskett stated it is getting bullish on shares of the low cost retailer. “Lastly, we’re upgrading Ollie’s to Purchase-Rated from Accumulate-Rated for quite a lot of causes together with: (1) extra retailer closings present incremental market share/actual property alternatives; (2) shoppers growing concentrate on worth (as evidenced by latest stories from WMT, TJX, ROST)…” Maxim initiates Gentle & Marvel at purchase Maxim says the playing firm is properly positioned in a digital future. “Gentle & Marvel is well-positioned to take advantage of all three markets, and the stability sheet has been strengthened following the 2022 divestitures of its lottery and sports activities betting companies that decreased leverage.” Argus downgrades Wayfair to carry from purchase Argus stated in its downgrade of the furnishing retailer that the “firm’s prospects seem muted amid the present surroundings of excessive rates of interest and fewer residence gross sales.” “We’re downgrading Wayfair to HOLD from BUY. We proceed to imagine W is about for sturdy development when the housing market recovers; nevertheless, the corporate’s prospects seem muted amid the present surroundings of excessive rates of interest and fewer residence gross sales.”