CDT Environmental Know-how Funding Holdings Restricted (NASDAQ:CDTG) shares have had a extremely spectacular month, gaining 28% after a shaky interval beforehand. However the final month did little or no to enhance the 80% share worth decline over the past yr.

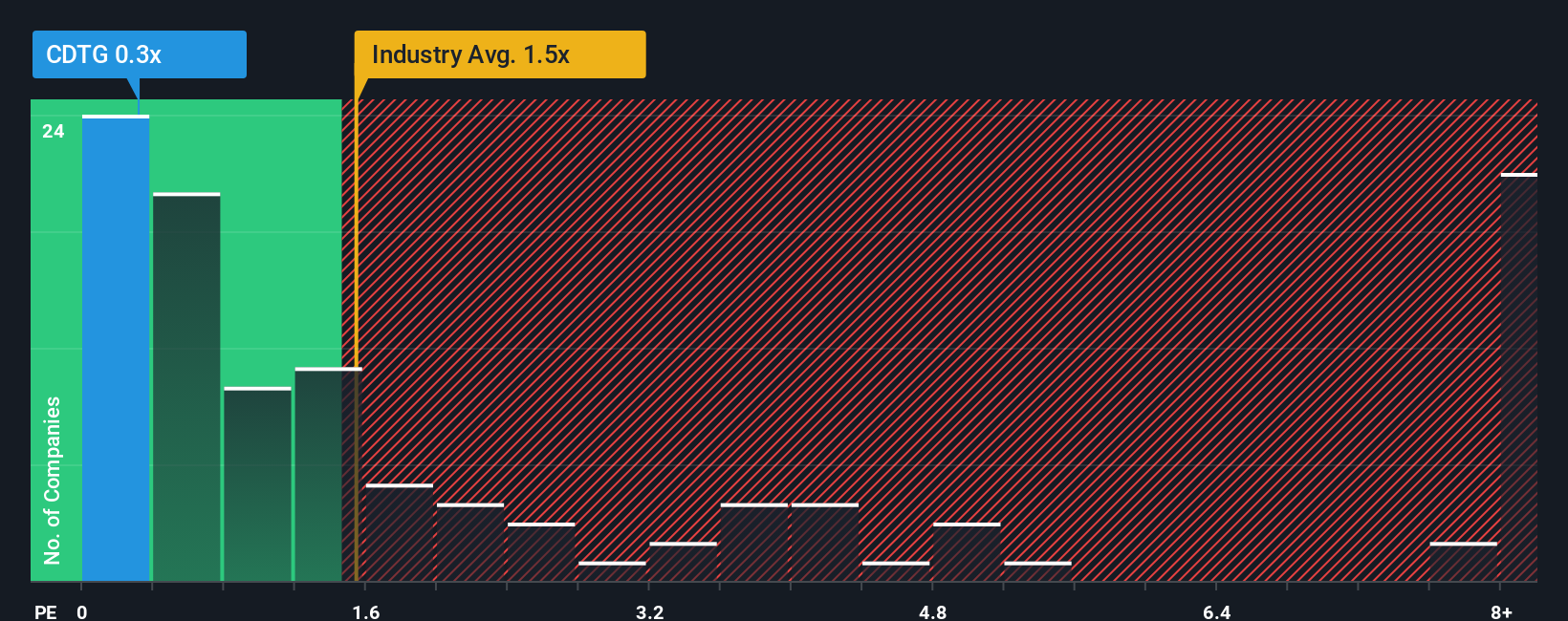

Though its worth has surged greater, CDT Environmental Know-how Funding Holdings should still be sending bullish indicators for the time being with its price-to-sales (or “P/S”) ratio of 0.3x, since nearly half of all firms within the Industrial Providers business in the US have P/S ratios larger than 1.5x and even P/S greater than 5x usually are not uncommon. Nonetheless, we would must dig a bit deeper to find out if there’s a rational foundation for the lowered P/S.

View our latest analysis for CDT Environmental Technology Investment Holdings

How CDT Environmental Know-how Funding Holdings Has Been Performing

For instance, take into account that CDT Environmental Know-how Funding Holdings’ monetary efficiency has been poor currently as its income has been in decline. It may be that many anticipate the disappointing income efficiency to proceed or speed up, which has repressed the P/S. Nonetheless, if this does not eventuate then present shareholders could also be feeling optimistic in regards to the future path of the share worth.

Need the complete image on earnings, income and money stream for the corporate? Then our free report on CDT Environmental Technology Investment Holdings will enable you shine a lightweight on its historic efficiency.

Do Income Forecasts Match The Low P/S Ratio?

CDT Environmental Know-how Funding Holdings’ P/S ratio could be typical for an organization that is solely anticipated to ship restricted development, and importantly, carry out worse than the business.

Looking again first, the corporate’s income development final yr wasn’t one thing to get enthusiastic about because it posted a disappointing decline of 13%. Regardless, income has managed to carry by a useful 26% in combination from three years in the past, because of the ancient times of development. Accordingly, whereas they’d have most popular to maintain the run going, shareholders could be roughly happy with the medium-term charges of income development.

Weighing that latest medium-term income trajectory towards the broader business’s one-year forecast for growth of 6.7% reveals it is about the identical on an annualised foundation.

With this info, we discover it odd that CDT Environmental Know-how Funding Holdings is buying and selling at a P/S decrease than the business. It might be that the majority buyers usually are not satisfied the corporate can preserve latest development charges.

The Backside Line On CDT Environmental Know-how Funding Holdings’ P/S

Regardless of CDT Environmental Know-how Funding Holdings’ share worth climbing lately, its P/S nonetheless lags most different firms. It is argued the price-to-sales ratio is an inferior measure of worth inside sure industries, however it may be a robust enterprise sentiment indicator.

Our examination of CDT Environmental Know-how Funding Holdings revealed its three-year income developments wanting much like present business expectations hasn’t given the P/S the enhance we anticipated, provided that it is decrease than the broader business P/S, There may very well be some unobserved threats to income stopping the P/S ratio from matching the corporate’s efficiency. income developments counsel that the chance of a worth decline is low, buyers seem to understand a chance of income volatility sooner or later.

You might want to be aware of dangers, for instance – CDT Environmental Technology Investment Holdings has 4 warning signs (and a couple of which should not be ignored) we predict you need to find out about.

It is essential to be sure you search for an amazing firm, not simply the primary concept you come throughout. So if rising profitability aligns along with your concept of an amazing firm, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Inventory Screener & Alerts

Our new AI Inventory Screener scans the market every single day to uncover alternatives.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Shopping for

• Excessive development Tech and AI Firms

Or construct your personal from over 50 metrics.

Have suggestions on this text? Involved in regards to the content material? Get in touch with us instantly. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles usually are not supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary state of affairs. We intention to convey you long-term centered evaluation pushed by elementary knowledge. Observe that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.