Skip to content

There are two particular components to bear in mind for shopper spending in March and April. The 2 roll round presently yearly however are notably acute in 2025.

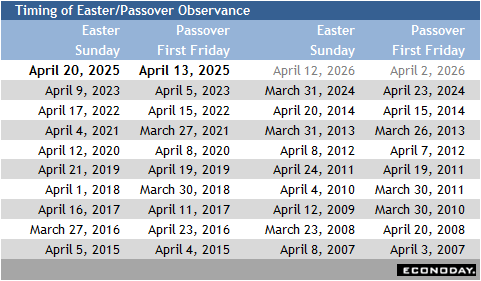

The primary is the timing of the spring holidays. Specifically, the Easter observance falls practically three weeks later in 2025 than it did in 2024. Easter Sunday is April 20 this 12 months whereas it was March 31 final 12 months. Final March bought a lift from spending on vacation preparations and journey. That spending will happen in April. It must also be famous given the late timing of the vacation, March retail spending gained’t profit from some early hen purchasing.

One other factor to notice is that many faculties time their spring break to coincide with Easter. This 12 months spring break gained’t profit March with expenditures on journey. Nonetheless, April may get some additional profit from the holiday time, particularly since journey plans could also be extra expansive through the hotter climate.

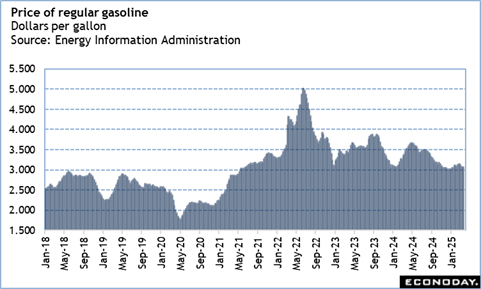

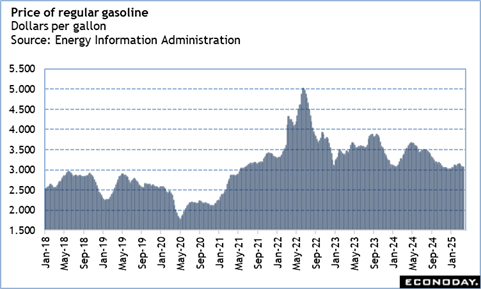

With out the additional journey in March, the declines in gasoline costs in March in all probability gained’t get an offset in elevated quantity of gross sales within the report on retail spending. Conversely, gasoline costs are prone to rise in April prematurely of the deadline of Might for refineries to alter over to summer season reformulation. Though the seasonal issue enable for the rise, the amount of gross sales could also be greater than regular and increase the greenback worth of gross sales at service stations.

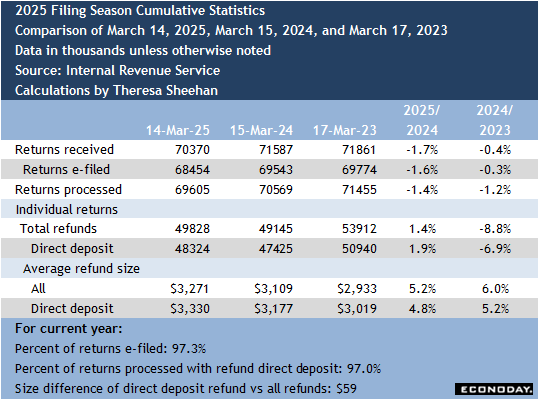

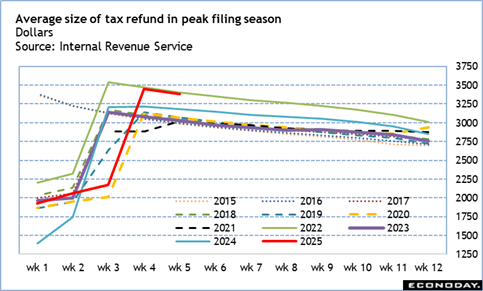

The second is how the 2025 tax submitting season is progressing. On the constructive facet is that this 12 months’s common refund is bigger than final 12 months’s. These bigger refunds didn’t begin to arrive in pressure till late in February. Some spending that may have occurred in February could possibly be pushed into March. What’s now in query is that if customers will spend these refunds without delay. Some might return into the financial system within the near-term. Customers typically enhance spending at dwelling and backyard shops in March to restore injury from the winter months and/or take up dwelling initiatives within the spring. Nonetheless, this 12 months, a few of that discretionary spending could also be subsumed into nondiscretionary bills. Some households might not spend the month till April, saving it for journey and vacation prices. Given low ranges of shopper confidence, a few of these refunds might simply go into financial savings towards anticipated laborious occasions or to scale back debt.

The upshot is that how customers behave this spring might cut back private consumption expenditures late within the first quarter though spending that spending will in all probability be made up initially of the second quarter. Those that attempt to gauge the well being of the retail sector typically common exercise in March and April as extra consultant of the sector through the interval. The retail 12 months runs from February to January to accommodate regular exercise over the winter and spring holidays. However the laborious knowledge of the month-to-month report on retail gross sales and the quarter GDP numbers don’t have that possibility.

The report on retail spending in March is ready for launch at 8:30 ET on Wednesday, April 16. The advance estimate for first quarter GDP will probably be launched at 8:30 ET on Wednesday, April 30.

Share This Story, Select Your Platform!