It could be of some concern to shareholders to see the Marvell Expertise, Inc. (NASDAQ:MRVL) share value down 16% within the final month. However that does not undermine the incredible long run efficiency (measured over 5 years). Certainly, the share value is up a whopping 373% in that point. So we do not assume the current decline within the share value means its story is a tragic one. However the true query is whether or not the enterprise fundamentals can enhance over the long run.

With that in thoughts, it is value seeing if the corporate’s underlying fundamentals have been the driving force of long run efficiency, or if there are some discrepancies.

View our latest analysis for Marvell Technology

Marvell Expertise is not at the moment worthwhile, so most analysts would look to income development to get an thought of how briskly the underlying enterprise is rising. When an organization would not make income, we would typically hope to see good income development. That is as a result of quick income development may be simply extrapolated to forecast income, usually of appreciable measurement.

Within the final 5 years Marvell Expertise noticed its income develop at 17% per 12 months. That is properly above most pre-profit firms. Arguably, that is properly and actually mirrored within the robust share value achieve of 36%(per 12 months) over the identical interval. It is by no means too late to begin following a prime notch inventory like Marvell Expertise, since some long run winners go on profitable for many years. On the face of it, this appears lke an excellent alternative, though we notice sentiment appears very optimistic already.

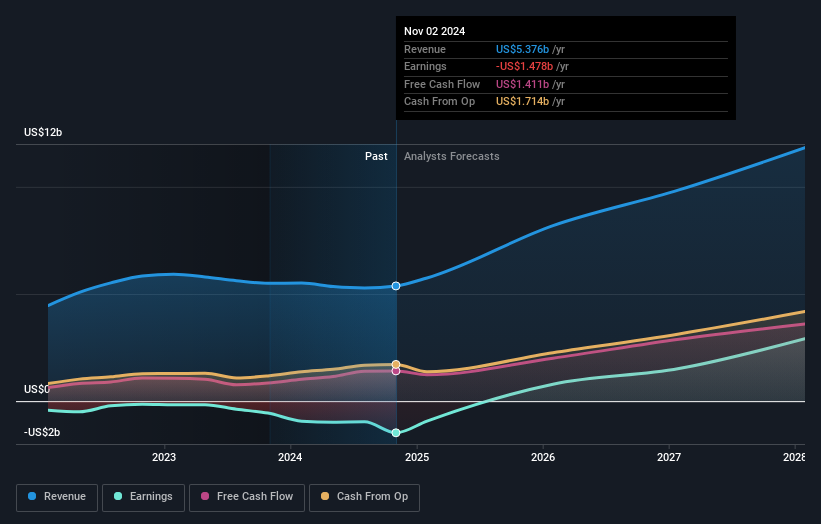

You may see how earnings and income have modified over time within the picture under (click on on the chart to see the precise values).

We like that insiders have been shopping for shares within the final twelve months. Even so, future earnings will probably be much more necessary as to if present shareholders generate profits. If you’re pondering of shopping for or promoting Marvell Expertise inventory, it is best to try this free report showing analyst profit forecasts.

What About Dividends?

When funding returns, you will need to take into account the distinction between complete shareholder return (TSR) and share value return. Whereas the share value return solely displays the change within the share value, the TSR contains the worth of dividends (assuming they had been reinvested) and the good thing about any discounted capital elevating or spin-off. It is honest to say that the TSR provides a extra full image for shares that pay a dividend. Within the case of Marvell Expertise, it has a TSR of 384% for the final 5 years. That exceeds its share value return that we beforehand talked about. And there is not any prize for guessing that the dividend funds largely clarify the divergence!

A Totally different Perspective

It is good to see that Marvell Expertise has rewarded shareholders with a complete shareholder return of 52% within the final twelve months. After all, that features the dividend. That is higher than the annualised return of 37% over half a decade, implying that the corporate is doing higher not too long ago. Somebody with an optimistic perspective might view the current enchancment in TSR as indicating that the enterprise itself is getting higher with time. I discover it very attention-grabbing to have a look at share value over the long run as a proxy for enterprise efficiency. However to actually achieve perception, we have to take into account different info, too. For example, we have recognized 2 warning signs for Marvell Technology that you ought to be conscious of.

Marvell Expertise isn’t the one inventory insiders are shopping for. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please notice, the market returns quoted on this article replicate the market weighted common returns of shares that at the moment commerce on American exchanges.

New: Handle All Your Inventory Portfolios in One Place

We have created the final portfolio companion for inventory traders, and it is free.

• Join a limiteless variety of Portfolios and see your complete in a single forex

• Be alerted to new Warning Indicators or Dangers through e-mail or cellular

• Observe the Truthful Worth of your shares

Have suggestions on this text? Involved in regards to the content material? Get in touch with us instantly. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles usually are not meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary state of affairs. We goal to deliver you long-term targeted evaluation pushed by basic information. Observe that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.